Licogi 13 JSC (Licogi 13; HNX: LIG) has recently disclosed its semi-annual financial statement for 2024 to the Hanoi Stock Exchange (HNX).

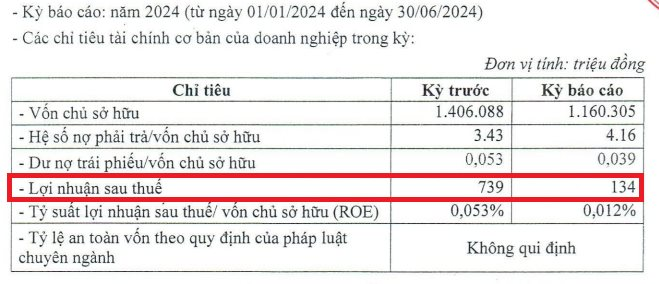

Accordingly, in the first six months, the company reported a profit of 134 million VND, an 81.9% decrease compared to the same period in 2023.

The return on equity (ROE) was 0.012%, while it was 0.053% in the previous year.

In the financial years 2022 and 2023, Licogi 13 posted after-tax profits of 9 billion VND (ROE of 0.69%) and 2.6 billion VND (ROE of 0.19%), respectively.

As of June 30, 2024, Licogi 13’s equity capital stood at 1,160 billion VND, a 17.5% decline year-over-year. The debt-to-equity ratio was 4.16, corresponding to the company’s payables of 4,827 billion VND. Of this, bond debt amounted to 45 billion VND.

Thus, Licogi 13’s total assets currently exceed 5,987 billion VND, with payables accounting for 81%.

Evidently, the company’s after-tax profits in recent years have been modest considering its nearly 6,000-billion-VND capital.

Licogi 13, led by CEO Pham Xuan Thang, reported a modest after-tax profit of 134 million VND in the first half of this year, despite its nearly 6,000-billion-VND market capitalization.

According to data from HNX, Licogi 13 currently has a single bond issue, LIGH2123001, worth 75 billion VND. It was issued on December 31, 2021, with a 33-month term and will mature on September 30 this year.

So far in 2024, the company has repurchased this bond issue in four separate early buyback transactions. The current outstanding value of the bond issue is 25 billion VND.

Licogi 13 JSC, established in June 2005, primarily operates in real estate, railway and road construction, civil and public works, and electricity generation, transmission, and distribution. Its headquarters are located at Licogi 13 Building, Khuat Duy Tien Street, Nhan Chinh Ward, Thanh Xuan District, Hanoi.

The company has a charter capital of nearly 951 billion VND. Its legal representative is CEO Pham Xuan Thang.

On the stock market, LIG shares closed at 3,400 VND each on September 4, up 3.03% from the previous session, with a trading volume of over 317,000 units.

The Vanishing Act: Unraveling the Mystery Behind DIC Corp’s Unscathed Profit Amidst Plummeting Revenue

After a thorough review, DIC Corp reported a significant drop in revenue, totaling VND 187 billion, resulting in a revised figure of VND 635 billion. Despite this decline, the company’s net profit remained relatively unchanged at approximately VND 4 billion, largely due to deferred corporate income tax.

“Revenue Down, Management Costs Up: Saigonres Swings to Loss Post-Review”

Saigonres witnessed a significant shift in its financial standing, moving from a reported profit of 2.3 billion VND to a staggering loss of 23.3 billion VND after a thorough review. This drastic change can be attributed to reduced revenue and soaring business management expenses, highlighting the challenges faced by the company.

“Vingroup’s Acquisition of VinWonders Nha Trang Proves Profitable with Nearly 2,000 Billion VND in Earnings: Every 2 VND in Revenue Generates Over 1 VND in Profit”

“In February 2024, Vingroup announced its acquisition of a 99% stake in VinWonders Nha Trang from its partners. The total cost of the transaction amounted to 10.319 trillion VND. This move showcases Vingroup’s strategic expansion and their commitment to developing captivating attractions within Vietnam.”