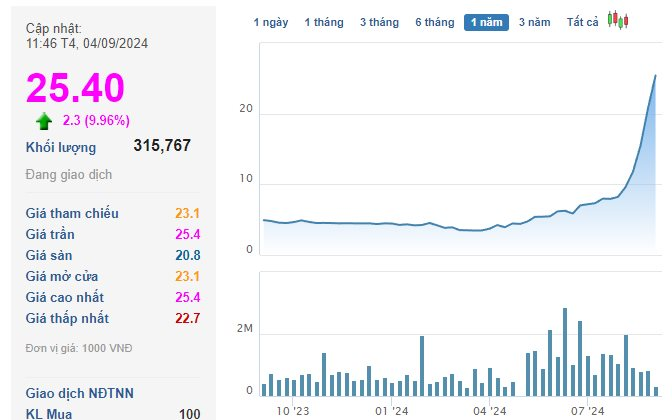

The first trading session after the National Day holiday witnessed a rather gloomy performance as large-cap stocks simultaneously underwent adjustments. However, CTP – Minh Khang Capital Trading Public Joint Stock Company on the HNX unexpectedly attracted attention as it hit the ceiling with no sellers right after the opening bell.

This was the third consecutive session where the stock price rose to its maximum limit, climbing to the 25,400 VND per share threshold, inching closer to the historical peak set in mid-2017. Over the past three months, the stock price has surged by nearly 300%, and if compared to the beginning of the year, it has sextupled.

It is worth noting that CTP was previously manipulated. Specifically, in December 2020, SSC issued a decision to sanction Le Van Hoan (Hanoi address) for using 29 accounts to continuously buy and sell, creating fake supply and demand, thus manipulating CTP shares.

The Entire Senior Leadership Simultaneously Resigned

The surge in CTP stock price came as a surprise amid Minh Khang Capital Trading Public’s volatile business performance. The most notable event was the company receiving eight resignation letters from its management team all at once. The entire Board of Directors, including Chairman Nguyen Tuan Thanh, Vice Chairman – CEO Le Minh Tuan, and Board members, were on this list. Even the members of the Supervisory Board submitted their resignations.

At the annual general meeting held in late June, a shareholder suggested that agreeing to the resignation of all eight leaders of the Board of Directors and the Supervisory Board would result in an insufficient number of members as per regulations. Therefore, for the time being, only a maximum of two Board members and one Supervisory Board member should be allowed to resign, and the remaining leaders should continue their governance until suitable replacements are found.

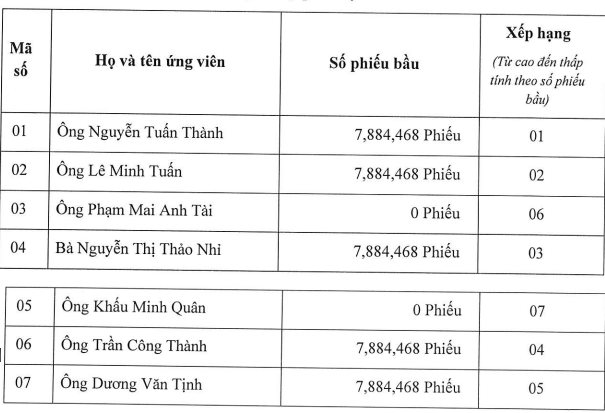

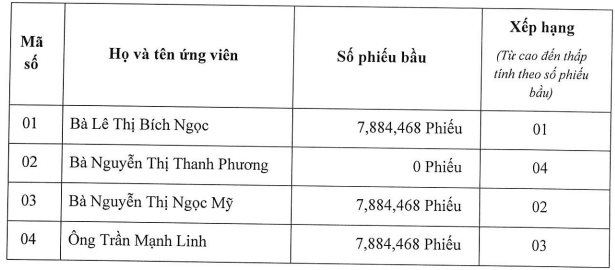

Consequently, CTP shareholders agreed to dismiss two Board members, Mr. Phan Mai Anh Tai and Mr. Khau Minh Quan, and elected Mr. Tran Tuan Thanh and Mr. Duong Van Tinh as their replacements. In addition, Ms. Nguyen Thi Thanh Phuong was dismissed from the Supervisory Board, and Mr. Tran Manh Linh was elected in her place. Thus, the CTP Board currently comprises seven members (with Mr. Nguyen Tuan Thanh remaining as Chairman), and the Supervisory Board consists of three people.

