After a fruitless house-hunting period, Ms. M (38), a Ho Chi Minh City resident, decided to invest her savings of over VND 2 billion in a bank deposit in mid-2023. However, the interest earned paled in comparison to the rising property prices. Recently, as her term deposit matured, Ms. M withdrew her savings and resumed her search for an apartment in Ho Chi Minh City, prioritizing soon-to-be-completed projects so she could move in immediately. If she finds a suitable property this year, she is prepared to take out a mortgage to finalize the purchase.

With ready cash on hand, Ms. Hien, a homeowner in Binh Thanh District, Ho Chi Minh City, is now looking to invest in an apartment for long-term rental purposes. According to this investor, with the land market still in recovery and shophouses requiring substantial capital, apartments in the affordable price range that can be quickly put into operation for rent are her preferred choice at this time. However, finding a suitable soon-to-be-completed project with immediate rental potential is no easy task in Ho Chi Minh City’s primary market.

Homebuyers are taking advantage of year-end promotions, typically the time when developers offer attractive sales policies to entice buyers.

According to a real estate agent selling apartments in Ho Chi Minh City’s western area, some projects are experiencing a shortage of rental units despite high demand. Although there is a limited supply of rental properties on the market, rental prices have shown signs of increasing from the beginning of the year, especially in projects with completed amenities and infrastructure. As a result, investors who visit the project site gain a better understanding of the market demand and are quicker to make purchasing decisions. “Some customers even decide to book a unit immediately after viewing the project, mostly in the completed or soon-to-be-completed phases, where the number of available units is limited,” the agent shared.

A recent visit to Akari City, a Nam Long project located on Vo Van Kiet Street, Binh Tan District, Ho Chi Minh City, revealed that the second phase of the project is nearing completion and is expected to welcome its first residents in early Q4 2024. The internal project area has been landscaped, and completed apartments are ready for daily visits by potential buyers. Additionally, the developer is offering attractive sales policies during this final stage. For customers who opt for a bank loan, the bank will provide a 70% loan limit with an 18-month interest-only period and a 24-month grace period on principal repayment. Customers who do not require a loan will receive a discount of up to VND 700 million. As one of the few completed apartment projects in Ho Chi Minh City that remains affordable, Akari City has garnered significant market interest.

In terms of real demand, there is an uneven distribution of interest across projects due to concerns about asking prices. However, there has been a gradual increase in the number of customers visiting show flats, viewing actual units, and participating in events. Data for Q2 2024 from DXS-FERI indicates a 50-70% increase in property searches compared to the previous quarter. The implementation of new laws has also boosted buyer confidence.

Many individuals, including both end-users and investors, are now withdrawing their savings or consolidating funds to invest in real estate towards the end of the year. Among them are those anticipating the new Law and land price framework, expected to be issued soon in Ho Chi Minh City. Some investment groups are taking advantage of developer promotions to secure properties with the intention of reselling them for a profit in the next phase.

