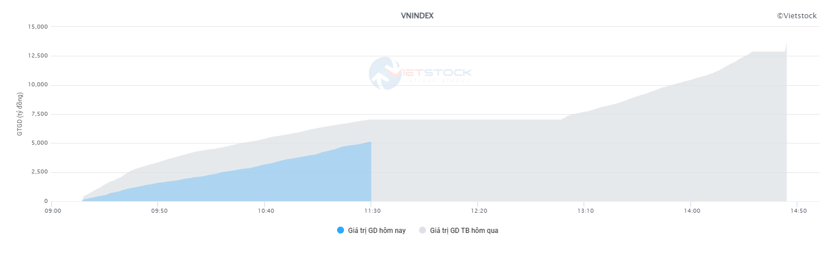

Caution continues to dominate investor sentiment after two consecutive losing sessions, with market liquidity this morning at low levels. The trading volume of VN-Index reached more than 223 million units in the morning session, equivalent to a value of 5.1 trillion VND, down more than 27% compared to yesterday morning. HNX-Index recorded a trading volume of nearly 17 million units, with a value of more than 321 billion VND.

Source: VietstockFinance

|

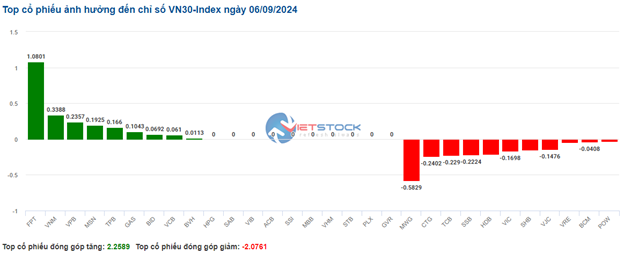

GAS, FPT, and BID are currently the main pillars holding up the index, contributing more than 1 point to the VN-Index. Meanwhile, VHM, CTG, and VIC are the most negative stocks, taking away about 1.2 points from the index.

Most sectors are in the red. Among them, telecommunications led the decline, falling more than 3% under pressure from VGI (-2.93%), VNZ (-14.85%), FOX (-1.22%), and CTR (-0.96%). This was followed by energy, real estate, and industrial sectors, which fell by about 1% each.

The financial sector is also in the red, although some large-cap stocks such as VCB, BID, VPB, LPB, and TPB are still slightly higher. Within this sector, securities stocks recorded sharper declines than banks and insurance companies, with many stocks falling by more than 1%, including HCM (-1.37%), MBS (-1.82%), FTS (-1.61%), SHS (-1.88%), VIX (-1.26%), CTS (-1.15%), VDS (-2.4%), and BVS (-1.52%), among others.

Information technology and utilities are currently the only two bright spots in the market, mainly thanks to the gains in two large-cap stocks, FPT (+0.77%) and GAS (+0.96%).

10:30 am: Money flows remain cautious

Investors remain cautious after the previous losing session, leading to a significant decline in trading volume and a tug-of-war between the main indices around the reference level. As of 10:30 am, the VN-Index fell 1.4 points to trade around 1,266 points. The HNX-Index dropped 0.61 points to trade around 234 points.

Stocks in the VN30 basket were mixed, with buying and selling forces relatively balanced. Specifically, FPT, VNM, VPB, and MSN contributed 1.08 points, 0.34 points, 0.24 points, and 0.19 points to the overall index, respectively. On the other hand, MWG, CTG, TCB, and SSB faced selling pressure, taking away more than 1.1 points from the VN30-Index.

Source: VietstockFinance

|

Leading the recovery was the information technology sector, with the gain mainly driven by the large-cap stock FPT, which rose 0.84%… while the remaining stocks in the sector were either unchanged or slightly lower, including CMG, ITD, and PIA.

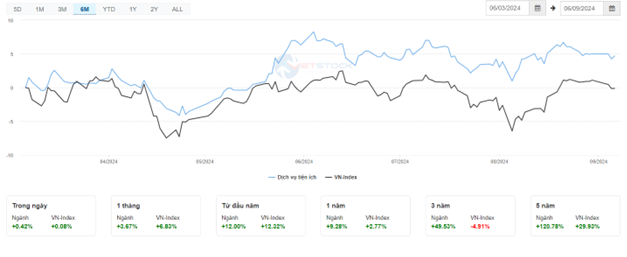

Following closely was the utilities sector, which posted a modest recovery of 0.38% as strong differentiation was observed within the sector, with 114 out of 148 stocks trading at the reference price. Notably, GAS rose 1.08%, BGE gained 0.96%, CNG increased by 0.7%, and QTP climbed 0.7%… Conversely, REE, NT2, PPC, and SBA remained in negative territory, but the declines were not significant. Additionally, it is worth mentioning that utilities maintained their outperformance compared to the VN-Index over the past six months.

On the other hand, the telecommunications services sector continued its downward trend, extending its losses for the third consecutive session, with a decline of 1.7%. Specifically, the red color dominated the sector, mainly due to losses in the two large-cap stocks, VGI, which fell 2%, and CTR, which dropped 0.8%. Meanwhile, buying interest was observed in some mid- and small-cap stocks, such as FOC, which rose 0.69%, SGT, which climbed 1.73%, and YEG, which inched up 0.22%… However, these gains were not enough to turn the tide for the sector.

Compared to the opening, the differentiation trend persisted, with more than 1,000 stocks trading at the reference price, and sellers slightly outnumbered buyers, with 331 declining stocks versus 201 advancing stocks.

9:30 am: Caution at the opening

At the opening of the session on September 6, as of 9:30 am, the VN-Index fluctuated around the reference level and dropped slightly by more than 1 point to 1,266.58 points. Meanwhile, the HNX-Index also edged lower to 234.44 points.

According to the latest report from ADP, private-sector employment growth hit its lowest level in over 3.5 years. Specifically, in August, private companies added only 99,000 jobs, significantly lower than the July figure of 111,000 (revised down) and far below the Dow Jones forecast of 140,000. This was the weakest job growth since January 2021.

Another report from the US Department of Labor also painted a less-than-optimistic picture. It showed that job openings in July fell to their lowest level since the beginning of 2021. Meanwhile, Challenger, Gray & Christmas, a reputable job consulting firm, recorded August as the month with the highest number of layoffs since 2009 and the year with the slowest hiring pace in their history of tracking.

The red color temporarily dominated the VN30 basket, with 16 declining stocks, 8 advancing stocks, and 6 unchanged stocks. Among them, CTG, HDB, and BCM were the most negative stocks. On the upside, GAS, BID, and BVH were the best-performing stocks.

The healthcare sector was one of the most prominent industries in the market. Notably, stocks such as DVM, IMP, DCL, DHT, PBC, PMC, and TTD all traded in positive territory.

Tomorrow’s Stock Market Outlook: Will the Force of Bottom-Fishing Persist?

“The stock market witnessed a late surge of buying activity on September 4th, as bargain hunters stepped in to take advantage of the dip. This bottom-fishing pushed the market to trim its losses, instilling hope among investors that this trend could persist and potentially pave the way for a market rebound.”