CTPs Board of Directors as of June 2024

CTPs Supervisory Board as of June 2024

After submitting their resignations, the Chairman and Vice Chairman also registered to divest their entire capital from the company. However, in the latest update, both leaders did not sell any shares, citing “trading did not go as expected” as the reason.

On August 29, CTP received another resignation letter from Ms. Tran Thi Lan Anh, who stepped down from her position as Vice President.

Dull Business Results, an Individual Quietly Riding the Waves of Millions of Shares for Huge Profits

Minh Khang CTP, formerly known as Thuong Phu Joint Stock Company, was established in 2010 with an initial charter capital of 3 billion VND. The company primarily engaged in the production, processing, and trading of various coffee products and was recognized as one of the largest producers of coffee beans in Vietnam. The company has been expanding into the export processing of Arabica coffee beans.

Following the divestment of nearly 97% of the capital of Nansan Vietnam Joint Stock Company (specializing in the production and export of Arabica coffee beans) in late 2019, the company diversified into multiple industries. Currently, Minh Khang CTP operates mainly in the fields of coffee production, processing, and trading, as well as construction materials and real estate. The chartered capital is 121 billion VND.

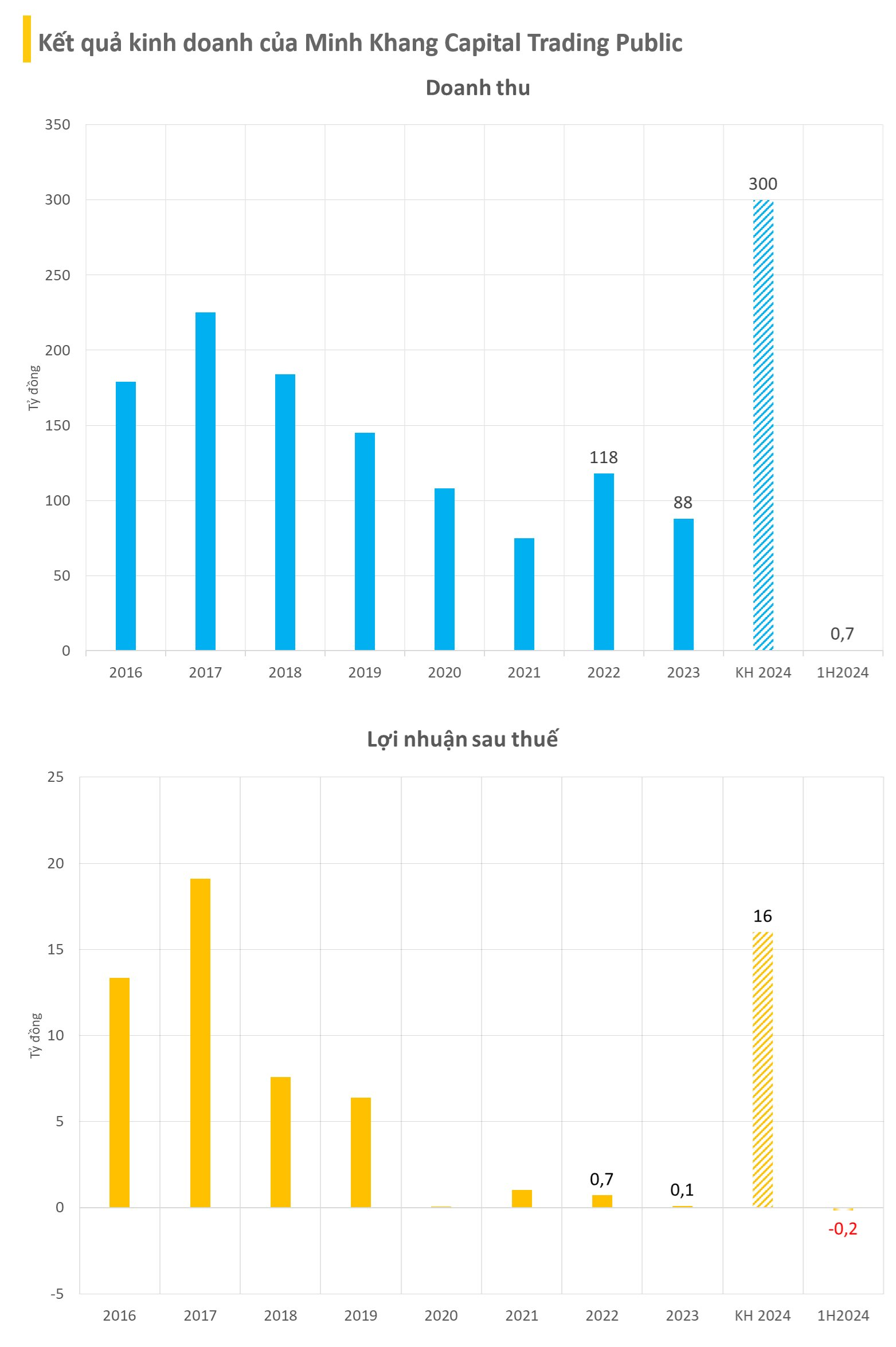

Regarding business performance, in 2023, CTP recorded 88 billion VND in net revenue and 111 million VND in after-tax profit, a decrease of 25% and 84%, respectively, compared to the previous year. In 2024, the company plans to increase its business revenue by 5-7% compared to the previous year. However, the results for the first half of the year are not quite on track. CTP’s semi-annual financial statements for 2024 show that the company earned a meager 700 million VND in revenue over six months. Notably, this revenue was generated in the first quarter, while in the second quarter of 2024, CTP had zero revenue. Consequently, CTP incurred a loss of nearly 180 million VND in the first half of the year, compared to a profit of nearly 400 million VND in the same period last year.