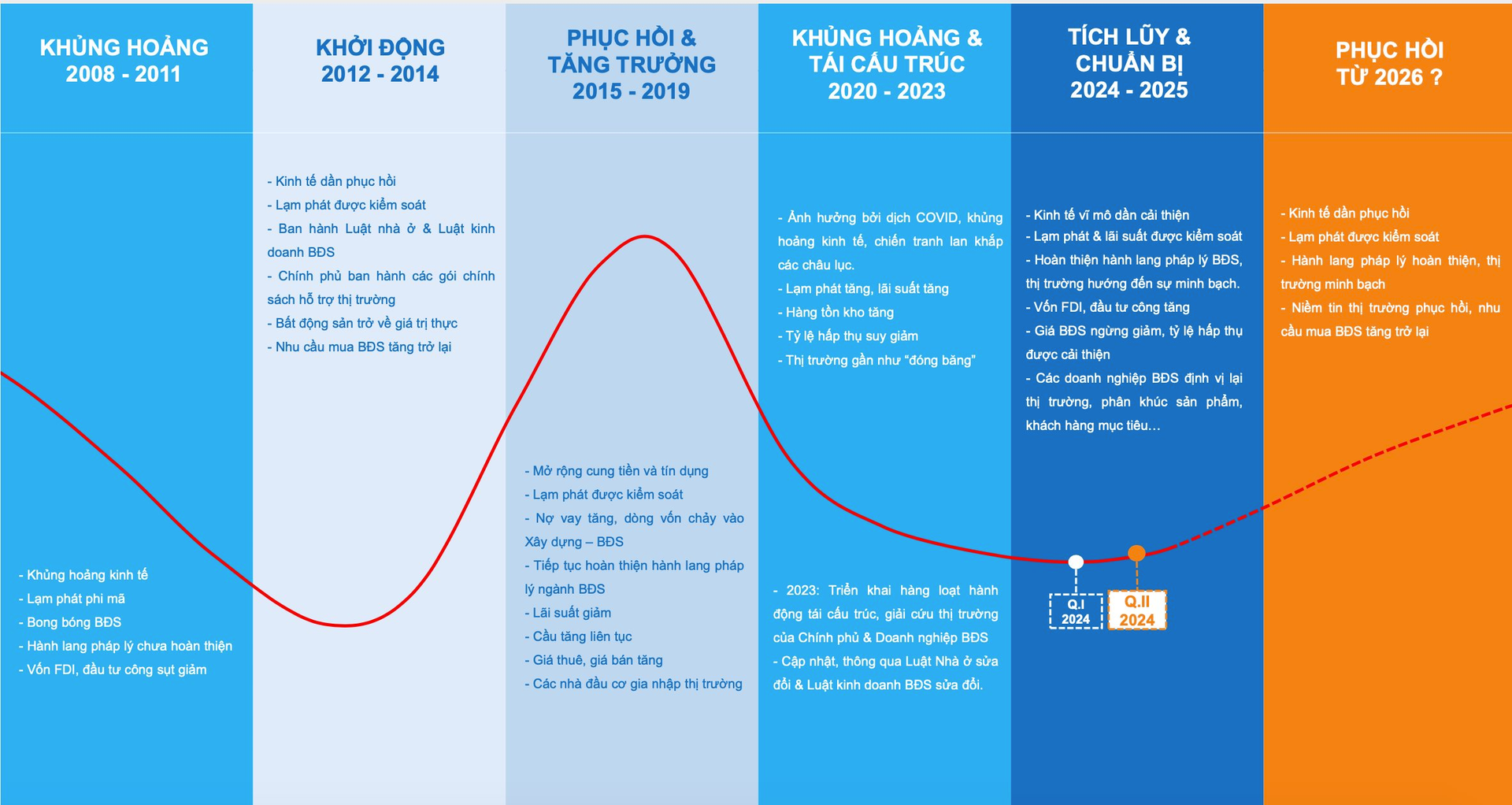

The real estate market is gearing up for a rebound as it enters a new phase. Data source: DXS – FERI

Recently, when asked about the segment that would experience the most significant price increase due to the new Laws, Mr. Le Quoc Kien, a veteran real estate investor in Ho Chi Minh City, opined that various property types, including apartments, shophouses, villas, agricultural land, and land plots, would be significantly impacted regarding legal corridors, initial land processing costs, and capital mobilization expenses.

As a result, the primary market prices of new projects will increase, leading to a rise in secondary market prices for already-implemented or completed projects. This will be a considerable driving force for real estate prices from 2025 onwards, explaining the strong desire to purchase properties during this phase.

According to most industry insiders, apartments and shophouses in large cities that cater to actual housing needs will maintain their leading position in the market and undergo adjustments in the final months of the year. This segment will also be the first to experience a recovery in both prices and demand. However, the Southern real estate market faces challenges due to limited supply and prices that exceed the affordability of the majority.

What’s the Buzz on Southern Land in Response to the New Law?

The impending new law, which awaits the issuance of a circular for guidance, has left land-related dossiers in Ho Chi Minh City in limbo since August 1. This has created significant challenges for real estate transactions during this period.