Positive psychology after the holidays was completely crushed as global stock markets plunged into a sea of red. The VN-Index’s recovery efforts were futile, closing 8.07 points lower at 1,275 with a negative breadth of 313 declining stocks versus 117 gainers.

With the exception of real estate, most sectors experienced downward pressure. Thanks to gains in VHM (up 2.41%) and VRE (up 2.6%), the real estate sector rose 0.52%, along with other positively traded stocks such as PDR (up 3.94%), NLG (up 2.44%), and DXG (up 1.27%). VHM, VRE, and PDR alone contributed 2.5 points to the overall market.

On the flip side, banks declined by 0.98%; transport decreased by 0.87%; materials fell by 0.98%; and financial services dropped by 1.1%. Telecommunications declined by 2.04%, while energy dipped by 2.17%. Accompanying this were top stocks that dragged the market down, including VCB, which sank 0.95 points; VPB, adding 0.86 points; and FPT, contributing 0.64 points. Others included GVR, TCB, and MBB. Altogether, this group took away 5.23 points from the overall market.

The broad sell-off improved liquidity across the three exchanges compared to the previous week’s closing session, with a total matched order value of 17,300 billion VND. Foreign investors sold a net of 791.3 billion VND, with a net sell value of 766.6 billion VND for matched orders alone.

The main sector for foreign net buying on the matched order side was real estate, along with personal and household goods. The top foreign net buys on the matched order side included PDR, VNM, CTG, NLG, DXG, FRT, VRE, VHM, BCM, and NVL.

On the foreign net-selling side for matched orders, financial services stood out. The top foreign net sells on the matched order side were DGC, HPG, VPB, FPT, MSN, VCI, HDB, FUEVFVND, and E1VFVN30.

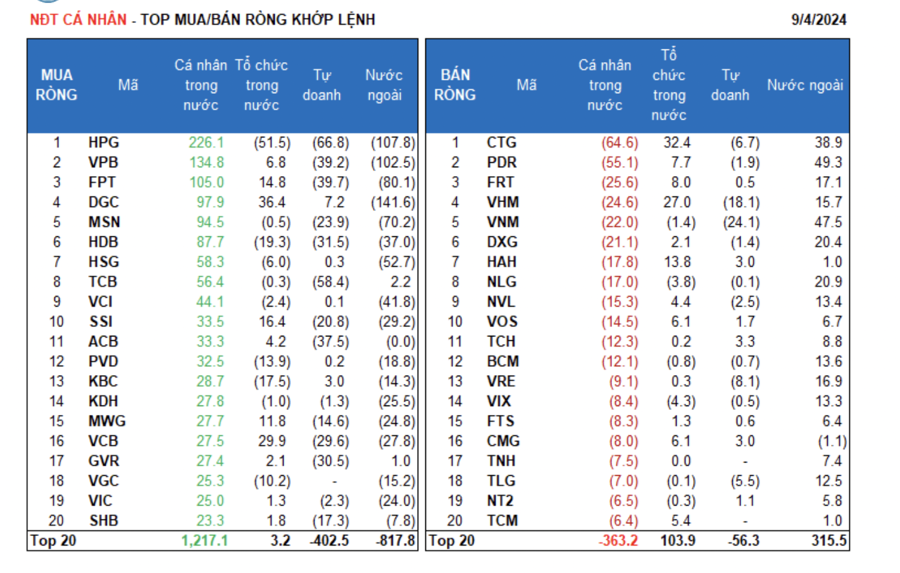

Individual investors net bought 1,012.5 billion VND, with a net buy value of 1,121.1 billion VND for matched orders.

For matched orders, they net bought 13 out of 18 sectors, mainly in banking. The top buys for individual investors included HPG, VPB, FPT, DGC, MSN, HDB, HSG, TCB, VCI, and SSI.

On the net-selling side for matched orders, they sold 5 out of 18 sectors, mainly in real estate and industrial goods & services. The top sells included CTG, PDR, FRT, VHM, VNM, DXG, NLG, NVL, and VOS.

Proprietary trading resulted in a net sell of 413.9 billion VND, with a net sell value of 447.6 billion VND for matched orders. For matched orders, proprietary trading net bought 3 out of 18 sectors. The sectors with the strongest net buys were financial services, industrial goods & services, and consumer discretionary. The top net buys for proprietary trading on the matched order side included FUESSVFL, FUEVFVND, E1VFVN30, DGC, IJC, TCH, DPG, HAH, CMG, and KBC.

The top net sell was the banking sector. The top net sells for proprietary trading included HPG, TCB, FPT, VPB, ACB, HDB, GVR, VCB, STB, and MBB.

Domestic institutional investors net bought 175.0 billion VND, with a net buy value of 93.1 billion VND for matched orders. For matched orders, domestic institutions net sold 7 out of 18 sectors, with the highest value in basic materials. The top net sells included HPG, HDB, KBC, FUESSVFL, CTR, PVD, GMD, VGC, LCG, and DIG.

The sector with the highest net buy value was banking. The top net buys included DGC, MBB, CTG, VCB, VHM, STB, SSI, FPT, HAH, and MWG.

Today’s matched orders with prior agreement amounted to 2,036.9 billion VND, an increase of 24.8% from the previous day, contributing 11.8% to the total transaction value. Notable transactions included agreements between domestic individuals for VCI (over 11 million units worth 512.3 billion VND) and VIC (over 5 million units worth 221.4 billion VND). There were also agreements between foreign investors for banks (ACB, VCB, MBB) and PNJ.

The allocation of money flow increased in banking, steel, construction, IT, and oil & gas, while it decreased in real estate, securities, chemicals, food & beverage, retail, and textiles & garments.

For matched orders, the allocation of money flow increased in the large-cap VN30 and small-cap VNSML groups but decreased in the mid-cap VNMID group.