Early Monday morning, according to the reporter from Nguoi Lao Dong Newspaper, many people have been actively contacting their banks or going to branches and transaction counters to close accounts that have not been used or “forgotten” for many years. Not just 1-2 bank accounts for receiving salaries, payments, many people said they have up to 5-7 cards, accounts, even nearly a dozen domestic debit cards (ATMs), credit cards…

Ms. Nguyen Thoa (residing in District 4, Ho Chi Minh City) said that right after receiving information about a credit cardholder from Eximbank having a transaction worth 8.5 million VND but nearly 11 years later, the bank announced a debt of over 8.8 billion VND, she immediately checked her accounts and cards.

“Many years ago, I had a credit card from Sacombank, there was a debt that occurred and was fully paid off. Now, I called Sacombank’s hotline and was told that the card was temporarily locked because there were no transactions. Now, I’m going to cancel the card, I just have to pay an annual fee that occurs in the first 2 months of 2024, the fee is not too high because the fee for the whole year is only 299,000 VND” – Ms. Thoa said.

Ms. Ngoc Yen (residing in Thu Duc City) shared the story of her reviewing all the unused cards to close them. Regarding ATM cards, Agribank employees told her that after 6 months of no transaction, the ATM card will be temporarily locked; BIDV also automatically temporarily locks the card after 12 months of no transaction…

For other banks such as Sacombank, VietinBank, when the liquidity of a customer’s account is 0 VND and there is no transaction for 12 months, the bank will “freeze” the account.

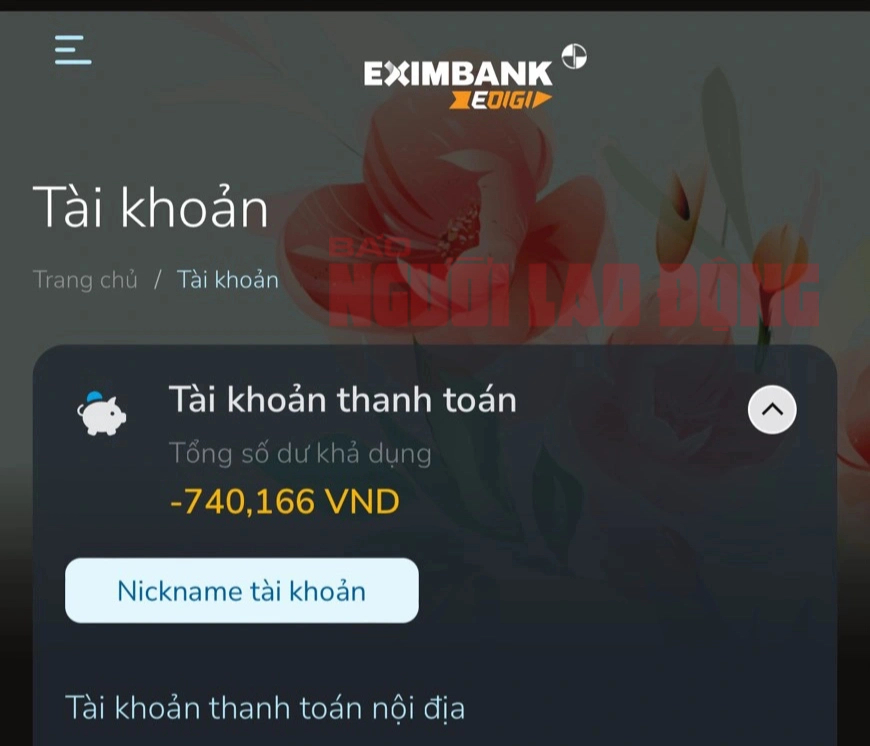

An inactive domestic payment account still incurs fees.

The deputy general director of a commercial bank explained that this “freezing” is to prevent business units from including it in statistical data, avoiding unrealistic statistics and reducing the load on the system.

So why don’t other banks proactively lock the accounts of customers who have not used them for a long time (over 12 months) to avoid accruing fees?

In response to this question, the leader of a bank said that even though the customer’s payment account is not active, it still belongs to the customer’s ownership. The bank has to run data every month and spend resources to manage this account volume.

“Only when the account is temporarily frozen will it be removed from the statistical data and management. It will be very difficult to close it permanently because there are quite a few cases where the account has a balance of 0 VND but after a period of time, customers continue to use it and there are transaction occurrences. There are also cases where customers complain about why their accounts are closed” – the leader of this bank explained.

Earlier, Nguoi Lao Dong Newspaper reported cases where many people stopped using their payment accounts but still had to pay account management fees. The customer’s account had a balance of 0 VND but still incurred fees, and when they checked, they suddenly discovered a debt of millions of VND. And to close the account, the card holder has to fully pay the fluctuating fee for the balance of the account that occurred to the bank.