Illustration. Source: Int

Ho Chi Minh City Stock Exchange (HoSE) has recently announced a supplementary list of securities ineligible for margin trading.

As per the notice, HoSE attributed the ineligibility of these securities to the negative post-tax profits of the parent company’s shareholders in the reviewed semi-annual consolidated financial statements for 2024.

The listed companies include FECON Mineral Joint Stock Company (FCM), HACISCO Joint Stock Company (HAS), Power Generation Corporation 3 (PGV), Quoc Cuong Gia Lai Joint Stock Company (QCG), Saigon Real Estate Corporation (SGR), and TMT Automobile Joint Stock Company (TMT).

Recently, HoSE also added three stocks to the margin cut list: TLH (from Tien Len Steel Corporation), EVE (from Everpia Joint Stock Company), and STK (from Century Yarn Securities Company).

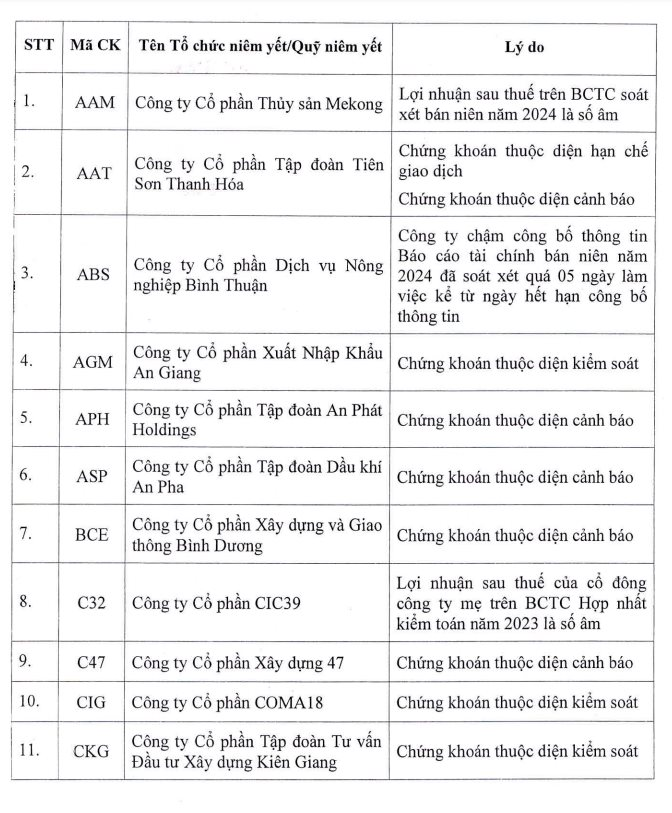

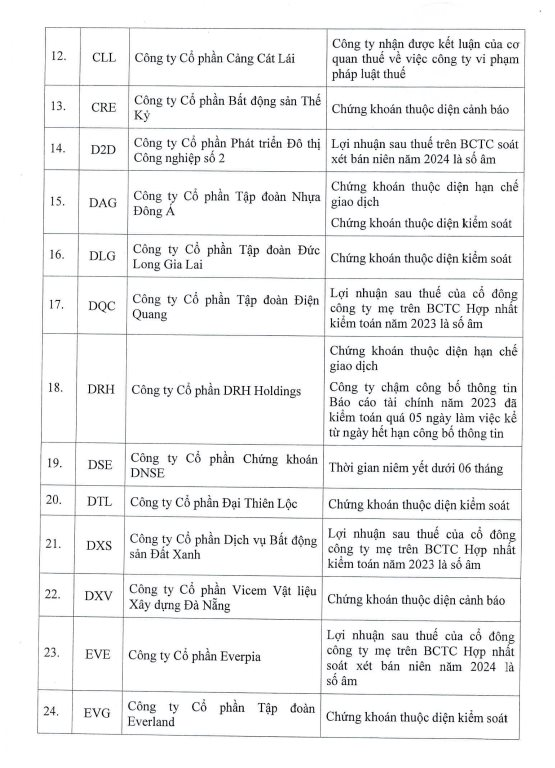

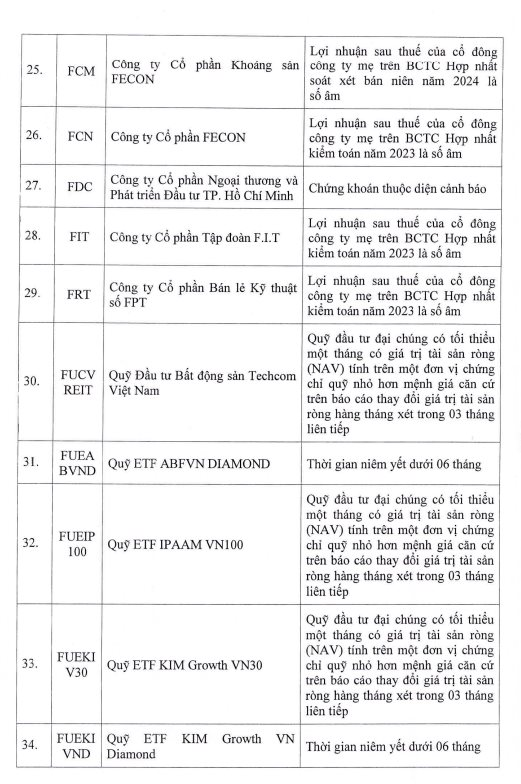

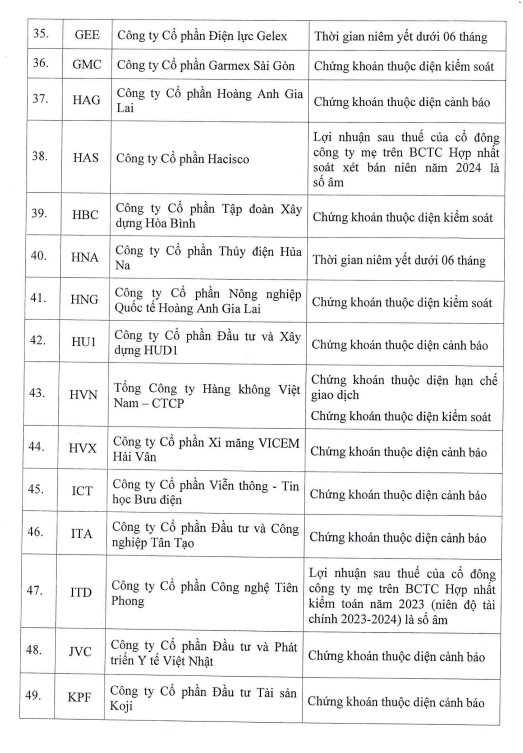

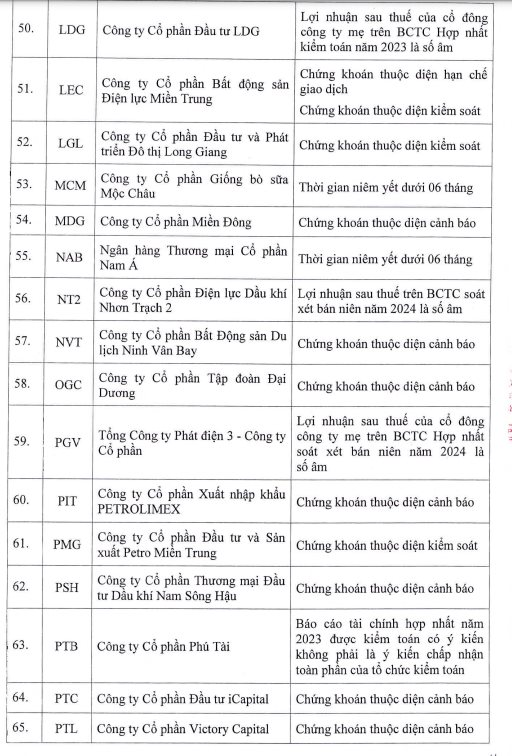

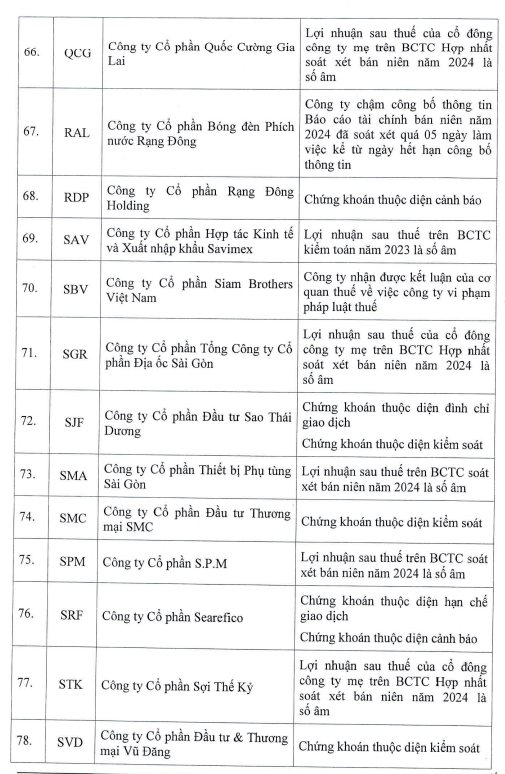

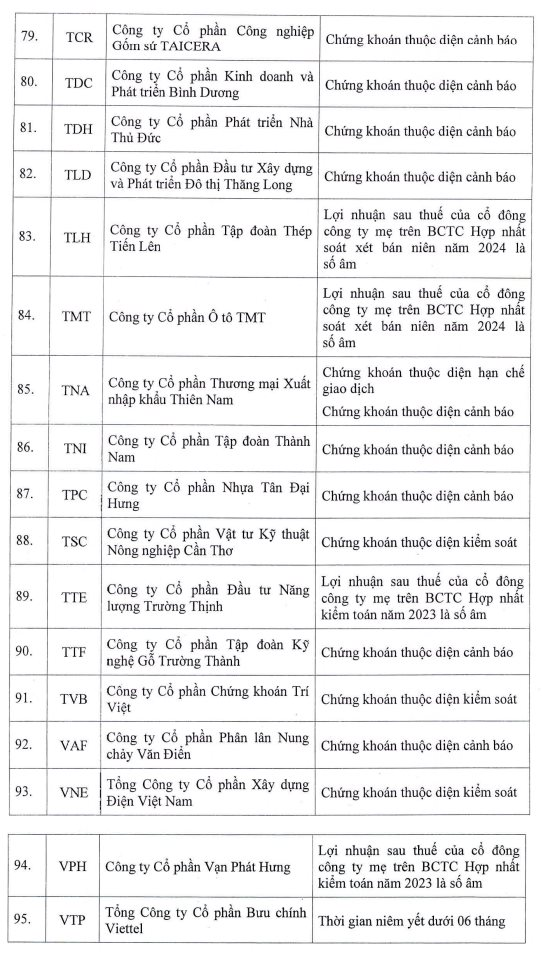

As of August 30, 2024, there are 95 securities on the HoSE that are ineligible for margin trading. The reasons for the margin cuts include stocks under warning/control/trading restriction; negative post-tax profits, audited reports with auditors’ opinions; and listing time of less than six months.

Below is the list of 95 HoSE-listed stocks that are margin-ineligible as of August 30, 2024: