ND2 Announces Impressive Dividend Payouts and Consistent Double-Digit Dividend Yield

With an execution rate of 20% (1 cp receiving VND 2,000) and nearly 50 million cp in circulation, ND2 is estimated to distribute nearly VND 100 billion in dividends to shareholders. The expected payment date is October 16, 2024.

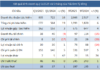

Source: VietstockFinance

|

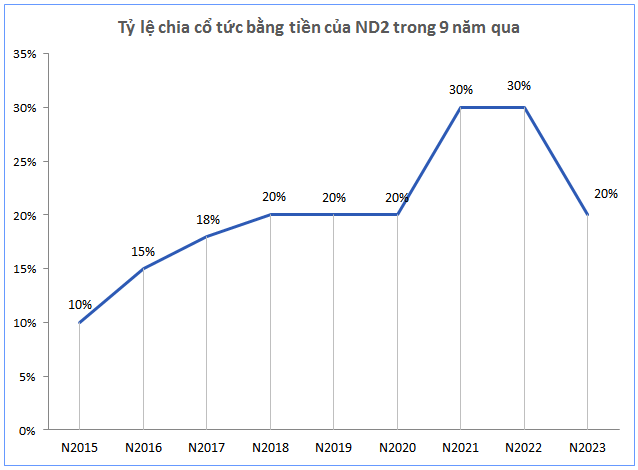

Over the past nine years (2015-2023), ND2 has consistently maintained a double-digit cash dividend yield for its shareholders, ranging from a minimum of 10% to a maximum of 30%.

Source: VietstockFinance

|

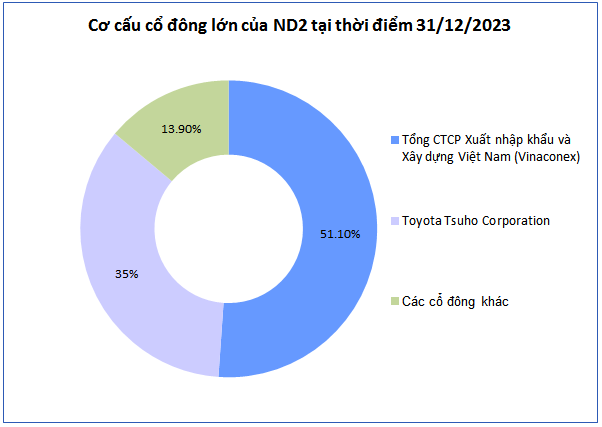

As of December 31, 2023, ND2 has only two major shareholders. The first is the Vietnam Construction and Import-Export Corporation (Vinaconex), which is the parent company and holds 51.1% of the capital, estimated to receive over VND 51 billion in dividends. The second largest shareholder is Toyota Tsuho Corporation, holding 35% of the shares and expected to earn nearly VND 35 billion.

| ND2’s Business Results for the First Half of 2024 |

In terms of business performance, ND2 concluded the first half of 2024 with impressive figures, achieving VND 131 billion in net revenue, a 20% increase compared to the same period last year. Net profit reached over VND 36 billion, a staggering 56-fold increase from the previous year’s figure of approximately VND 600 million.

The Company’s explanation attributes these results to its business as a power producer (hydropower), where revenue heavily relies on hydrological conditions. The water flow into the reservoir during the first six months of 2024 was higher than the previous year, resulting in a significant increase in production. Consequently, the output for the first half of this year reached 142.96 million Kwh, compared to 113.47 million Kwh in the same period last year, representing an increase of 29.49 million Kwh. Additionally, a substantial 36% reduction in financial expenses (mainly interest expenses) contributed to the exponential growth in net profit.

Despite the remarkable improvement in financial performance, ND2 has only accomplished 35% of its revenue target and over 23% of its profit goal for the year, as per the growth plan (a 14% increase in net revenue and a 45% rise in post-tax profit compared to 2023 results) approved by the General Meeting of Shareholders.

The Vanishing Act: Unraveling the Mystery Behind DIC Corp’s Unscathed Profit Amidst Plummeting Revenue

After a thorough review, DIC Corp reported a significant drop in revenue, totaling VND 187 billion, resulting in a revised figure of VND 635 billion. Despite this decline, the company’s net profit remained relatively unchanged at approximately VND 4 billion, largely due to deferred corporate income tax.