Illustrative image

DongA Bank has just announced new deposit interest rates, effective today (September 5), with increases across all major tenors.

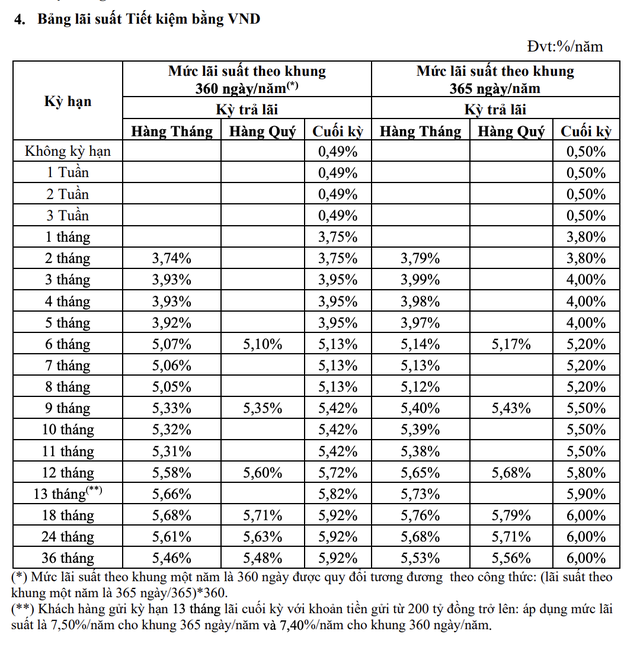

Specifically, for the term savings option with an annual interest rate of 365 days, the interest rate for 1-2 month terms increased by 0.2% to 3.8% per annum, and the rate for 3-5 month terms increased by 0.4% to 4% per annum.

DongA Bank offers an increase of 0.3% for 6-8 month deposits, bringing the interest rate to 5.2% per annum. Meanwhile, the interest rate for 9-11 month deposits increased significantly by 0.6% to 5.5% per annum.

The 12-month tenor increased by 0.5% to 5.8% per annum, while the 13-month tenor is now offered at 5.9% after an increase of 0.3%. Additionally, DongA Bank continues to offer a “special rate” of up to 7.5% per annum for deposits of VND 200 billion and above with a tenor of 13 months or more.

Notably, DongA Bank has increased interest rates for tenors of 18-36 months by up to 0.8%, all reaching 6% per annum from today.

Furthermore, DongA Bank will continue to offer additional interest rates based on the deposit amount.

In detail, the bank offers an additional 0.05% for deposits between VND 200 million and less than VND 500 million. For deposits between VND 500 million and less than VND 1 billion, the additional interest is 0.1%. For deposits of VND 1 billion and above, the additional interest is 0.15%.

With these additional interest rates, customers depositing VND 1 billion and above at DongA Bank can enjoy an interest rate of up to 6.15% per annum for tenors of 18-36 months.

After this interest rate adjustment, DongA Bank is now among the few banks offering interest rates of 6% per annum and above, along with HDBank, BVBank, NCB, BaoViet Bank, OceanBank, SHB, and Saigonbank.

It is worth noting that DongA Bank is under special control. In recent weeks, the bank has been actively adjusting its deposit interest rates after a long period of inactivity. DongA Bank has increased deposit interest rates twice in August, with the latest adjustment involving an increase of 0.1-0.4% for tenors ranging from 1 to 11 months.

Source: DongA Bank

In recent weeks, the pace of deposit rate increases has shown signs of slowing down, both in the number of banks making adjustments and the frequency of changes. However, deposit interest rates are still expected to face upward pressure in the final months of 2024.

In a recently published analysis report, MBS Securities predicts that as credit growth is currently expanding three times faster than capital mobilization, banks are aggressively increasing deposit interest rates to enhance the competitiveness of savings accounts compared to other investment channels in the market.

The analytics team expects the cost of funds to continue rising in the second half of 2024 due to stronger credit demand from mid-2024 onwards as production and investment accelerate in the final months of the year.

“We forecast that the 12-month deposit interest rate of large commercial banks may increase by another 0.5 percentage points, returning to the range of 5.2-5.5% per annum by the end of 2024,” MBS wrote in its report.

The Ultimate Guide to HDBank’s Interest Rates: Maximize Your Savings with Online Deposits

In early September, HDBank offered an attractive interest rate bracket for individual customers, ranging from 0.5% to 8.1% per annum. The peak interest rate for regular savings accounts was set at 6.1% per annum, while deposits of 500 billion VND and above were eligible for an impressive maximum rate of 8.1% per annum.

The Ultimate Guide to Agribank’s Interest Rates: Maximize Your Returns with the 24-Month Term Deposit Offer in September 2024

In September, Agribank offered a competitive 4.8% annual interest rate on personal deposits with a 24-month term. This market-leading rate showcases Agribank’s commitment to rewarding customers with attractive returns on their savings.