Another noteworthy point is that during the surge in CTP stock price, an individual named Nguyen Ngoc Lan Phuong successfully rode the waves. Ms. Phuong purchased 725,000 CTP shares (5.99% of capital) on June 12, becoming a major shareholder. This individual continued to accumulate more than 1.1 million shares on June 13. At that time, the CTP stock price was in the range of 6,400 VND per share.

In mid-July, Ms. Phuong started selling her shares when the stock price had climbed to the 8,000 VND per share range. By August 2, she had sold 300,000 shares, reducing her ownership to 347,800 shares (a ratio of 2.87%). Thus, Ms. Phuong made a considerable profit from this wave of trading in CTP shares.

The Vanishing Act: Unraveling the Mystery Behind DIC Corp’s Unscathed Profit Amidst Plummeting Revenue

After a thorough review, DIC Corp reported a significant drop in revenue, totaling VND 187 billion, resulting in a revised figure of VND 635 billion. Despite this decline, the company’s net profit remained relatively unchanged at approximately VND 4 billion, largely due to deferred corporate income tax.

“Revenue Down, Management Costs Up: Saigonres Swings to Loss Post-Review”

Saigonres witnessed a significant shift in its financial standing, moving from a reported profit of 2.3 billion VND to a staggering loss of 23.3 billion VND after a thorough review. This drastic change can be attributed to reduced revenue and soaring business management expenses, highlighting the challenges faced by the company.

“Vingroup’s Acquisition of VinWonders Nha Trang Proves Profitable with Nearly 2,000 Billion VND in Earnings: Every 2 VND in Revenue Generates Over 1 VND in Profit”

“In February 2024, Vingroup announced its acquisition of a 99% stake in VinWonders Nha Trang from its partners. The total cost of the transaction amounted to 10.319 trillion VND. This move showcases Vingroup’s strategic expansion and their commitment to developing captivating attractions within Vietnam.”

Travel to Multiple Destinations and Win Big This 2-9 Holiday

During the 4-day holiday period from September 2nd, Khanh Hoa province recorded an estimated 175,200 tourist arrivals, a 14.6% increase compared to the same period last year. The province’s tourism director, Ms. Nguyen Thi Le Thanh, shared that approximately 403,000 visitors were recorded at various attractions, marking a 15% rise from the previous year.