In the reviewed semi-annual consolidated financial statements, Joint Stock Corporation for Investment and Construction Development (DIC Corp, code DIG) recorded revenue of VND 635 billion, up 77% over the same period last year but down VND 187 billion compared to the self-prepared report.

After deducting cost of goods sold, gross profit reached VND 109 billion, up 47% over the same period but down VND 44 billion compared to the self-prepared report.

During the period, financial revenue reached VND 35 billion, an increase of VND 7 billion compared to the self-prepared report. Expenses remained relatively unchanged.

As a result, DIC Corp recorded a pre-tax profit of VND 22 billion, a decrease of VND 26 billion compared to the self-prepared report. Thanks to the deferred tax income of nearly VND 10 billion (down VND 8 billion compared to the self-prepared report), the post-tax profit before and after the review remained at nearly VND 4 billion, down 95% over the same period last year.

CSJ Vung Tau Phase 1 Project Perspective. Photo: DIC Corp

In 2024, DIC Corp targets revenue of VND 2,300 billion, up 72% over 2023; and pre-tax profit of VND 1,010 billion, six times the result of the previous year. Thus, after six months, the company has only achieved 28% of its revenue target and a meager 2% of its profit target.

As of June 30, 2024, DIC Corp’s total assets amounted to VND 18,461 billion, slightly higher than the self-prepared report figure of VND 18,444 billion. Short-term assets accounted for VND 16,702 billion, an increase of VND 5 billion compared to the self-prepared report. Long-term assets stood at nearly VND 1,759 billion, about VND 12 billion higher than the self-prepared figure.

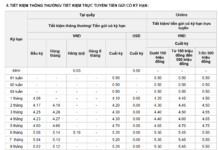

Total liabilities were recorded at nearly VND 10,572 billion, an increase of about VND 17 billion compared to the self-prepared report. Financial borrowings remained unchanged, with VND 2,159 in short-term loans and VND 2,166 in long-term loans.

In late August, the company announced that the People’s Committee of Ha Nam province had issued a decision on land allocation (second phase) to DIC Corp for the implementation of the Lam Ha Center Point Residential Area project in Lam Ha ward, Phu Ly city. Accordingly, the legal procedures for the Lam Ha Center Point Residential Area project have been basically completed as stipulated.

In the fourth quarter of 2024, DIG will continue to expedite the relevant procedures to meet the construction conditions, including determining and fulfilling financial obligations related to land, obtaining land use right certificates and ownership of assets attached to the land, approving construction design drawings, and applying for construction permits.

Located in the planning area of Bac Chau Giang Urban Area, the Lam Ha Center Point Residential Area spans 13.6 hectares, with a total investment of VND 2,115.9 billion. This project is identified as one of DIC Corp’s key projects to be implemented during the period of 2021 – 2025.

The Lam Ha Center Point Residential Area is one of the projects that DIC Corp expects to generate revenue in 2024, along with the following: Eco-tourism Urban Area of Dai Phuoc (Dong Nai); New Urban Area of DIC Nam Vinh Yen City, Vinh Phuc; DIC Victory City Urban Area, Hau Giang; Hiep Phuoc Residential Area Project; Vung Tau Gateway Apartment Project; and CSJ Phase 1 Project.

The Province with Vietnam’s Largest Lake and Second Largest Hydropower Plant Prepares for Three New Expressway Projects Worth VND 28,000 Billion, Attracting Global Attention from Industry Leaders.

The Hoa Binh province is home to the largest hydroelectric power plant in Southeast Asia, a feat of engineering in the 20th century, with a breathtaking reservoir that stretches 240 km in length. With plans to develop three new expressway sections – Ba Vi – Cho Ben, Hoa Lac – Hoa Binh, and Hoa Binh – Moc Chau – the province is set to become even more accessible and economically vibrant.

“Revenue Down, Management Costs Up: Saigonres Swings to Loss Post-Review”

Saigonres witnessed a significant shift in its financial standing, moving from a reported profit of 2.3 billion VND to a staggering loss of 23.3 billion VND after a thorough review. This drastic change can be attributed to reduced revenue and soaring business management expenses, highlighting the challenges faced by the company.

The Rise of Long-Term Investments: Phu Quoc’s Seafront Condos with Permanent Ownership in High Demand

The Phu Quoc real estate market is witnessing a paradigm shift towards long-term investment strategies. Seafront apartments with permanent ownership are currently dominating the scene, offering a unique combination of legal credibility, scarcity, competitive pricing, and lucrative investment potential. These properties provide the perfect opportunity for those seeking a stable and profitable future in this vibrant coastal destination.

“Vingroup’s Acquisition of VinWonders Nha Trang Proves Profitable with Nearly 2,000 Billion VND in Earnings: Every 2 VND in Revenue Generates Over 1 VND in Profit”

“In February 2024, Vingroup announced its acquisition of a 99% stake in VinWonders Nha Trang from its partners. The total cost of the transaction amounted to 10.319 trillion VND. This move showcases Vingroup’s strategic expansion and their commitment to developing captivating attractions within Vietnam.”