Selling pressure mounted in the afternoon session, causing the market to plunge with 426 losers and only 13 gainers, while 276 stocks added marks and 14 hit the ceiling price, leaving 876 stocks unchanged.

Banking, securities, and real estate stocks, which were the bright stars driving the recovery in the morning session, quickly turned red and put significant pressure on the market.

The Vingroup trio of VHM, VIC, and VRE tried to hold their ground but eventually succumbed to the selling pressure, even narrowing their gains from the morning session, with VRE returning to the reference price.

Only five sectors posted gains, including food and essentials retail up 10%, semiconductors up 2.04%, real estate up 0.7%, production materials up 0.34%, and hardware up 0.08%.

Among the numerous declining sectors, healthcare led with a 3.02% drop, followed by telecommunications with a 2.61% loss. The market also witnessed five sectors falling over 1%: software, distribution and durable goods retail, vehicles and components, raw materials, and energy.

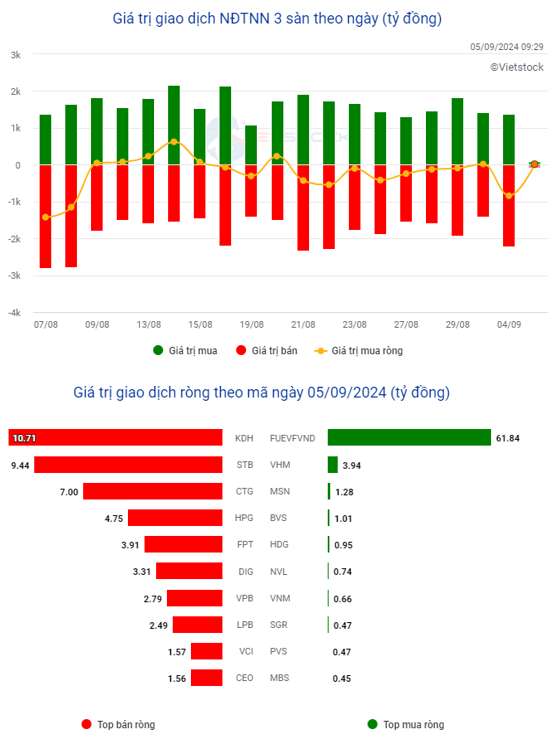

Today’s total market liquidity reached nearly VND 18,254 billion, increasing in the afternoon session. Foreign investors’ trading activities followed a similar pattern, with buying and selling values spiking towards the end of the session, resulting in a large-volume session with a buying value of nearly VND 2,671 billion and a selling value of over VND 3,421 billion, leading to a net sell-off of nearly VND 751 billion.

| Enter Title |

Net selling pressure focused on FPT, with a value of nearly VND 297 billion, while the next stock on the list saw less than VND 93 billion in net selling. Conversely, net buying efforts in VHM, at nearly VND 189 billion, and VNM, at over VND 91 billion, were insufficient to balance the market. Overall, foreign investors have been net sellers in 9 out of the last 10 sessions.

14:15: Large caps exert pressure, market turns red

At the start of the afternoon session, the market continued to face pressure and officially turned red after just 25 minutes due to the decline of many large-cap stocks such as FPT, GVR, CTG, MWG, etc. As of 14:00, the VN-Index fell nearly 4 points to 1,271.87. The bearish scenario was also observed in the HNX and UPCoM markets.

The red dominated the market as 423 stocks declined, including 14 hitting the floor price, while 269 advanced and 913 remained unchanged.

The pressure was widespread but most evident in many large-cap stocks such as FPT falling 2.26%, MWG down 1.45%, HPG losing 0.59%… Notably, many banking and securities stocks gradually turned from green to red, exerting significant pressure on the market. The scenario of a green morning session followed by an afternoon sell-off dominated by large caps has become familiar in recent times.

FPT was also the most net-sold stock in the market, with a value of over VND 292 billion, creating a significant gap with the rest and being one of the main factors widening the net selling value in the overall market to nearly VND 733 billion. Today’s net selling volume is also gradually approaching the strong net selling volume of the previous session.

Only four sectors remained in positive territory, including food and essentials retail up 10%, semiconductors up 2.04%, real estate up 0.89%, and production materials up 0.19%.

Among the numerous declining sectors, healthcare led with a 3.15% drop, followed by telecommunications with a 2.18% loss. The market also witnessed three sectors falling over 1%: software, distribution and durable goods retail, and specialized services and commerce.

Morning session: Cooling off before lunch break

The market consecutively soared in the first half of the morning session, surpassing the 1,282-point level with the VN-Index up more than 6 points. However, it then pulled back and ended the morning session with a gain of 2.02 points, reaching 1,277.82.

