Data from the Livestock Department shows that Vietnam produces 20 million tons of industrial animal feed annually, but imported input materials account for 85%, or about 17 million tons per year.

CORN, SOYBEANS, AND WHEAT ARE ALL IMPORTS

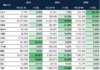

According to the General Department of Customs, exports of animal feed and raw materials reached nearly $584.18 million in the first seven months of 2024, a 10.5% decrease compared to the same period in 2023.

Of that, exports to the Chinese market reached nearly $239.15 million, a 23.5% decrease compared to the same period in 2023, accounting for 40.9% of the country’s total exports of animal feed and raw materials.

The Southeast Asian market came next, with exports totaling over $175.76 million, a decrease of 18.1% from the same period in 2023 and accounting for 30% of Vietnam’s total exports of animal feed and raw materials.

In the first seven months of 2024, Vietnam’s exports of animal feed and raw materials to the United States reached over $74.87 million, an increase of 80.2% compared to the same period in 2023, accounting for 12.8% of the country’s total exports of animal feed and raw materials.

In the opposite direction, in the first seven months of 2024, Vietnam spent $2.91 billion on imports of animal feed and raw materials, a slight increase of 2.2% over the same period last year.

Argentina was Vietnam’s largest supplier of animal feed and raw materials, with imports worth $827 million, up 10.8%. The United States followed with $652 million, a 56% increase, and Brazil with $404 million, a 14% decrease. Vietnam also spent $248 million on animal feed and raw material imports from China, a 53% increase over the same period last year, and $109 million from India, a 70% decrease.

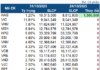

Corn, wheat, and soybeans were the three most imported raw materials. Corn imports reached over 5.74 million tons, valued at over $1.43 billion, an increase of 34.3% in volume and 1.9% in value. The average import price of corn was $249 per ton, a decrease of 24.1% compared to the first seven months of 2023.

Argentina was Vietnam’s largest corn supplier in the first seven months of 2024, accounting for 55.5% of the total volume and 54% of the total import value, with nearly 3.19 million tons, or over $772.29 million, an increase of 130.3% in volume and 70.9% in value.

The second-largest market was Brazil, which supplied over 1.57 million tons, or $402.69 million worth, in the first seven months of 2024, accounting for 27.4% of the total volume and 28.2% of the total import value. This marked a 14% increase in volume but a 12.4% decrease in value. Laos was the third-largest market, with 74,589 tons, or $18.64 million, a 23.5% increase in volume but an 11.7% decrease in value.

PRICES OF VARIOUS IMPORTED ANIMAL FEED RAW MATERIALS HAVE DECREASED

In the first seven months of 2024, Vietnam imported over 3.44 million tons of wheat, valued at over $954.67 million, an increase of 24.8% in volume but a decrease of 2.8% in value compared to the same period in 2023. The average import price of wheat was $291.8 per ton, a decrease of 12.3%.

Brazil was the main source of wheat imports for Vietnam during this period, accounting for 34% of the total volume and 30.7% of the total import value. Over 1.17 million tons of wheat were imported from Brazil, worth $293.15 million, a significant increase of 348.9% in volume and 205.9% in value. Australia was the second-largest supplier, accounting for 21.4% of the total volume and 23.8% of the total import value, with 737,112 tons imported for over $227.46 million, a decrease of 65.3% in volume and 69.1% in value.

Ukraine was the third-largest supplier, with 612,846 tons, or $159.42 million, accounting for 17.8% of the total volume and 16.7% of the total import value, a substantial increase of 2,412% in volume and 1,862% in value. Wheat imports from the United States totaled 257,223 tons, or $84.22 million, a 49.3% increase in volume and a 19.4% increase in value compared to the same period in 2023.

According to the General Department of Customs, soybean imports in the first seven months of 2024 reached over 1.31 million tons, valued at over $687.65 million, with an average price of $523.7 per ton. This represented an increase of 8.7% in volume but a decrease of 11.9% in value and 18.9% in price compared to the same period in 2023.

Brazil was the largest source of soybean imports, with 780,916 tons, or nearly $394.61 million, in the first seven months of 2024, a 31.8% increase in volume and a 10.2% increase in value compared to the same period in 2023. It accounted for nearly 59.5% of the total volume and 57.4% of the total import value of soybeans.

The United States was the second-largest supplier, with 422,669 tons, or $229.12 million, accounting for 32.2% of the total volume and 33.3% of the total import value. This marked a 12.3% decrease in volume and a 30.6% decrease in value compared to the first seven months of 2023.

Canada was the third-largest supplier, with 70,863 tons, or $42.71 million, making up 5.4% of the total volume and 6.2% of the total import value. This represented a 2.2% increase in volume but a 16.8% decrease in value compared to the previous year.

Mr. Duong Tat Thang, Director of the Livestock Department, said that since the beginning of the year, animal feed prices have dropped two to three times. This is due to the decrease in the prices of various imported animal feed raw materials. Specifically, the average import price of corn in the first seven months of 2024 was $249 per ton, a 24.1% decrease. Wheat was $291.8 per ton, a 12.3% decrease, and soybeans were $523.7 per ton, an 18.9% decrease compared to the same period in 2023.

“Businesses and farmers hope that the prices of animal feed raw materials will continue to decrease in the last months of 2024,” said Mr. Thang. This is because there is currently a gap between the prices of raw materials and the prices of animal feed produced by enterprises, which usually lock in raw material purchase contracts three to six months in advance, plus transportation time of about one and a half months and storage time of less than three months. Lower animal feed prices will lead to lower farming costs and benefit livestock farming.”

To reduce the amount of imported raw materials, the Ministry of Agriculture and Rural Development has promoted the conversion of a portion of rice-growing areas to animal feed crop cultivation for over a decade. However, this initiative has not been successful because rice farming for export is more profitable than growing corn, and rice fields are irrigated, while corn requires dry land. Additionally, in Son La, many corn-growing areas have been converted to fruit orchards in recent years due to their higher economic returns.

Therefore, Mr. Thang suggested that increasing the domestic supply of raw materials involves utilizing agricultural by-products as input for animal feed production. Many by-products from crop farming, forestry, and aquatic product processing have significant potential for use in animal feed production.

“The Creative Hub for Fashion’s Future: 2025”

“We cannot rely on outsourcing forever,” emphasized Deputy Minister of Industry and Trade, Phan Thi Thang. “The textile and footwear industries must take control of their raw materials and design processes. Establishing a trading center for the development of raw materials and accessories for the Vietnamese fashion industry is an essential step towards achieving this goal.”