Vietnamese stocks opened lower on September 4, in line with global and regional markets. The main index, VN-Index, closed down 0.63% at 1,275.8 points as large-cap stocks came under selling pressure, and foreign investors offloaded nearly VND794 billion ($33.7 million) worth of shares.

Brokerages remain optimistic about the market’s overall healthy trend and view the correction as a buying opportunity for investors.

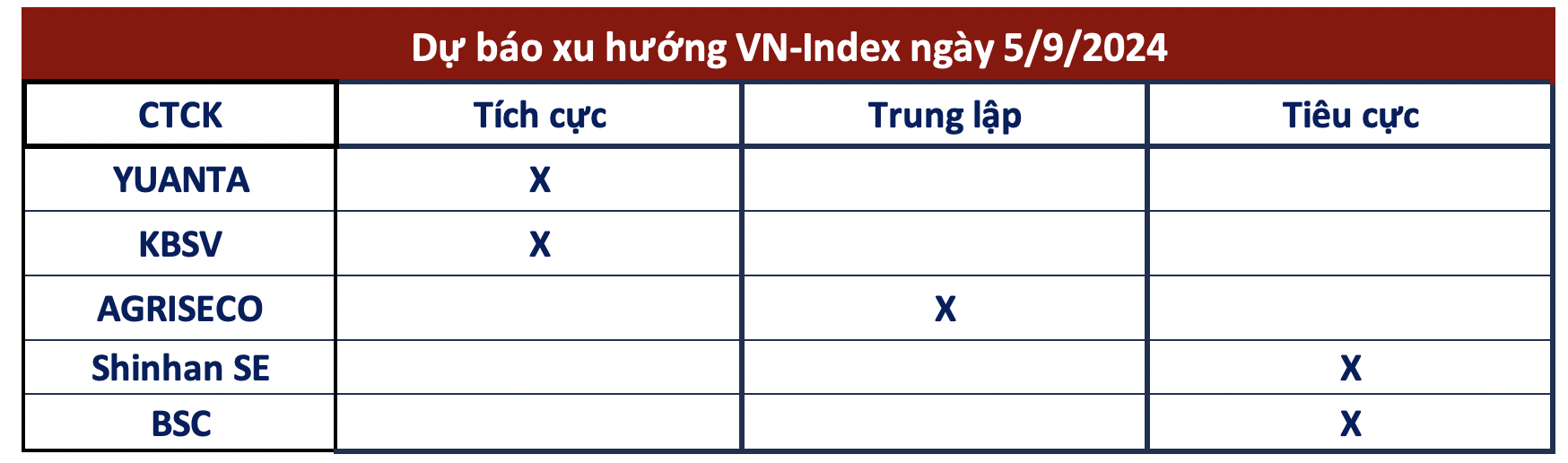

Yuanta Securities Vietnam expects the market to resume its uptrend, with the VN-Index likely ranging between 1,277 and 1,282 points in the next session. The market is showing signs of entering a short-term accumulation phase, which may lead to stock divergence. If the index surpasses 1,282 points, the short-term uptrend will become more apparent.

Yuanta advises investors to focus on stock-specific trends during this phase and maintain a high proportion of stocks in their short-term portfolios.

According to KBSV Securities Corporation, large sell-offs occurred only at the beginning of the session, and bottom-fishing demand helped prices recover in some stock groups. As the short-term uptrend remains intact, there is a high probability that the VN-Index will rebound and resume its upward trajectory around support levels. KBSV recommends increasing allocations at distant support levels.

Agriseco Research views the correction as healthy and expects the VN-Index to narrow its range while retesting the 1,270-point support area. Investors are advised to hold their positions and consider buying large-cap stocks during intraday dips.

Shinhan Securities Vietnam takes a more cautious stance, noting that after seven sessions of consolidation and failing to break above the 1,300 resistance, the VN-Index is likely to witness profit-taking and range-bound trading in the coming sessions. They predict the market to fluctuate between 1,270 and 1,280 points, with strong support around 1,260. Shinhan recommends investors to await corrective dips to initiate new long positions.

Similarly, BSC Securities Corporation suggests that the VN-Index is showing signs of shifting to a lower trading range. They advise investors to exercise caution in the upcoming sessions.