The average income of CEOs in Vietnam’s public companies is revealed in a new report, with the top earner bringing in an impressive 17 billion VND annually.

A recent report, “Income of General Directors, Chairpersons of the Board of Directors, and Independent Members of the Board of Directors in Vietnamese Public Companies in 2023,” sheds light on the compensation of top executives. The study, conducted by FiinGroup, FiinRatings, and VNIDA, analyzed 200 public companies with a capitalization of 500 billion VND or more as of the end of 2023. It found that the average income of CEOs in these companies stood at 2.5 billion VND per year per person in 2023.

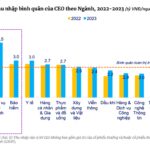

Breaking it down by industry, the real estate, financial services (mainly securities companies), and insurance sectors boasted the highest average incomes for General Directors. When looking at different types of enterprises, state-owned enterprises lagged significantly behind private companies in terms of CEO income, despite similar operational efficiency.

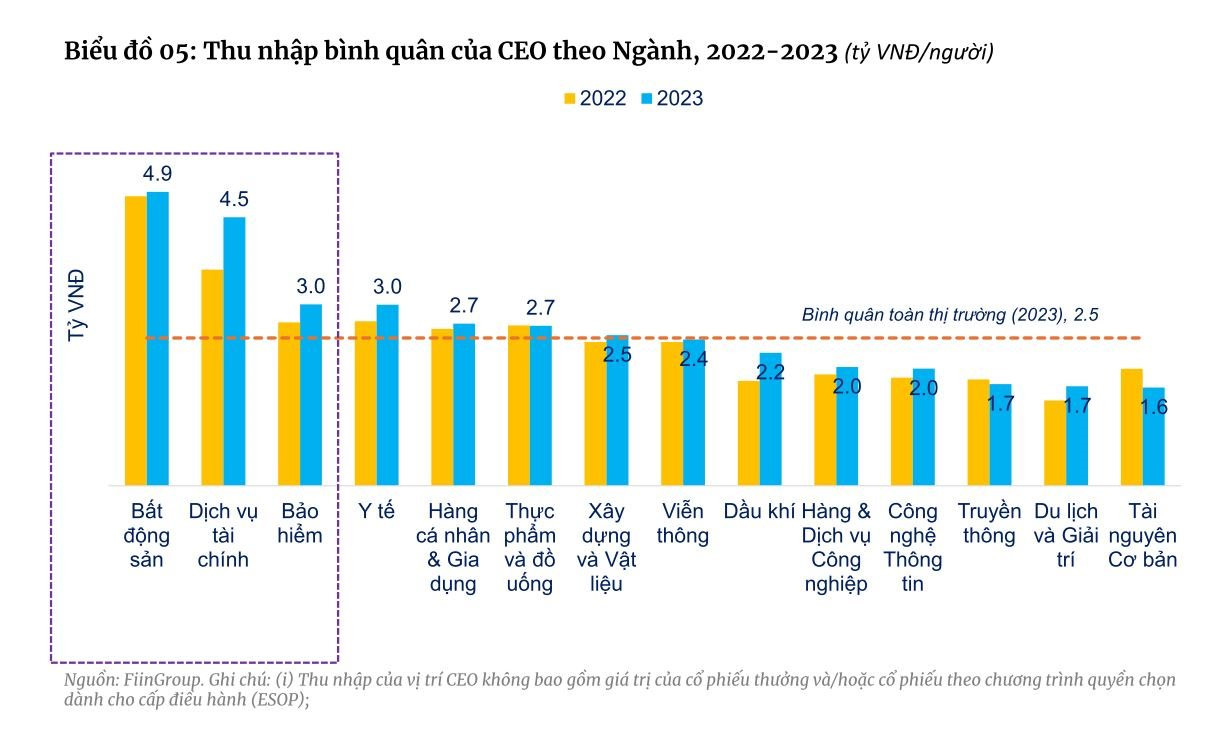

Notably, the top earner among the 15 companies with the highest CEO incomes was the Urban Development Corporation – JSC (KBC), with a reported income of 17 billion VND in 2023 by FiinGroup. Following closely in second place was Masan Group JSC (MSN), with VHM, NLG, VIC, VRE, and HCM also making the list.

The report also revealed that CEOs in state-owned enterprises earned less than half of their counterparts in private companies, despite similar operational efficiency (as indicated by the return on equity – ROE). This disparity arises from the current mechanism where the Chairperson of the Board of Directors in state-owned enterprises also holds an executive position.

In terms of market capitalization, CEOs in large-cap companies enjoyed significantly higher incomes, approximately 52% above the market average in 2023. This aligns with the positive operational efficiency observed in this group compared to the other two categories.

