The report, “Income of General Directors, Chairpersons, and Independent Members of the Board of Directors at Public Companies in Vietnam in 2023,” offers a comprehensive insight into the compensation of key executives, encompassing General Directors, Chairpersons of the Board of Directors, and independent Board members, based on disclosures from public companies in Vietnam.

The analysis covers 200 public companies out of 1647 listed or registered for stock trading on 3 exchanges (HOSE, HNX, and UPCoM), representing 85.6% of the total market capitalization across these exchanges as of the end of 2023.

These public companies generated nearly VND 3,300 trillion in revenue in 2023, accounting for 72% of the total revenue of listed enterprises on the 3 exchanges and equivalent to 32% of Vietnam’s GDP for the same year.

This includes 15 out of 27 banks, 9 out of 43 securities companies, 3 out of 14 insurance companies, and 173 out of 1563 businesses in other sectors (non-financial).

The report’s analyses are solely based on figures from public disclosures, such as accounting bases, income statements, and explanations of executive compensation, excluding benefits from stock bonuses or ESOP programs as they don’t immediately reflect the actual income received by executives during the financial year.

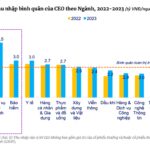

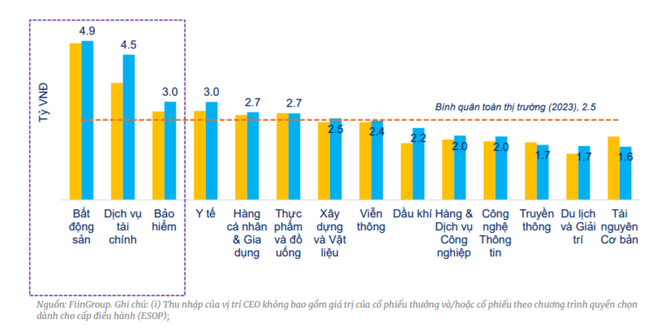

Symbolic executive compensation is also excluded from the data. According to FiinGroup’s report, the average income of CEOs in 2023 was VND 2.5 billion per year per person. Real estate, financial services (mainly securities companies), and insurance were the top 3 industries with the highest average CEO income, surpassing the market average.

Some companies in the top 15 enterprises with the highest income levels have foreign CEOs, including Masan (MSN) and Nam Long Real Estate (NLG).

The report reveals that CEO income in state-dominated enterprises is less than 50% of that in private enterprises, despite similar operational efficiency in terms of return on equity (ROE). This disparity arises from the current mechanism where the Chairperson of the Board in state-owned enterprises also holds an executive position.

CEOs in the large-cap group earn significantly more than the market average, about 52% higher than the overall market average in 2023, which is reasonable given the superior operational efficiency of large-cap companies compared to the other groups.

While the IT, banking, and retail sectors demonstrated better operational efficiency with higher ROE (>15% in 2023), the average CEO income in these sectors remained relatively low. This is because the figures do not include the value of stock bonuses received by executives through ESOP programs.

In 2023, industries with high ratios of completed post-tax profit plans, such as Oil and Gas, Financial Services (mainly Securities), and Insurance, experienced substantial growth in the average income of General Directors.

On the other hand, amid low consumer demand, the Retail and Basic Materials (Steel, Wood, etc.) sectors underperformed in 2023, leading to a decrease in the average income of General Directors compared to 2022.

Turning to the income of Chairpersons of the Board of Directors, the average for 2023 was VND 1.7 billion per person. Banking and Financial Services (mainly securities companies) had the highest average income for Chairpersons due to the executive nature of these leadership roles. The correlation between income and operational efficiency becomes more evident when analyzed according to market capitalization.

Enterprises with state capital (state ownership ranging from 25% to less than 51% of total ownership) had the highest ROE but lower average income for Chairpersons (and CEOs) compared to the overall market average, with a difference of 16%-20%.

When examining market capitalization, there is a distinct correlation between the average income of Chairpersons and operational efficiency. Industries with higher ROE tend to have higher incomes for Chairpersons compared to other sectors.

The report finds a significant correlation between the income of Chairpersons and operational efficiency in the banking sector. The average income of Chairpersons and the average ROE in the banking industry are both high. This is partly due to the fact that many bank chairpersons also hold executive positions.

In contrast, while the IT and retail sectors exhibit high operational efficiency (ROE), the average income of Chairpersons is very low.

Looking specifically at 2023, the income of Chairpersons was not directly linked to company growth targets in most industries. Leadership compensation is usually determined in the previous year, and in Vietnam, company growth is not typically a KPI or a factor in deciding the compensation of key executive positions.

The Average Annual Income of Real Estate CEOs Reaches 4.9 Billion VND, Topping 14 Industry Sectors: KBC CEO Leads the Pack with a 17-Billion-VND Payday in 2023

A recent survey by FiinGroup of 200 public companies revealed that CEOs in the real estate industry earned an average of 4.9 billion VND per year, topping the list of 14 sectors. The highest-paid CEO in this industry was Ms. Nguyen Thi Thu Huong of KBC, who took home a impressive 17 billion VND in 2023.

Unveiling the “Massive” Income of Chairpersons and CEOs in the Banking and Real Estate Sectors

The average income of a CEO in the real estate, securities, and insurance industries is an impressive 2.5 billion VND per year. This figure showcases the potential earnings of those at the top of these lucrative sectors. It is a testament to the rewards that come with leadership and expertise in these fields.

Sacombank Reaps 5.342 Billion Dong Profit in H1 2024

As per the recently released financial report, Sacombank’s consolidated total assets reached over VND 717 trillion as of June 30, 2024, marking a 6.4% increase since the beginning of the year. Notably, earning assets surged by 11%. The bank has demonstrated impressive growth in both deposit mobilization and lending activities, outpacing the industry average.