In a recent announcement, Gojek has revealed that it will be ceasing its operations in Vietnam, effective September 16. The Indonesian ride-hailing company stated that the decision was made by its parent company, GoTo Group, as part of a strategic review of its market presence to optimize growth. According to Gojek, this move aims to consolidate their business and align with their long-term growth strategy.

“We will provide the necessary support to all affected parties during this transition and ensure compliance with relevant regulations and laws”, the company added.

Gojek expressed its sincere gratitude to its employees, users, driver-partners, and restaurant partners who have been part of their journey in Vietnam. The company pledged to support all stakeholders during this transition while adhering to applicable regulations and laws.

Gojek’s exit from the Vietnamese market comes amid fierce competition from established rivals Grab and Be. Additionally, the entry of tycoon Pham Nhat Vuong into the ride-hailing industry with his electric taxi company, Xanh SM, which has rapidly expanded across the country in just over a year, has also contributed to the competitive landscape.

In recent years, the Indonesian company has been losing market share to its competitors. According to a report on the “Popularity of Motorbike-hailing Apps in 2024” by Q&Me, Grab remains the most popular ride-hailing app among Vietnamese users, but its market share has been challenged by two local companies, Be and Xanh SM, while Gojek has fallen to the fourth position.

The report also indicates that 42% of Vietnamese users choose Grab for their motorbike-hailing needs, followed by Be and Xanh SM with 32% and 19% respectively, while only 7% of users regularly use Gojek. A few years ago, Gojek held a higher position, but it has since been pushed back as the market became more competitive.

Amid this landscape, Grab has maintained its dominant position in the Vietnamese market, despite the narrowing gap with competitors like Be and Xanh SM.

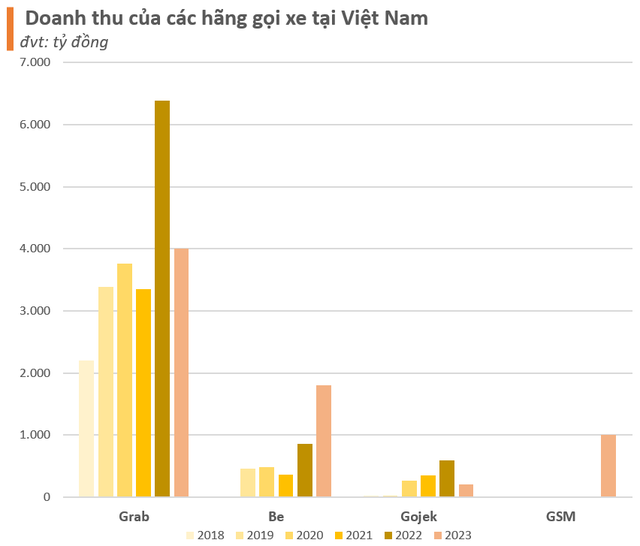

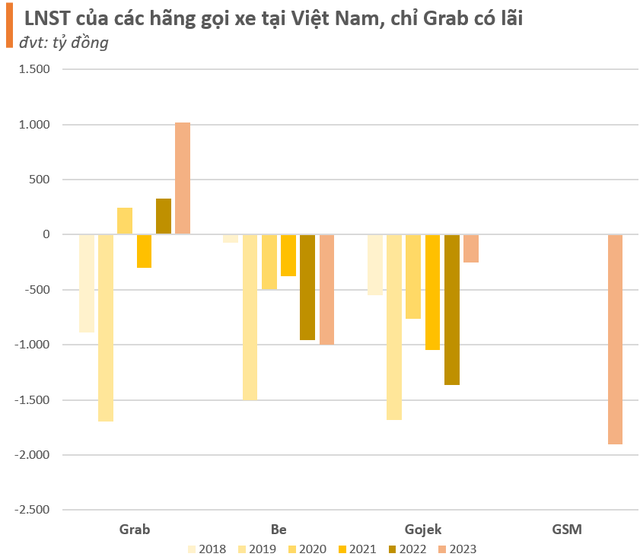

With the loss of market share, Gojek’s financial performance has also taken a hit. In 2023, prior to the entry of GSM, the company’s revenue took a significant dip to around VND 200 billion, while its competitors all brought in revenues in the thousands of billions. Grab, in particular, maintained its “big brother” status with revenues of over VND 4,000 billion, the highest in this sector in Vietnam.

