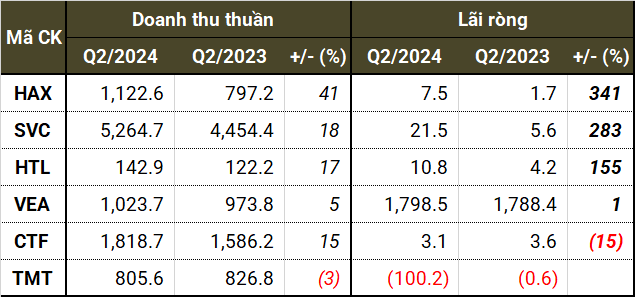

Out of the six automotive businesses listed on the stock exchanges (HOSE, HNX, and UPCoM), HAX, SVC, HTL, and VEA witnessed robust growth in both revenue and net profit. CTF posted higher revenue but lower profit, while TMT disappointed with a historical loss.

The combined revenue of the automotive industry in Q2 2024 reached VND 10.1 trillion, a 16% increase, but net profit declined by 3.4% to VND 1.7 trillion.

|

Financial results of automotive companies in Q2 2024 (in VND billion)

Source: VietstockFinance

|

The most notable performer this period was Hang Xanh Automobile Service JSC (Haxaco, HOSE: HAX) with a more than 40% surge in revenue and a remarkable 340% jump in net profit, amounting to over VND 1,100 billion and VND 7.5 billion, respectively. The gross profit margin stood at 8.6%, one of the highest in recent years.

HAX’s revenue has been consistently growing each quarter, but profit has not followed the same trajectory due to the luxury car business segment still being in recovery mode and facing intense price competition. The company attributed the improved profit compared to the previous year to the efficient operations of its subsidiaries.

“The business situation in the automobile market in Q2 2024 was better than the same period last year,” explained Saigon General Service Corporation (HOSE: SVC), as its revenue increased by 18% to VND 5,200 billion. Net profit tripled to VND 21.5 billion.

SVC’s financial performance has been on a clear upward trajectory since its low in Q1/2023, although it has not yet reached the peak of 2022. However, it’s worth mentioning that its financial income in Q2 2024 was VND 73 billion, a fifteen-fold increase compared to the previous year.

Technology and Automobile Engineering JSC (HOSE: HTL) reported a significant profit in the quarter, thanks to the sales of Hino trucks and specialized equipment from Japan. “The depreciation of the Yen in 2024 made the selling price of vehicles and specialized equipment more attractive to customers,” HTL said. Revenue reached VND 143 billion, a 17% increase, while net profit rose by 155% to nearly VND 11 billion. The gross profit margin for the quarter was over 13%, higher than the average of recent years.

In Q2, profit from joint ventures and associates continued to contribute VND 1,600 billion to Vietnam Engine and Agricultural Machinery Corporation (UPCoM: VEA)’s net profit, a 3.6% increase, which remained stable despite the industry’s challenges. This crucial factor kept net profit flat compared to the previous year at nearly VND 1,800 billion. VEA’s core business also saw positive momentum in Q1/2023, with revenue exceeding VND 1,000 billion, a 5% improvement, and gross profit reaching VND 170 billion, a 10% increase.

Why did CTF and TMT’s profits decline?

Amid the growth of most companies on a low base in the same period last year, what caused the profits of CTF and TMT to move in the opposite direction?

The revenue of Ford distributor, City Auto JSC (HOSE: CTF), increased by 15% to over VND 1,800 billion, but net profit decreased by 15% to VND 3.1 billion. According to the company, the automobile market and consumer demand in the first six months of the year remained subdued due to the economic recession.

A closer look reveals that while CTF’s gross profit increased, various expenses also rose significantly, including interest expense, selling expenses, and management expenses, which surged by 23%, 15%, and 55%, respectively. As a result, the company incurred a loss from business operations of VND 11.6 billion, compared to a loss of nearly VND 3 billion in the same period last year. A sudden gain of VND 12.1 billion in support expenses for organizing events, sales, and other activities helped CTF maintain profitability.

The case of TMT Automobile JSC (HOSE: TMT) is unique as it experienced a decline in both revenue and net profit. The truck manufacturer saw a slight drop in revenue of 3%, totaling VND 806 billion. Operating at a loss, the company incurred a gross loss of VND 47.6 billion, compared to a gross profit of VND 54 billion in the previous year. Halving interest expenses was not enough to prevent TMT from incurring a loss of VND 100 billion, the most significant since its listing in 2010.

“2024 has been a challenging year for the economy in general and businesses in particular. Economic recession, frozen real estate market, sharp decline in public investment, rising inflationary pressures, and consumers’ tightened spending have led to a deep drop in automobile consumption, despite automakers and dealers continuously slashing prices to clear inventory,” TMT explained the reasons behind the disappointing results in Q2.

| Net profit of TMT by quarter from 2019 to present |

What to expect in the second half of the year?

