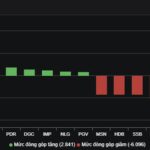

Technical Signals for the VN-Index

In the trading session on the morning of September 5, 2024, the VN-Index gained points, and improved liquidity indicated that investor sentiment was less pessimistic. The Stochastic Oscillator indicator is currently continuing to decline after giving a sell signal in the overbought region. If the indicator falls out of this region, the risk of adjustment will increase in the next sessions.

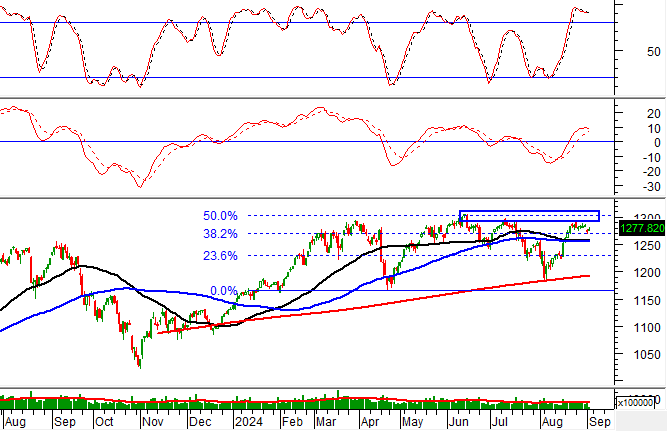

Technical Signals for the HNX-Index

On September 5, 2024, the HNX-Index slightly increased, while trading volume significantly dropped, indicating investors’ cautious sentiment. At the same time, the HNX-Index is testing the Middle line of the Bollinger Bands, while the MACD indicator is gradually narrowing the gap with the signal line. If the indicator gives a sell signal again and the index falls out of the support region, a short-term adjustment scenario may occur in the next sessions.

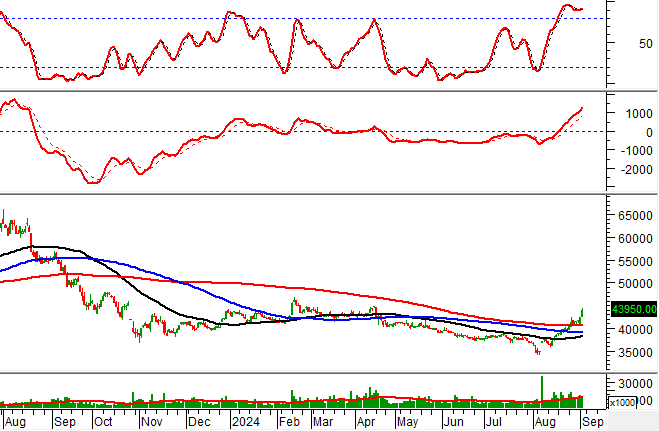

VHM – Vinhomes Joint Stock Company

On the morning of September 5, 2024, VHM’s price increased sharply, forming a Rising Window pattern, and liquidity exceeded the 20-session average, indicating dynamic trading by investors. Moreover, the stock price continued to surge after successfully breaking through the 20-day SMA, while the MACD indicator kept expanding the gap with the signal line, giving a buy signal earlier, further reinforcing the stock’s mid and long-term upward potential.

VNM – Vietnam Dairy Products Joint Stock Company

On the morning of September 5, 2024, VNM’s price increased, along with a significant rise in trading volume, expected to surpass the 20-day average at the session’s close, reflecting investors’ optimism. Furthermore, the stock price rebounded after breaking above the Middle line of the Bollinger Bands, while the Stochastic Oscillator indicator gave a buy signal again, suggesting that the short-term upward potential is materializing.

Technical Analysis Department, Vietstock Consulting

The Stock Market Bleeds Red Post-Holiday

The domestic stock market witnessed a broad-based sell-off today (9/4) as trading resumed after the holiday season. The correction in global and regional markets had a psychological impact on investors, triggering a cautious sentiment across the board.