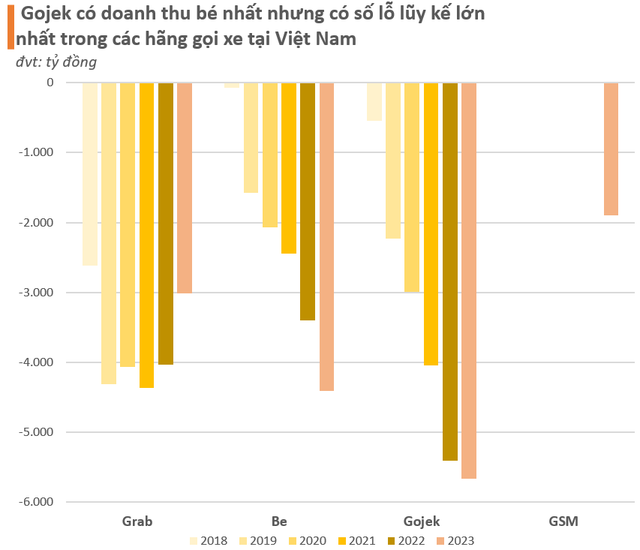

Gojek’s loss in 2023 suddenly decreased to only VND 250 billion compared to the record high of nearly VND 1,400 billion in 2022, while the low revenue figure suggests that since last year, this ride-hailing company has stopped “burning money”. According to our data, as of the end of 2023, Gojek had accumulated losses of nearly VND 5,700 billion in the past 6 years.

Both Grab and Be have accumulated losses of a few thousand billion VND as well. However, the difference is that Grab has started making profits, even earning thousands of billion VND in 2023.

According to Business Times (Singapore), Gojek Vietnam accounted for less than 1% of GoTo’s total transaction value in the second quarter of 2024. As a result, the exit from Vietnam is not expected to impact the company’s financial situation.

Gojek first launched in Vietnam in August 2018 under the name GoViet, offering GoBike (motorbike-hailing) and GoSend (delivery) services. Just two months later, they expanded to include the online food delivery service, GoFood.

In August 2020, the GoViet brand was officially replaced by Gojek Vietnam, with the company’s colors, driver uniforms, and branding changing from red to green, black, and white, mirroring its parent company’s image.

Prior to this, Gojek had withdrawn from Thailand in 2021. GoTo is now focusing on its home market and Singapore. In Indonesia, Gojek’s total transaction value (GTV) and the number of completed orders in the second quarter of 2024 increased by 18% and 24%, respectively, compared to the same period last year, reaching an all-time high.

In Singapore, Gojek witnessed a 3-percentage point increase in market share during the last quarter. Known for its high average order value (AOV), Singapore remains a key market for GoTo.

Regarding Gojek, it is a well-known Southeast Asian unicorn startup, founded in 2010 in Jakarta, Indonesia, with a modest beginning of just 20 motorbike drivers. In 2015, the Gojek app was launched in the Indonesian market, offering three services: GoRide (motorbike taxi), GoSend (delivery), and GoMart (grocery shopping assistance).

This Indonesian startup was once valued at over USD 10 billion before merging with the e-commerce platform Tokopedia to form GoTo Group in May 2021. Today, the app offers over 20 convenient services, connecting more than 170 million users with over 2 million driver-partners and 500,000 restaurant partners across 5 markets in the Southeast Asian region.

The Electric Revolution: Grab’s Surprising Choice for 1,000 New Electric Taxis

Gojek, the rival of Grab, has unveiled an ambitious plan to transition its fleet to electric motorcycles by 2030. This bold move underscores the company’s commitment to sustainability and reducing its environmental footprint. With this initiative, Gojek aims to lead the industry towards a greener and more sustainable future, one that promises a cleaner, quieter, and more efficient ride-sharing experience for both passengers and drivers alike.

The Road Less Traveled: VNPAY Taxi’s Vision to Redraw the Tech-Taxi Landscape

The Vietnamese ride-hailing market seemed set in stone, that is until VNPAY Taxi arrived. Despite being a late entrant, VNPAY Taxi possesses unique advantages that position it as a formidable contender that cannot be ignored by its competitors.