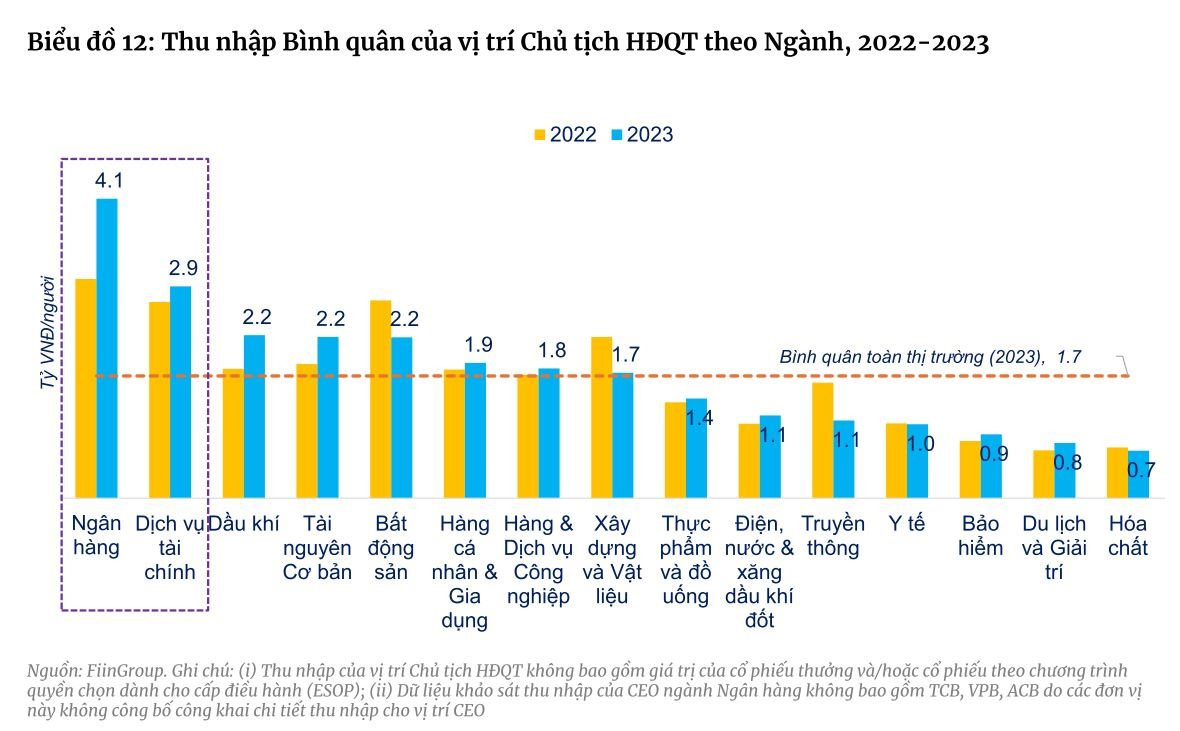

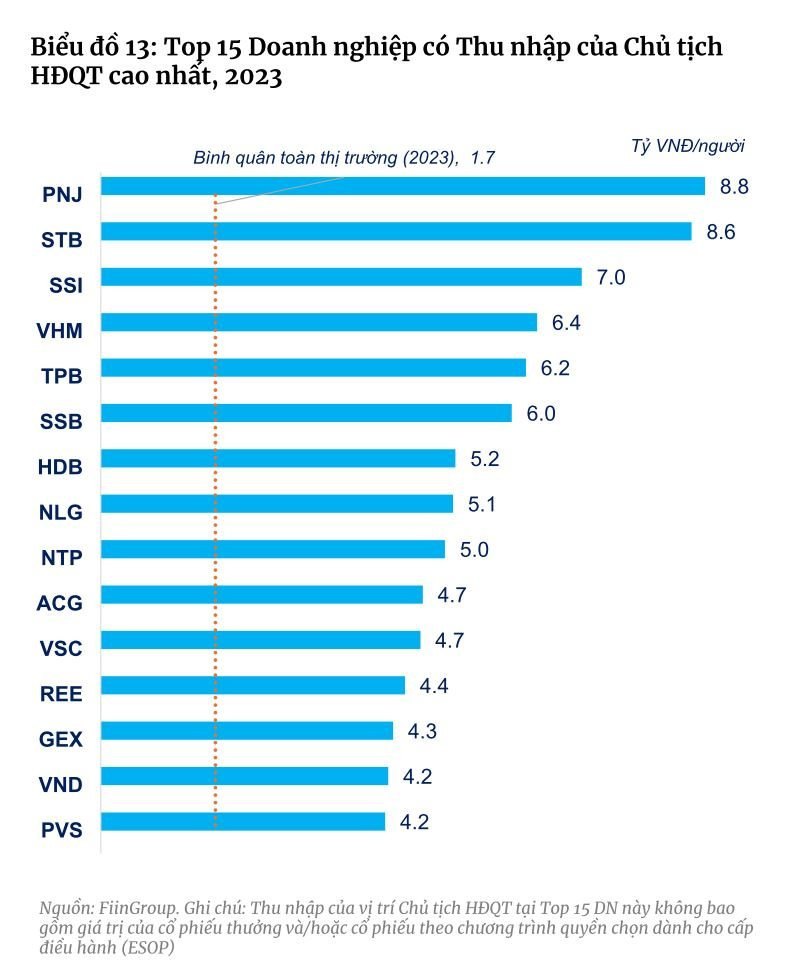

Turning to the Chairpersons of the Board of Directors, their average income for 2023 was 1.7 billion VND per person. The banking and financial services sectors (mainly securities companies) boasted the highest average incomes for this position, thanks to the involvement of these leaders in operational decision-making.

The research team from FiinGroup noted that companies like PNJ, VHM, NLG, NTP, and REE stood out with higher incomes for their Chairpersons compared to the majority of other companies. They attributed this to the dual role of these individuals, serving as both Chairpersons and taking on some operational responsibilities typically associated with CEOs.

Unveiling the “Massive” Income of Chairpersons and CEOs in the Banking and Real Estate Sectors

The average income of a CEO in the real estate, securities, and insurance industries is an impressive 2.5 billion VND per year. This figure showcases the potential earnings of those at the top of these lucrative sectors. It is a testament to the rewards that come with leadership and expertise in these fields.