There are approximately 115 real estate enterprises listed on the Vietnamese stock exchange. As of the second quarter, the total inventory value of these enterprises was estimated to be approximately VND 400,000 billion at the end of the second quarter.

Notably, many of these businesses are holding inventory levels that account for more than half of their total assets.

The enterprise with the largest inventory value in the industry is Novaland, a real estate investment group, with a value of over VND 142,000 billion, an increase of over 2% from the beginning of the year, and accounting for 59% of total assets.

Novaland’s inventory structure includes nearly VND 8,400 billion in completed and under-construction real estate, with the remaining VND 134,000 billion in other assets.

Khang Dien House Trading and Investment Joint Stock Company (KDH) has seen a 14% increase in inventory value over the past six months, reaching nearly VND 21,500 billion, accounting for 76% of total assets.

According to the explanation, the value of construction in progress at the residential project in Binh Trung Dong ward with a scale of 5.8ha (Binh Trung Dong 1) increased by more than VND 1,000 billion compared to the beginning of the year, to nearly VND 4,200 billion. The value at Binh Hung 11A residential area also increased by more than VND 900 billion, to over VND 1,500 billion.

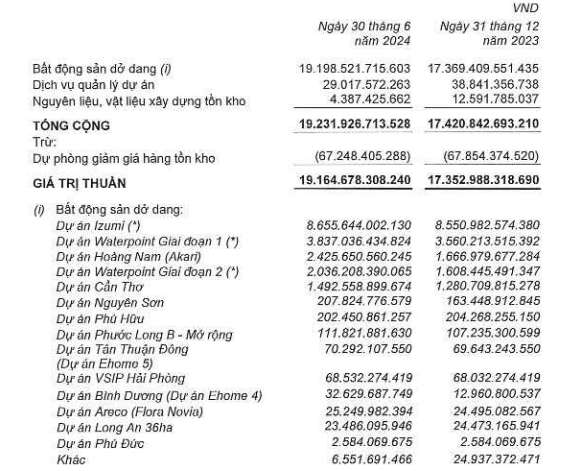

Nam Long Investment Joint Stock Company (NLG) has an inventory value of nearly VND 19,200 billion, an increase of 10%, accounting for 64% of total assets. This includes the value of the Izumi project (nearly VND 8,700 billion), Waterpoint phase 1 (over VND 3,800 billion), phase 2 (over VND 2,000 billion), and Akari (over VND 2,400 billion).

Consolidated financial statements Q2/2024 of NLG

Another case is Quoc Cuong Gia Lai Joint Stock Company (QCG) with over VND 7,000 billion in inventory value, accounting for nearly 75% of total assets. Of this, VND 6,500 billion is in uncompleted real estate.

Vinhomes (VHM), despite ranking second in terms of inventory value at VND 56,300 billion, accounts for only 11% of total assets. This includes over VND 48,600 billion in real estate under construction (a decrease of more than 5%), comprising land use fees, site clearance costs, and the purchase price of subsidiary companies allocated to projects such as Vinhomes Ocean Park 2 and 3, Vinhomes Grand Park, Vinhomes Smart City, and others.

“Vingroup Shares Soar: Related Warrants Surge 30%-80% in a Day”

Since August 7, Vinhomes stock has surged nearly 19% to a three-month high, while Vingroup’s stock has also climbed almost 4% and Vincom Retail has seen a 12% jump.

The Stock Market’s Resurgence: A Week of Robust Recovery

The stock market witnessed a robust recovery this week, with real estate stocks soaring in both volume and liquidity. Meanwhile, Tan Tao Group Joint Stock Company’s shares continue their steep downward correction, as news emerges of a company linked to Ms. Dang Thi Hoang Yen registering to purchase nearly 6 million ITA shares. In other news, FPT Retail’s stock has been consistently reaching new price peaks.