Vietnam’s Ministry of Finance has released the latest draft of the Law on Management and Investment of State Capital in Enterprises. This draft proposes three options for the proportion of post-tax profit allocation to the Enterprise Development Investment Fund: a maximum of 50%, 80%, or 100%.

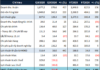

According to the Ministry of Finance’s estimates, the first option of allocating a maximum of 50% of post-tax profits would result in a reduction of VND 19,847 billion in budget revenue from dividends and profits (based on the 2021 state budget settlement from dividends, profits, and post-tax profits). The second option, allocating up to 80% of profits, would cause a budget reduction of approximately VND 49,616 billion. The third option, leaving 100% of post-tax profits in the enterprise, would result in a budget reduction of VND 69,463 billion. The Ministry of Finance leans towards the second option of allocating up to 80%.

The Ministry of Finance proposes to transfer the Enterprise Development Investment Fund while many enterprises want to retain it. (Illustrative image)

“The option of allocating up to 80% of enterprise profits to the Enterprise Development Investment Fund reduces state budget revenue but does not lose it. This money is reinvested in enterprises, and if necessary, the competent authority can still decide to contribute to the budget,” the Ministry of Finance said.

According to the State Capital Management Committee at Enterprises (representing the owner of 19 corporations and general companies), in the first six months of 2024, the total revenue of these units exceeded VND 1 quadrillion, with pre-tax profits of about VND 57 trillion and contributions to the state budget of VND 86 trillion.

In addition, the Ministry of Finance also proposes to add regulations to “manage” the Enterprise Development Investment Fund. According to point c, Clause 3, Article 10 of the draft law, the Ministry of Finance has the task and authority to submit to the Prime Minister for decision on contributing to the state budget from the source of the Enterprise Development Investment Fund and transferring the Enterprise Development Investment Fund with state capital invested between agencies representing the owner of capital.

This regulation has met opposition from the units. In their feedback, the Party Committee of Central Enterprises requested the drafting committee to clarify cases of transferring the Enterprise Development Investment Fund between agencies representing the owner of capital and proposed to omit the regulation on transferring this fund.

“Enterprises that make profits and have sources to allocate to the Enterprise Development Investment Fund but are transferred will have a countereffect and will not encourage or motivate enterprises. When the fund is transferred, enterprises will lack resources to implement investment projects to improve production capacity, strengthen governance capacity, and affect the operation and development of enterprises,” analyzed the Party Committee of Central Enterprises.

In addition, the opinions also stated that the Enterprise Development Investment Fund belongs to the enterprise’s owner’s equity. For limited liability companies with two or more members and joint-stock companies, the Enterprise Development Investment Fund belongs to the owners of the shareholders and contributing members. The state is just one of the shareholders or contributing members. Transferring the Enterprise Development Investment Fund may harm the rights and interests of other shareholders or contributing members.

“In a volatile situation, owner’s equity (including the Enterprise Development Investment Fund allocated annually) helps ensure the ‘resilience’ of enterprises against risks and unpredictable changes. The direct transfer of this fund between enterprises with 100% state capital is inappropriate and may affect the rights and legitimate interests of other shareholders/contributing members,” said the Party Committee of Central Enterprises.

In response to the proposal, the Ministry of Finance said that the Enterprise Development Investment Fund is formed from the owner’s equity in the enterprise. After the decision to increase the charter capital from the Enterprise Development Investment Fund, this fund can be called the enterprise’s capital. Therefore, the owner has the right to retrieve it into the state budget, transfer it, or leave it to increase the charter capital corresponding to the ratio of state capital invested in the enterprise.

Clarifying the delegation of management, supervision, and personnel

One of the changes made by the Ministry of Finance in the draft is the exclusion of second-tier enterprises (F2 enterprises) from the scope of the law. The Ministry of Finance has refined the draft law to exclude other enterprises with state capital investment. Enterprises with state capital investment are enterprises and economic organizations operating under the Law on Enterprises and other specialized laws with investment capital from the agency representing the owner of capital in the enterprise.

Regarding personnel, the draft also proposes reducing 21 units of enterprises subject to the Prime Minister’s decision on the appointment, dismissal, and discipline of leaders (for the positions of chairman of the members’ council, chairman of the company, and chairman of the board of directors). It is expected that only seven large corporations and general companies will be under the government’s decision on the appointment, dismissal, and discipline of leaders (including the Military Telecommunications Corporation, Post and Telecommunications Corporation, Coal and Mineral Industries Corporation, Petroleum Corporation, Electricity Corporation, Chemical Corporation, and Vietnam Railways Corporation).

The draft law also promotes decentralization in deciding investment policies for enterprises. Accordingly, investment projects with a total investment of VND 20,000 billion or more will be decided by the National Assembly, while the Prime Minister will decide on projects ranging from VND 5,000 billion to under VND 20,000 billion. The agency representing the owner of capital will decide on investment projects ranging from VND 1,000 billion to under VND 5,000 billion or with a total investment equal to 50% of the charter capital. Investment projects outside the authority of the above-mentioned agencies do not need to be established or approved for investment policies.

In an interview with Tien Phong, Mr. Can Van Luc, Chief Economist of the Bank for Investment and Development of Vietnam, said that the Ministry of Finance considers the options for the proportion of post-tax profit retention in line with the state budget revenue sources. Regarding the proposal to transfer the Enterprise Development Investment Fund between enterprises, Mr. Luc said that it should only be focused on intra-group or corporation transfers.

“This is similar to restructuring within a group or corporation. The proposal to transfer the Enterprise Development Investment Fund from one group or corporation to another unit needs to be carefully considered to avoid affecting the operation of enterprises,” said Mr. Luc.

Regarding the regulation on decentralization of investment policy decision-making, Mr. Luc proposed to further promote decentralization in investment policy decision-making…

The Deputy Prime Minister: Investing in the Nha Trang – Da Lat Expressway Must Be a Top Priority

Vice Prime Minister Tran Hong Ha affirmed the importance of the Nha Trang – Dalat expressway project, stating that it is a crucial investment for the region’s economic development. He emphasized that with proper planning and execution, the project has the potential to bring about significant economic growth not only for the respective localities but also for the entire region.

The Ultimate Guide to the Upcoming Car Plate Number Auction: Over 388,000 Options Available for Bidding, Starting September 5th.

The Ministry of Public Security is gearing up for its 5th auction of prestigious vehicle license plates. This time, a whopping 388,389 license plates are up for grabs, including over 56,000 plates from Hanoi and almost 54,000 from Ho Chi Minh City. Mark your calendars and get ready to bid for your chance to secure one of these exclusive license plates!

Will the Wave of Investment in Western Southern Land Return?

It is challenging to see a significant wave of investment in land in the Southwest region. Any potential investment would likely come from the dynamic Southeast region, which boasts a vibrant ecosystem of sea ports, airports, and industrial parks, making it a more attractive prospect for investors, according to economic expert Dr. Dinh The Hien.