The Vietnamese stock market opened in the red on September 4th after a four-day holiday break, with the VN-Index plunging 17 points to 1,268 points just 15 minutes into the opening auction session. The market staged a mild recovery afterward as bottom-fishers stepped in. However, selling pressure resurfaced after 11:00 a.m., dragging the VN-Index down by over 13 points to 1,270 points. Meanwhile, the HNX and UpCoM indices also witnessed declines, falling to 236 points and 93.7 points, respectively.

Foreign investors continued to offload Vietnamese stocks, with net sell orders on the Ho Chi Minh Stock Exchange (HoSE) reaching VND460 billion. They aggressively sold shares of companies like DGC, HPG, and MSN while scooping up PDR, DXG, and VIX stocks.

Trading volume across the market remained low, with just over 317 million shares changing hands, valued at less than VND7.5 trillion. Of all the stocks traded, 189 tickers advanced, while 584 declined, including 11 stocks hitting the daily limit down and 11 reaching the ceiling price.

According to experts, the market’s steep decline during the morning session was not entirely unexpected.

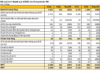

Sector Performance on September 4th Morning Session

A consultant from VPS Securities attributed the sharp correction at the opening of the September 4th session partly to the influence of the US stock market, which witnessed a drop of over 600 points. This triggered a psychological response from investors, leading to short-term profit-taking. However, the consultant noted that investors are no longer overly concerned about the market being in the red or green, as sectors have already undergone significant differentiation. Instead, they focus on their investment portfolios and sector-specific strategies to maximize profits.

“Many sectors witnessed a mild decline during the early trading hours but later recovered to near the reference price. The market is currently facing resistance in the 1,290–1,300-point range. It is highly likely that the market will surpass this threshold in September and October,” the consultant predicted.

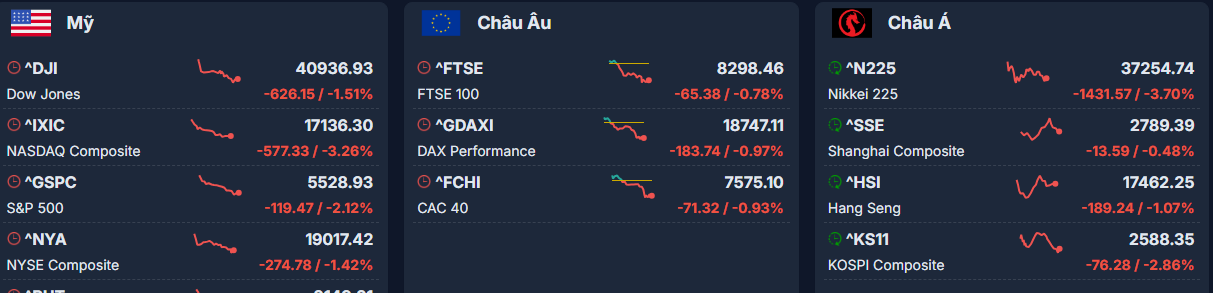

US Stock Market and Other Markets Plunge

An investment expert attributed the market decline to the negative sentiment spilling over from the US stock market and other global markets, while domestic macroeconomic factors remain favorable. This presents an opportunity for investors to consider buying potential stocks in the public investment sector.

On the previous night, the US stock market experienced its worst trading day since the global sell-off on August 5th. At the close of the September 3rd session, the Dow Jones Industrial Average had lost more than 626 points (-1.51%) to settle at 40,936 points. Meanwhile, the S&P 500 and Nasdaq Composite indices dropped 119 points (-2.12%) and 577 points (-3.26%) to 5,528 points and 17,136 points, respectively.

Following the US market’s suit, stock markets in the Asia-Pacific region also witnessed a broad sell-off during the morning session. Japan’s Nikkei 225 index led the decline in the region, falling by 3.19%, while the Topix dropped by 2.79%.

South Korea’s Kospi and Kosdaq indices also posted significant losses, falling by 2.17% and nearly 3%, respectively. Australia’s S&P/ASX 200 declined by almost 1.7%, mainly due to weakening oil prices. Hong Kong’s Hang Seng index fell by 1.5%, and China’s CSI 300 lost 0.47%.