With 3.4 million shares outstanding, UPC will have to spend over VND 5.4 billion on dividends. The payment date is set for October 10, 2024.

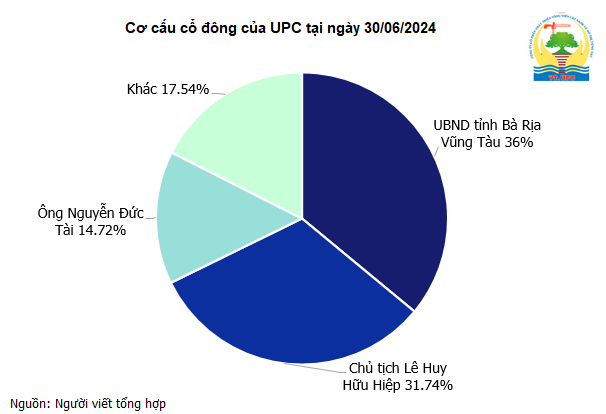

As of June 30, 2024, the People’s Committee of Ba Ria – Vung Tau province, the largest shareholder, owned 36% of UPC’s capital and will receive nearly VND 2 billion in dividends in the upcoming payout. Following them, Mr. Le Huy Huu Hiep, Chairman of the Board of Directors, holds 31.742%, and Mr. Nguyen Duc Tai, former Chairman of UPC, holds 14.722%, expecting to receive VND 1.7 billion and VND 800 million in dividends, respectively.

In terms of relationships, Mr. Nguyen Duc Tai is the father of Mr. Nguyen Duc Viet, a member of the Board of Directors and Vice General Director of UPC. Currently, Mr. Viet does not hold any shares in UPC.

UPC was transformed from Lam Vien Cay Xanh Company of Vung Tau city in 2009, with a charter capital of VND 34 billion. Its main business is managing, caring for, and planting new urban parks… UPC currently has three wholly-owned subsidiary companies, all of which are engaged in the construction of urban park projects. The Company had 631 employees as of the end of 2023.

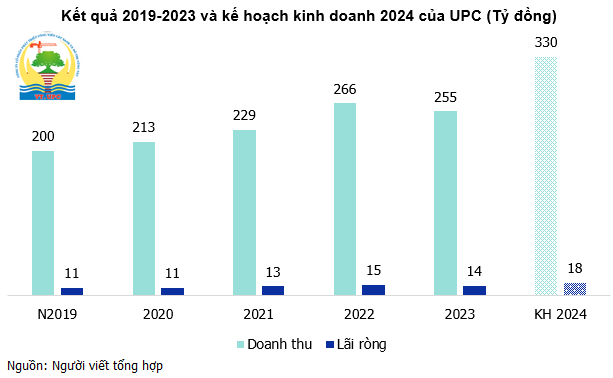

Regarding business performance, in the last five years (2019-2023), annual revenue has consistently exceeded VND 200 billion, along with an average net profit of VND 13 billion per year, higher than the previous phase, with an average profit of about VND 8 billion.

The stable business picture supports a consistent dividend policy. UPC has never forgotten to pay cash dividends to its shareholders since 2011, i.e., for 13 consecutive years, with a rate ranging from 12% to 14%. In the last two years (2021-2022), the dividend rate remained at 15% and increased to a record high of 16% in 2023.

In 2024, UPC again raised the dividend rate to 17% in cash based on ambitious business plans, with total revenue of VND 330 billion and net profit of VND 17.6 billion, up 29% and 24%, respectively, compared to 2023. These are all record numbers in the company’s history.

Since the beginning of 2024, UPC’s share price has been hovering around its historical peak of VND 25,000/share, but market liquidity has been extremely low, with no transactions due to the highly concentrated shareholder structure.

| UPC Share Price Movement since the beginning of 2023 |

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”

The Ultimate English Copy: “SJE to Offer Over 18 Million Shares at Half Market Price”

On August 26, the Board of Directors of Song Da 11 Joint Stock Company (HNX: SJE) approved a plan to offer more than 18 million shares to existing shareholders at VND 13,000 per share, equivalent to half of the current market price. SJE expects to raise nearly VND 236 billion to fund investment activities and repay loans.