These 200 public companies represent 85.6% of the total market capitalization across Vietnam’s three stock exchanges as of the end of 2023.

The companies generated nearly VND 3.3 quadrillion in revenue for 2023, accounting for 72% of the total revenue of listed enterprises on the three exchanges and equivalent to 32% of Vietnam’s GDP for the same year.

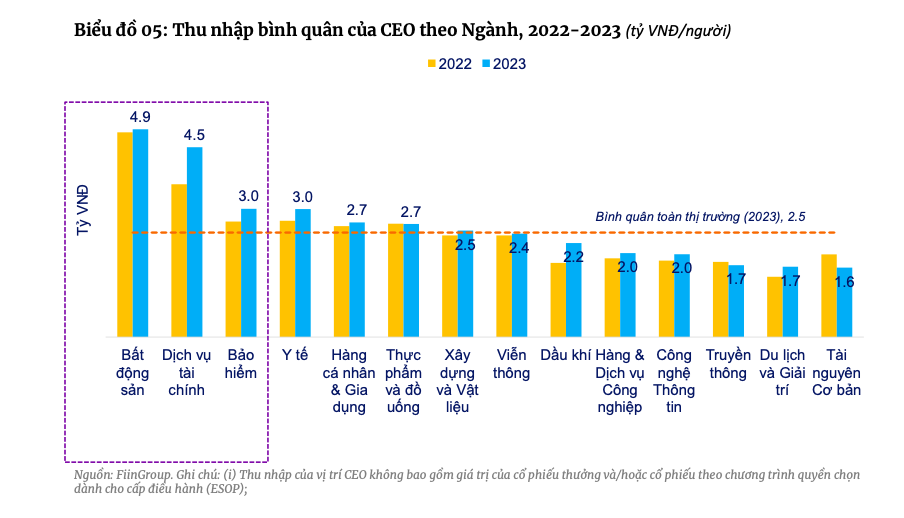

The real estate industry leads in CEO income, averaging up to VND 4.9 billion in 2023

Notable highlights from the report include an average income of VND 2.5 billion per year per person for general directors in 2023. The real estate, financial services (mainly securities companies), and insurance sectors offered the highest average incomes for the general director position.

Considering the nature of the businesses, the average income of CEOs in state-owned enterprises was significantly lower than in private enterprises, despite similar operational efficiency.

The real estate industry boasted the highest average income for CEOs, reaching VND 4.9 billion per year, followed by financial services (mainly securities) at VND 4.5 billion, and insurance at VND 3 billion per year.

In 2023, the average income of the BOD chairpersons was VND 1.7 billion per person. The banking and financial services sectors (mainly securities companies) had the highest average income for BOD chairpersons due to the involvement of these leaders in the management of these organizations. The correlation between income and operational efficiency became more apparent when analyzed according to market capitalization.

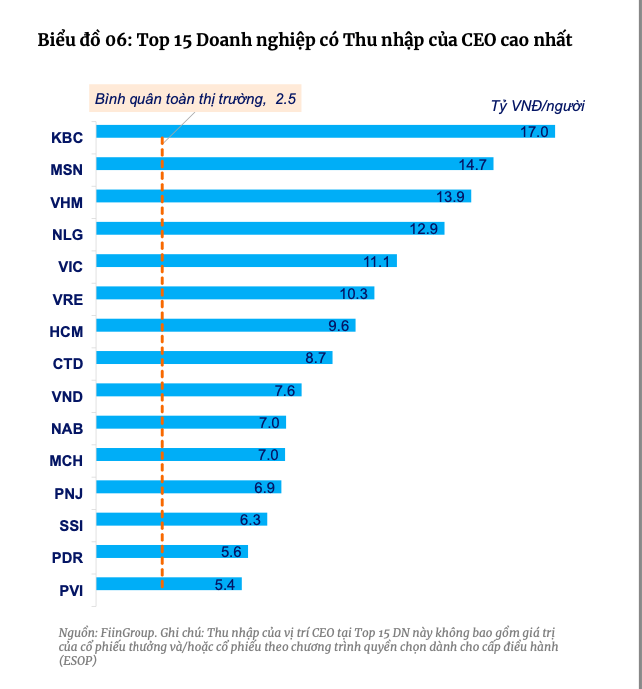

Top 15 listed companies with the highest CEO income. Source: FiinGroup

According to FiinGroup, the income of the BOD chairperson position showed a significant correlation with operational efficiency in the banking sector. The average income of BOD chairpersons and the average ROE (ratio of net profit to equity) in the banking sector were both high.

In contrast, the information technology and retail sectors demonstrated efficiency (high ROE) but had very low average incomes for BOD chairpersons.

Independent Members Receive Nominal Income

The income of independent BOD members varied significantly between industries, with the highest being in the personal goods and banking sectors. However, the average income still remained nominal in many enterprises.

Considering the market capitalization, the average income of independent BOD members improved significantly in the small-cap group in 2023 and slightly decreased in the mid-cap group.

“VNDIRECT Prepares to Dish Out a Whopping 760 Billion VND in Cash Dividends to Shareholders”

Just days before the cash dividend roll-out, VNDIRECT shareholders will receive 295 million shares from the public offering and bonus issue.