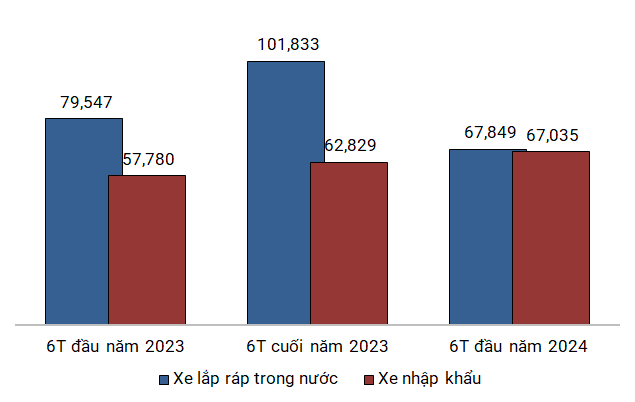

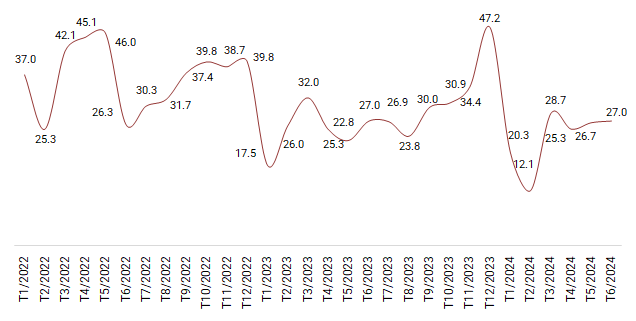

Data from the Vietnam Automobile Manufacturers’ Association (VAMA) and TC Group showed that approximately 79,000 vehicles were sold in Q2 2024, a 5.2% increase compared to the same period in 2023 but still significantly lower than the 117,000 vehicles sold in Q2 2022.

The months of April, May, and June 2024 recorded sales of 25,300, 26,700, and 27,000 vehicles, respectively, which were relatively high compared to the previous quarter. Cumulative sales in the first six months of 2024 totaled 140,000 vehicles, a decrease of nearly 7% year-on-year.

Since the expiration of the 50% reduction in registration fees in December 2023, there has been a significant drop in the sales of domestically assembled vehicles. In the first six months, local car sales reached nearly 68,000 units, a 15% decrease compared to the same period last year and a 33% drop compared to the last six months of 2023 when the incentive was in effect.

|

Vehicle sales every six months since 2023 (in units)

Source: Author’s compilation

|

In terms of market share by brand, Toyota regained the top spot in Q2 with 15,000 vehicles sold, a 15% increase year-on-year, capturing 19% of the total sales. This was a significant improvement from the 12% market share it held in Q1/2024. Hyundai followed closely with an 18% market share and sales of over 14,200 vehicles, a 7.2% increase. Ford ranked third with a 12.2% share and sales of 9,600 vehicles, a 10% increase. Mitsubishi stood out with a 49% surge in sales, recording 8,500 vehicles sold and capturing a 10.8% market share, placing it in fourth position.

In contrast, Kia and Mazda, both brands of “giant” Thaco, witnessed a decline in sales, with market shares of 10.6% and 3.3%, respectively, and sales of 7,700 and 7,000 vehicles. Thaco’s Bus and Peugeot’s luxury car brand were bright spots, with sales increasing by 108% and 39%, respectively. Thaco currently holds a 26.4% market share, slightly down from 26.8% in Q1/2024 and 28% in Q2/2023.

The domestic automobile manufacturing and assembly market is anticipating a 50% reduction in registration fees for the last three months of the year, instead of the usual six-month period for such incentives. This proposal was put forward by the Government Office at a meeting to discuss the draft decree on registration fee rates for domestically produced automobiles, based on the report of the Ministry of Finance and the opinions of the delegates present.

The shortened three-month period is likely to provide a significant boost to the demand for domestically produced and assembled vehicles in a context where the non-essential consumption sector, such as automobiles, is yet to show clear signs of recovery.

|

Vehicle sales by month from 2022 to present (in thousands of units)

Source: Author’s compilation

|

Vietnam Airlines Releases Reviewed Consolidated Financial Report for H1 2024

Vietnam Airlines (Vietnam Airlines, code: HVN) has released its reviewed consolidated financial statements for the first six months of 2024, reporting impressive figures. The airline’s revenue reached VND 52,562 billion, a nearly 20% increase compared to the same period last year. After deducting the cost of goods sold, gross profit stood at VND 6,704 billion, more than double the figure from the previous year.