The market was rattled this afternoon, with indices dipping slightly and individual stocks taking a more significant hit. Bottom-fishers remain passive, which isn’t surprising as they currently have the upper hand in price negotiations. At this point, covering sold-off stocks becomes a priority.

While VHM and VIC’s price increases distorted the indices, the crowd’s chaotic behavior persisted. Bets on a post-holiday surge seem to have backfired, with many now accepting significant discounts on their sales.

There’s no particularly negative news on the market; everything remains status quo. However, sentiment is weaker, and the market is currently dominated by short-term supply and demand dynamics rather than reacting to information. As the selling volume exceeds the buying power at reference prices, sellers must offer discounts to offload their positions. Buyers are aware of this dynamic and don’t need to raise their bids, resulting in many stocks closing at or near their daily lows.

It’s typical for the market to retreat if it lacked the strength to break through the previous high. The sideways movement before the holiday led many to bet on a positive scenario, but now it’s time to trim positions. Whether the consolidation phase at the end of August was accumulation or distribution depends on the outcome: if there’s a breakthrough, it’s accumulation; otherwise, it’s distribution. Currently, stocks are signaling more distribution, suggesting prices may continue to fall slightly before a strong enough covering flow emerges.

As the market is currently driven by short-term supply and demand, signals of saturation in supply and demand will also be reflected in liquidity and price volatility. Many stocks are declining with gradually increasing volume or maintaining above-average levels. As the selling pressure is gradually absorbed, the pressure will ease, no longer sufficient to expand the volatility range. After a few sessions, prices will gradually balance out again. Since there are no macro changes, the broader trend remains unaffected, and fluctuations over a few days or weeks are not a significant concern.

The market is still favorable, and the price drop presents an opportunity to cover stocks. The key is to maintain buying power to act on this scenario, as attempting to catch the bottom by reducing costs or using margin remains risky. Additionally, focus on stock purchase points around strong technical support levels and local supply and demand rather than solely on the index.

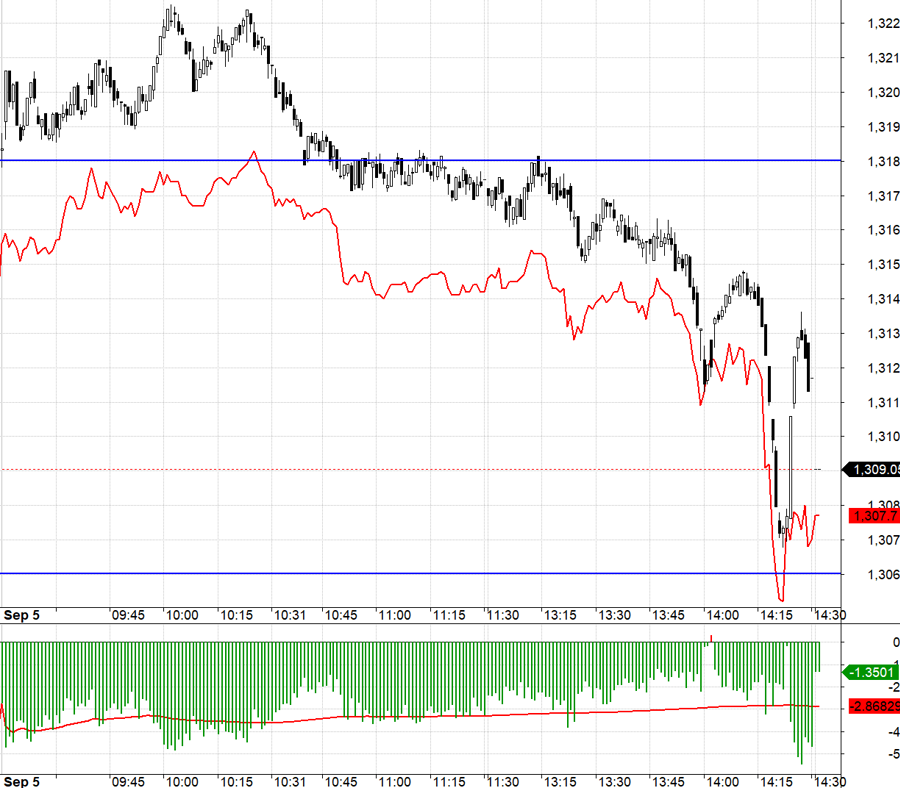

In today’s derivatives market, F1 maintained a wide discount to VN30, even during the index’s initial upward movement. There were two expected volatility ranges for the index: an upward range from 1318.xx to 1325.xx and a very wide opening range on the downside from 1318.xx to 1306.xx. On the upside, F1 opened a basis instead of following VN30, and although it surpassed 1318.xx, it couldn’t reach 1325.xx, peaking at around 1323. As a result, going long carried low risk but offered limited profit potential. In the latter half of the morning session, VN30 crawled just below 1318.xx while maintaining a discount of over 3 points, making it challenging to decide between going long or short. Going long had advantages, but it was uncertain if VN30 would breach 1318.xx, and going short was also tricky because the difference between VN30 and the 1318.xx threshold wasn’t enough to offset the basis. The acceptable risk point for going short presented itself at the beginning of the afternoon session when the basis was around -2 points and VN30 firmly tested 1318. A short setup could be initiated with a stop loss if VN30 crossed 1318.xx or the basis narrowed to over 2 points, sufficient to wager that such a loss would be offset by gains when VN30 fell to 1306.

The market may recover during the final trading session of the week, and macroeconomic data for August will be released this morning. A downward trend is still likely at the beginning of the day. The strategy is to focus on buying stocks and dynamically going long or short with derivatives.

VN30 closed today at 1309.05. Tomorrow’s resistances are 1318; 1325; 1335; 1339; 1346; 1350. Supports are 1306; 1302; 1294; 1290; 1279; 1269.

“Blog chứng khoán” reflects the personal views of the investor and does not represent the opinions of VnEconomy. VnEconomy respects the author’s perspective and writing style and does not hold responsibility for issues related to the investment views and opinions expressed in this blog.

The Elusive Art of Crafting the Perfect Tea: Navigating the Delicate Balance of Shan Snow Tea’s Uncertain Harvests and Market Fluctuations

It is the middle of the third harvest season for Shan Tuyet tea trees in Hoang Su Phi, Ha Giang. The harvest has been affected by heavy night-time rainfall and intense daytime sunshine, which have negatively impacted the growth and germination of the tea trees, resulting in reduced yield and lower prices.