This draft Decree guides the pricing of securities services applicable at the Vietnam Stock Exchange, Hanoi Stock Exchange, Ho Chi Minh City Stock Exchange (referred to as the Stock Exchange) and Vietnam Securities Depository and Clearing Corporation (referred to as VSDC) in accordance with the law.

The price of securities services applied at the Stock Exchange and VSDC

The prices of securities services stipulated in this Decree are exempt from value-added tax in accordance with the Law on Value-Added Tax and amending documents (if any).

For services where the Ministry of Finance does not prescribe prices, the Stock Exchange and VSDC set their own prices and are fully responsible for the service prices they offer, in accordance with the reality of service provision, price laws, securities laws, and related laws.

The Stock Exchange and VSDC must implement price listing and disclosure, complying with the regulations on prices, securities laws, and related guiding documents.

Before March 31st of each year, the Vietnam Stock Exchange, Hanoi Stock Exchange, Ho Chi Minh City Stock Exchange, and Vietnam Securities Depository and Clearing Corporation shall send a report on the results of the securities business production of the previous year to the Ministry of Finance (State Securities Commission, Price Management Department). Based on the reports and proposals of the Vietnam Stock Exchange and its subsidiaries, the State Securities Commission shall synthesize, review, evaluate, and if necessary, request supplementary reports and conduct surveys to gather more information.

When the factors forming the price or the domestic or international market price fluctuate and affect the production and business situation of the unit, the Stock Exchanges and the Vietnam Securities Depository and Clearing Corporation shall be responsible for developing a pricing scheme and sending it to the State Securities Commission for appraisal and proposal to the Price Management Department. The department will then report to the Ministry of Finance for consideration and adjustment of prices in accordance with regulations.

Price of listing management service

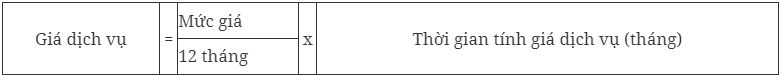

According to the draft, the price of listing management services for stocks, corporate bonds, investment fund certificates, and debt instruments as prescribed in the Law on Public Debt Management, is calculated according to the following formula:

The price level will be considered and decided by the Ministry of Finance, depending on the period. In the case of an organization listing multiple securities codes on the same Stock Exchange, the price will be calculated for each security code.

Timing of service price calculation: In the case of securities that are currently listed and not subject to delisting during the year, the timing of service price calculation is 12 months from January 1st of the year of price calculation.

For organizations registering for listing for the first time and not subject to delisting during the year, the timing of service price calculation for the first year will be from the month after the Stock Exchange issues the Decision on approval of listing to the end of December of that year.

“The Return of the Tra Fish King: Will Hung Vuong Make a Comeback?”

In early 2024, Hung Vuong Joint Stock Company announced a proposal to seek shareholder approval for a capital withdrawal from its member companies to raise funds to repay outstanding loans.