The market showed signs of differentiation in this morning’s session, as global stock markets remained lackluster, and domestic capital flows weakened significantly, coupled with continued strong outflows from foreign investors.

The first half of the session witnessed a strong recovery after yesterday’s sudden drop. The VN-Index peaked at 10:24 am, gaining 6.4 points. The latter half saw a retreat under selling pressure, especially as foreign investors dumped large volumes of blue-chips. The index closed with a gain of 2.02 points, or +0.16%.

The breadth of the market reflected this oscillating dynamic. When the index peaked, there were 230 gainers and 129 losers, but by the end of the morning session, this had shifted to 174 gainers and 188 losers. This tug-of-war is not necessarily a bad outcome, as the market has not yet seen strong capital inflows, and there are concerns about an impending correction.

The blue-chip stocks also underperformed, but some notable pillars emerged. VHM and VIC are the most remarkable duo, accelerating after a few quiet sessions last week. VHM posted its second consecutive strong gain, currently up 3.41%, trading at its highest level in four months. VIC, which lagged VHM, is up 3.07%, and its closing price is also the highest in three months. VHM even leads the market in liquidity, reaching VND 593.3 billion, while VIC ranks 15th with VND 113.1 billion. These two stocks contributed about 2.8 points to the VN-Index. Additionally, VRE rose 1.78%, VNM climbed 1.35%, and BID inched up 1.02%.

Out of the five stocks in the VN30 basket that increased by over 1%, four are in the Top 10 by market capitalization. Despite this, the VN-Index failed to show a clear gain, indicating that the rest of the market is under pressure. The VN30-Index is even down 0.02% with 12 gainers and 12 losers. The worst-performing stock in the basket is FPT, which lost 1.95% of its value, wiping out nearly one point from the VN-Index and over 2.5 points from the VN30-Index. After a positive run in August, FPT entered the Top 5 by market capitalization, so any price changes have a significant impact.

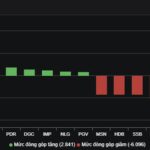

The VN30-Index’s performance indicates that blue-chips are weakening faster. From around 10:50 am, the index turned red. Many pillars faced significant price pressure, with some even turning from green to red, such as CTG, which lost 1.27% from its intraday high and is now down 0.71% for the day; HDB shed 1.47%, resulting in a 1.11% decline; GVR, MWG, STB, and others also saw notable losses.

Overall, approximately 40% of the stocks that traded on the HoSE this morning saw their prices fall by 1% or more from their session highs. While not all of these stocks fell enough to breach their reference prices, it still sends a clear signal of increasing selling pressure in the green zone.

On the positive side, this pressure has not led to a widespread sharp decline. Out of the 188 losers in the VN-Index, only 48 fell by more than 1%, and only 10 of those had liquidity of VND 10 billion or more. Trading was mainly focused on FPT, MWG, and HDB, which crossed the hundred billion dong mark. Additionally, DGC and GMD also had relatively high volumes. These five stocks accounted for over 88% of the total matched orders for all 48 deeply discounted stocks.

Moreover, liquidity on the HoSE decreased by about 10% compared to yesterday’s morning session, reaching over VND 6,352 billion in matched orders. The combination of price oscillations, a slight downward bias, and low liquidity is positive, at least during the market’s consolidation phase at the peak.

On the upside, there weren’t many notable transactions either. Out of the entire HoSE, 47 stocks rose by more than 1%, and only about 15 had liquidity of over VND 10 billion. VHM and VIC were, of course, the most prominent, followed by VNM, HCM, VRE, NVL, and DGW.

Thus, the vast majority of stocks today traded within a range of less than 1%, consistent with a sideways market. Regardless of how much VIC and VHM pulled up, and FPT, MWG, and HDB dragged down, the rest of the market remained largely unaffected, which is a positive sign.