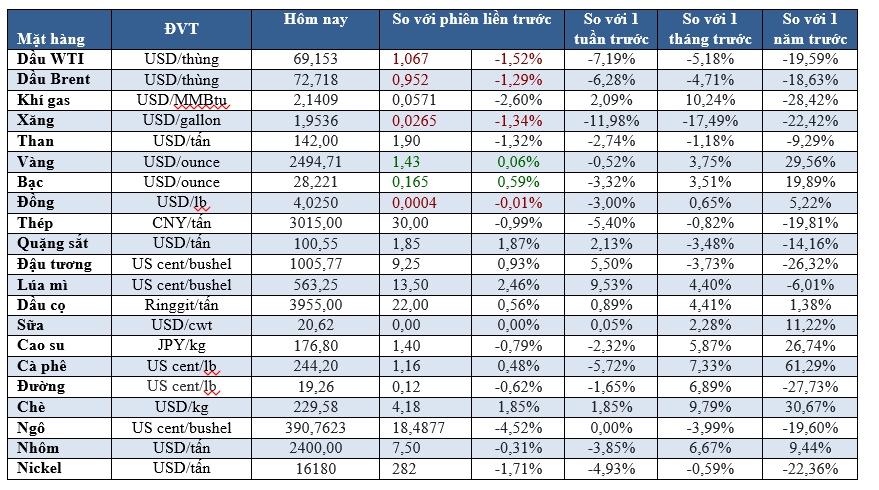

Crude oil prices fell by over $1 per barrel as traders worried about demand in the coming months.

Oil prices slip more than $1 per barrel on demand worries

Oil prices slipped by more than $1 per barrel as traders worried about demand in the coming months, with mixed signals from crude producers about increasing supply. Brent crude futures fell by $1.05, or 1.42%, to $72.70 per barrel. U.S. West Texas Intermediate (WTI) crude futures fell by $1.14, or 1.62%, to $69.20.

Both benchmarks fluctuated within a $1 range after news that OPEC+ was discussing a possible delay in increasing output due to expected higher production from Libya.

Muted data from the U.S. and China reinforced expectations of a weaker global economy and softer oil demand, contributing to a broader decline in world markets.

Meanwhile, traders believed that the dispute over Libya’s oil exports could end, bringing more crude supply back online.

Gold rebounds from lows after weak U.S. jobs data

Gold prices rose, buoyed by a softer dollar and lower yields, as weaker-than-expected U.S. job openings pointed to a potential Federal Reserve interest rate cut at this month’s policy meeting. Spot gold rose by 0.1% to $2,494.24 per ounce by 1741 GMT, bouncing back from a two-week low of $2,471.80 reached earlier in the session. U.S. gold futures settled up 0.1% at $2,526.00. Data showed U.S. job openings falling to a three-and-a-half-year low in July 2024.

Silver rose by 0.5% to $28.18 per ounce, platinum gained 0.5% to $907.68, and palladium fell nearly 1% to $929.25.

Copper edges higher after touching three-week lows on global growth worries

Copper prices edged higher as buying emerged after the metal touched three-week lows, but gains were capped by concerns about weaker global economic growth dampening demand for industrial metals. Three-month copper on the London Metal Exchange rose by 0.1% to $8,958 per tonne after touching $8,890, the weakest since August 12.

Worries about the Chinese economy deepened on Wednesday as data showed growth in the country’s services sector slowed in August following previously optimistic figures from the manufacturing and real estate sectors.

The most-traded October copper contract on the Shanghai Futures Exchange ended the day session down by 2.4% at 71,700 yuan ($10,081) per tonne, the lowest since August 13.

Aluminum on the LME fell by 0.5% to $2,394.50 per tonne, nickel dropped by 2.1% to $16,115, zinc declined by 1.7% to $2,797, lead lost 1.5% to $2,017, and tin slipped by 0.8% to $30,405.

Soybeans, corn rise on weather concerns; wheat gains

Soybean futures in Chicago rose on weather concerns, with corn drawing support from soybeans, and wheat gaining as harvest pressure eased and traders engaged in short-covering. Corn rose by 3-1/2 cents to $4.12-3/4 per bushel. Soybeans gained 9-1/2 cents to $10.21-1/2 per bushel. Soybeans also found support from the possibility that China could impose tariffs on Canadian canola oil, raising hopes that China might purchase more U.S. soybeans. The most actively traded CBOT wheat contract rose by 14 cents to $5.80-3/4 per bushel.