Expected Profit Margin Improvement

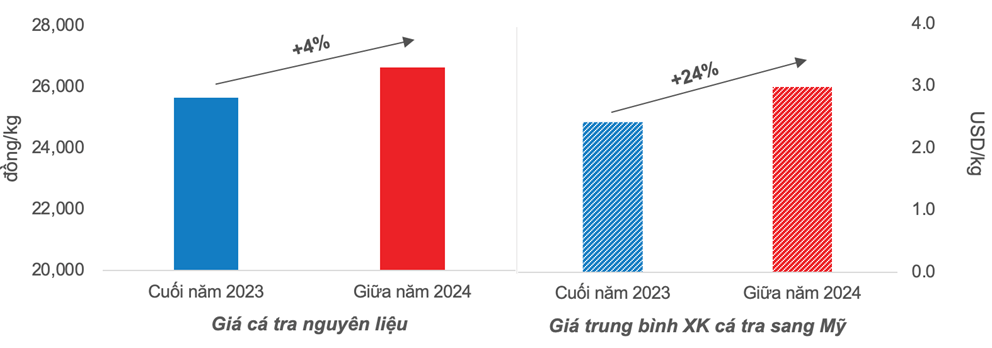

As of June 2024, the average export price of tra fish to the US increased by approximately 24% compared to the end of 2023, reaching $2.99/kg. The export price of tra fish is expected to continue its recovery in the second half of 2024 as consumer demand in major markets is gradually increasing again. Based on current market conditions, the Vietnam Association of Seafood Exporters and Producers (VASEP) expects Vietnam’s tra fish export price to rise by 5-10% in the latter half of 2024.

Meanwhile, the price of raw material tra fish has only increased by about 4% compared to the end of 2023 and has been showing a decreasing trend in recent months. This will support the improvement of VHC’s profit margin in the coming time, sharing some of the burden of transportation costs.

Raw Material Price Fluctuations and Average Export Price of Tra Fish from the end of 2023 to mid-2024

(Unit: VND/kg; USD/kg)

Source: VASEP

Capacity Expansion Plan for Collagen & Gelatin Business

In 2023, VHC disbursed a total investment of VND 677 billion for projects to increase production scale, and is expected to disburse an additional VND 930 billion this year (according to the plan presented at the 2024 Annual General Meeting of Shareholders). Notably, the project to increase the production capacity of Collagen & Gelatin (C&G) by 50% is the most remarkable. This is a high-profit margin business with few competitors, utilizing by-products in the production process of the core product – tra fish fillets, thereby helping the company maximize profits.

According to GrandviewResearch data, the demand for C&G is forecasted to reach a CAGR of 9.6% in the period of 2024 – 2030 as increasing income will encourage higher spending on health-related products, including collagen for better bone and skin health. This presents a significant opportunity for VHC – the first enterprise to successfully extract collagen from tra fish skin, to leverage its advantages and further tap into this sector’s potential.

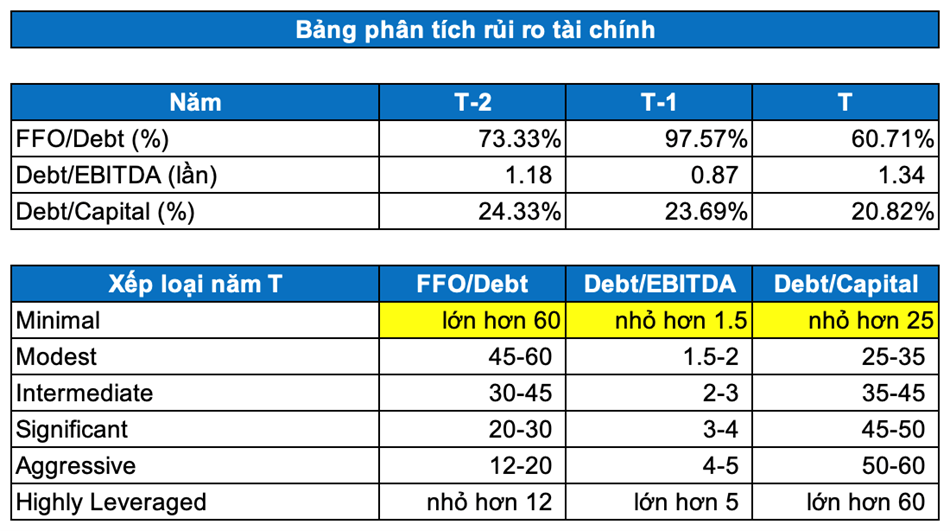

Low Financial Risk

Based on Standard & Poor’s criteria, VHC’s financial risk assessment indicators such as FFO/Debt, Debt/EBITDA, etc., have maintained a Minimal level in recent years. This risk level is the lowest in the financial risk classification. Therefore, investors can rest assured about this enterprise.

Source: VietstockFinance

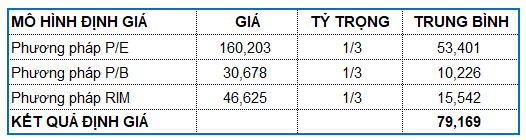

Valuation

The author uses the Market Multiple Models method in combination with RIM (Residual Income Model) to value the enterprise. With an equal weight assigned to each method, a reasonable valuation for VHC is calculated at VND 79,169.

Enterprise Analysis Division, Vietstock Consulting Department