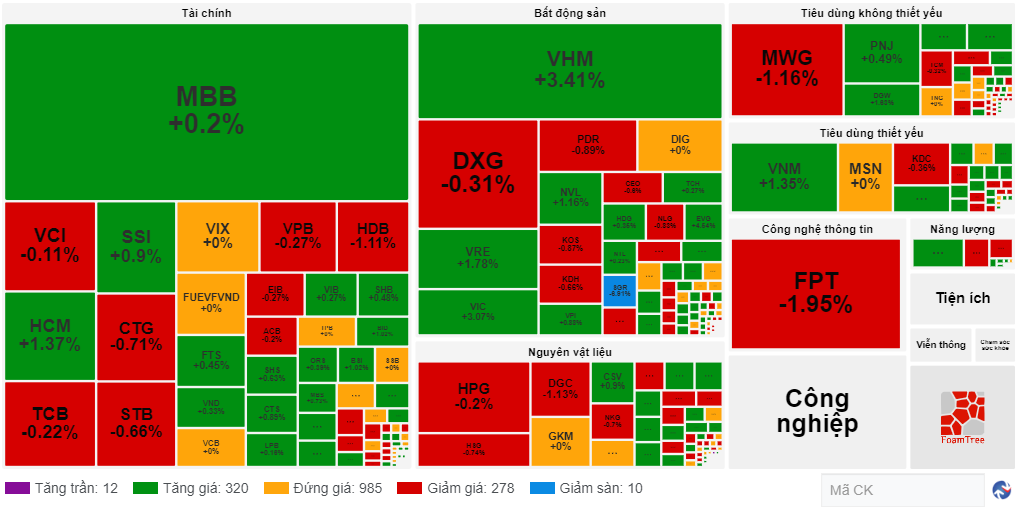

The market breadth included 331 gainers, including 12 stocks hitting the ceiling price, and 288 losers, including 10 stocks falling to the floor price, while 985 stocks were unchanged. The greens still dominated. The total trading value of the three exchanges exceeded VND 8,486 billion, a notable increase compared to the previous session’s sharp decline.

Source: VietstockFinance

|

Investors paid great attention to pillar stocks in the financial sector, such as MBB, VIB, SHB…, securities firms such as SSI, HCM, FTS, VND…, and real estate, especially the Vingroup trio of VHM up 3.41%, VIC up 3.01%, and VRE up 1.78%. Stocks in these sectors also took turns influencing the market in the morning session.

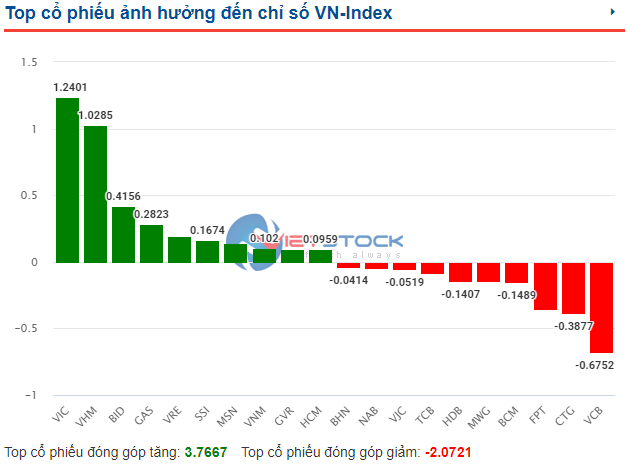

These three stocks significantly influenced the VN-Index, with VHM contributing 1.59 points, VIC adding 1.3 points, and VRE bringing in 0.2 points. All three were among the top 10 stocks with the most positive impact on the VN-Index in the morning session. On the other side, FPT was the heaviest burden, taking away 0.9 points.

FPT was also the most net-sold stock in the market, with over VND 234 billion, far surpassing the runners-up such as HPG with more than VND 53 billion, VCI with nearly VND 45 billion… In terms of net buying, VHM attracted nearly VND 78 billion, FUEVFVND over VND 65 billion, VNM more than VND 34 billion, and NVL nearly VND 13 billion. Overall, foreign investors were net sellers in the morning session, with a net sell-off of over VND 525 billion.

10:45: Continuing to gain ground, momentum from the financial and real estate sectors

Following the positive momentum from the start of the morning session, the market extended its gains, driven by the pillar sectors of finance and real estate. As of 10:30, the VN-Index rose 5.07 points to 1,280.87, while the HNX and UPCoM also traded in positive territory.

The market map was painted green with financial stocks such as MBB, HCM, SSI, VIX, FTS,… alongside real estate stocks like DXG, PDR, DIG, NVL, and the Vingroup trio of VIC, VHM, and VRE. Although the gains were not significant, the overall increase, coupled with their high weights in the market, provided a strong boost to the indices.

The total trading value of the market reached VND 6,247 billion, notably higher than the previous session and slightly above the 5-session average.

The “selective” net buying by foreign investors continued, with strong net buying in VHM of over VND 55 billion and FUEVFVND of nearly VND 54 billion. On the other side, FPT faced the most substantial net selling of nearly VND 71 billion, followed by CTG, STB, HPG, KDH, VPB…, which experienced relatively balanced net selling around VND 30 billion.

Opening: Vingroup trio accelerates, market rebounds after yesterday’s decline

After falling more than 8 points in the previous session, the VN-Index rebounded 2.88 points to 1,278.68 at the opening of September 5 and continued to climb to 1,280.33 at 9:30. The HNX and UPCoM also traded in positive territory, rising 0.44 points to 236.58 and 0.21 points to 93.96, respectively.

Overall, the market witnessed 278 advancing stocks, including 11 hitting the ceiling price, while 157 declined, including 2 falling to the floor price. Liquidity was higher than the previous session.

The Vingroup trio of stocks stood out in the market, especially in the real estate sector. Specifically, VIC rose 2.84%, VHM climbed 2.35%, and VRE advanced 1.52%. All three were among the top 10 stocks with the most positive impact on the VN-Index, contributing 1.24 points, 1.03 points, and 0.2 points, respectively, to the index’s 3.77-point gain.

Source: VietstockFinance

|

Source: VietstockFinance

|