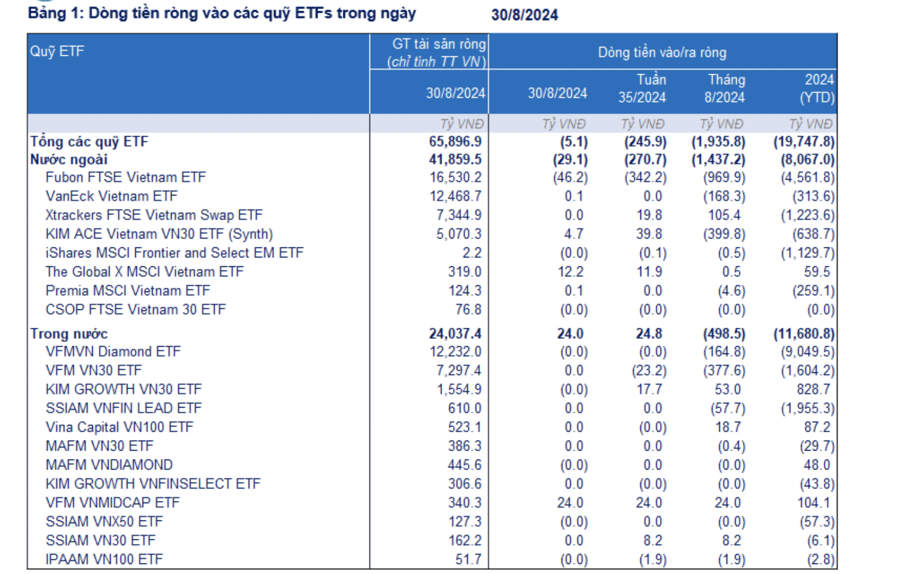

According to statistics from FiinTrade, during the week of August 26-30, 2024, ETFs investing in Vietnamese stocks continued to witness net outflows of nearly VND 246 billion. However, the outflows value decreased significantly by 62.7% compared to the previous week. The outflows trend was observed in 8 out of 22 funds, mainly in the Fubon FTSE Vietnam ETF.

For the month of August 2024, the ETF market recorded outflows of over VND 1,930 billion. This figure is considerably lower than the outflows of more than VND 2,500 billion recorded in July.

Thus, the cumulative net outflows from the beginning of 2024 in ETFs have reached over VND 19,700 billion, 12.4 times higher than the total net outflows of VND 1,500 billion in 2023, and equivalent to 32.5% of the net sales of foreign investors since the beginning of 2024.

The total net asset value of foreign and domestic ETFs stood at nearly VND 65,900 billion in the week of August 26-30, 2024, a decrease of 0.6% compared to the previous week. It’s important to note that this net asset value only takes into account the Vietnamese market.

Foreign ETFs experienced net outflows of over VND 270 billion, mainly driven by the Fubon FTSE Vietnam ETF (-VND 342.2 billion). In contrast, the KIM ACE Vietnam VN30 ETF and the Xtrackers FTSE Vietnam ETF attracted net inflows of nearly VND 40 billion and VND 20 billion, respectively.

The iShares MSCI Frontier and Select ETF witnessed net outflows of over VND 137 billion in the week of August 26-30. Specifically, in the Vietnamese market, the fund recorded outflows of nearly VND 55 million. As per the latest update on August 30, the fund had sold off most of its holdings and only retained VND 161,000 shares, valued at VND 2.5 billion.

Domestic ETFs saw net inflows of nearly VND 25 billion after three consecutive weeks of outflows, with a cumulative value of over VND 511 billion. The VFM VNMIDCAP ETF contributed the most (+VND 24 billion). Meanwhile, the Kim Growth VN30 ETF also attracted net inflows of nearly VND 18 billion. In contrast, the VFM VN30 ETF experienced net outflows of over VND 23 billion.

Additionally, there were net outflows in the capital flow of Thai investors through DRs in the fund managed by Dragon Capital. During the week of August 26-30, 2024, investors sold 300,000 DRs in the VFM VN30 ETF, equivalent to over VND 7 billion. A similar trend was observed in the VFM VNDiamond ETF, with 300,000 DRs sold, amounting to VND 10.6 billion.

On September 4, 2024, the Fubon FTSE Vietnam ETF continued its net outflows of over VND 44 billion and maintained its selling pressure on stocks. The top sold-off stocks were HPG (-177,000 shares, -VND 4.5 billion), VHM (-103,000 shares, -VND 4.3 billion), VIC (-96,000 shares, -VND 4.2 billion), SSI (-93,000 shares, -VND 3.1 billion), and SHB (-86,000 shares, -VND 907 million). Meanwhile, the VFM VNDiamond ETF recorded net inflows of nearly VND 40 billion, while the VFM VN30 ETF remained unchanged in terms of capital flow.

Commenting on the outlook for foreign capital flows, Mr. Huynh Minh Tuan, founder of FIDT, attributed the significant foreign capital outflows since the beginning of the year to global trends heavily influenced by the strong shift towards technology (especially AI) and a strong US dollar.

The net outflows by foreign investors in the Vietnamese market reflect a change in investment strategies by large funds and investors. They are redirecting their capital to markets with higher growth potential or lower interest rates, such as Japan and India.

Japan, with its negative interest rate policy and numerous economic stimulus packages, has been attracting significant attention. Meanwhile, India stands out with its young population and strong economic growth potential. As a result, Vietnam has faced selling pressure, particularly amid declining domestic market liquidity and less favorable macroeconomic news.

This shift in capital flows is not only impacting the Vietnamese stock market but also indicates the intensifying competition among countries in attracting foreign investment.

“However, with the decline in the Dollar Index and the aforementioned valuation expectations, this capital is also expected to return to the Vietnamese stock market soon,” Mr. Tuan added.

Mr. Tuan also noted that while the short-term valuation of the market is not extremely attractive, it is compelling as it reflects future expectations. In the short term, the focus should be on upgrading the market. The recent haste in addressing the prefunding issue for market upgrade demonstrates a positive direction in terms of orientation and vision.

For the medium term, the market needs quality goods and larger capitalization. This can be achieved by encouraging large companies to go public, such as Thaco, Huyndai Thanh Cong, Mobifone, Coop mart, Satra, VNPT, CP VN, and VSIP.

VnDirect also suggested that the cooling down of the international US dollar due to expectations of an early Fed rate cut will help ease pressure on the domestic exchange rate and, consequently, reduce net selling pressure from foreign investors in the near future.

Travel to Multiple Destinations and Win Big This 2-9 Holiday

During the 4-day holiday period from September 2nd, Khanh Hoa province recorded an estimated 175,200 tourist arrivals, a 14.6% increase compared to the same period last year. The province’s tourism director, Ms. Nguyen Thi Le Thanh, shared that approximately 403,000 visitors were recorded at various attractions, marking a 15% rise from the previous year.