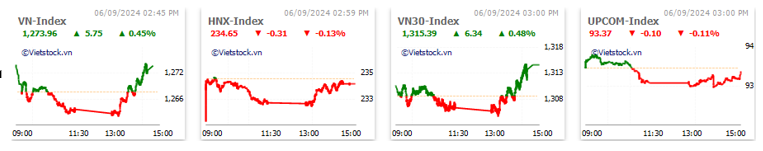

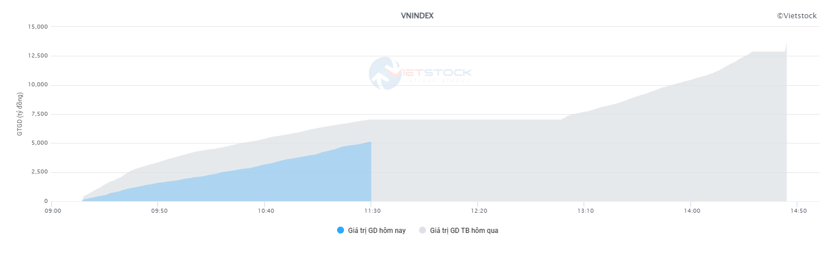

Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 514 million shares, equivalent to a value of more than VND12.2 trillion; the HNX-Index reached over 43.7 million shares, equivalent to a value of more than VND827 billion.

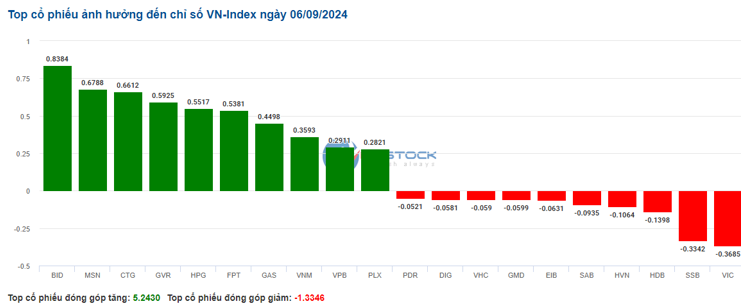

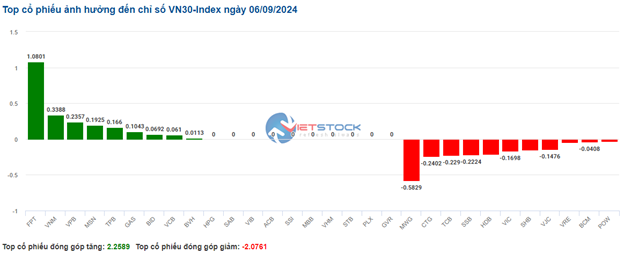

The VN-Index began the afternoon session with buying power quickly reappearing, helping the VN-Index to quickly regain the reference level and maintain its green status at the end of the session. In terms of impact, BID, MSN, CTG, and GVR were the codes with the most positive impact on the VN-Index, with an increase of more than 2.7 points. On the contrary, VIC, SSB, HDB, and HVN were the codes with the most negative impact, but the impact was insignificant.

Source: VietstockFinance

|

On the other hand, the HNX-Index had a rather negative performance, with the index being negatively affected by the codes KSV (-2.92%), SHS (-2.5%), MBS (-1.45%), and NVB (-2.17%)…

At the end of the session, the market increased by 0.45%. The information technology industry was the group with the strongest increase of 1.06%, mainly from the codes FPT (+1.15%), VBH (+8.18%), and POT (+7.39%). This was followed by the materials and consumer staples sectors, which increased by 0.95% and 0.55%, respectively. On the other hand, the telecommunications services sector had the largest decrease in the market, with -1.01% mainly coming from the code VGI (-2.16%), VNZ (-6.8%), CTR (-0.4%), and YEG (-0.33%).

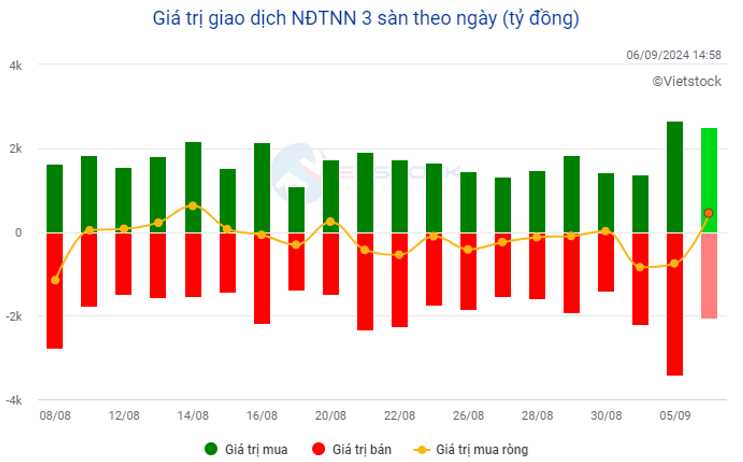

In terms of foreign trading, they returned to net buy more than VND 420 billion on the HOSE exchange, focusing on the codes FPT (VND 192.17 billion), CTG (VND 82.29 billion), VNM (VND 77.6 billion), and TPB (VND 51.77 billion). On the HNX exchange, foreign investors net bought more than VND 39 billion, focusing on the code PVS (VND 32.61 billion), IDC (VND 6.42 billion), SHS (VND 1.21 billion), and VTZ (VND 1.2 billion).

12:00 Low liquidity, sellers temporarily win

After a tug-of-war around the reference level in the first half of the morning session, selling pressure gradually prevailed as buyers were not very active. At midday break, the VN-Index decreased by 0.3%, closing at 1,264.45 points; the HNX-Index decreased by 0.64%, closing at 233.46 points. The breadth of the market is tilting towards the sellers, with 424 declining codes and 175 advancing codes.

Investors remain cautious after two consecutive losing sessions, and market liquidity this morning was low. The trading volume of the VN-Index reached more than 223 million units in the morning session, equivalent to a value of VND 5.1 trillion, a decrease of more than 27% compared to the previous morning. The HNX-Index recorded a trading volume of nearly 17 million units, with a value of over VND 321 billion.

Source: VietstockFinance

|

GAS, FPT, and BID are currently the main pillars holding up the index, contributing more than 1 point to the VN-Index. Meanwhile, VHM, CTG, and VIC are the most negative codes, taking away about 1.2 points from the index.

Most sectors were in the red. Telecommunications led the decline, falling more than 3% under pressure from VGI (-2.93%), VNZ (-14.85%), FOX (-1.22%), and CTR (-0.96%). This was followed by energy, real estate, and industrials, which decreased by about 1%.

The financial sector is also in the red, although some large-cap stocks such as VCB, BID, VPB, LPB, and TPB are still slightly up. Within this group, securities stocks recorded a larger decrease than banks and insurers, with many stocks falling more than 1%, such as HCM (-1.37%), MBS (-1.82%), FTS (-1.61%), SHS (-1.88%), VIX (-1.26%), CTS (-1.15%), VDS (-2.4%), and BVS (-1.52%),…

The information technology and utilities groups are currently the only two bright spots in the market, mainly due to the performance of two large-cap stocks, FPT (+0.77%) and GAS (+0.96%).

10:30 am: Cautious cash flow

Investors remain cautious after the previous losing session, leading to a significant decrease in trading volume and the main indices continuously fluctuating around the reference level. As of 10:30 am, the VN-Index decreased by 1.4 points, trading around 1,266 points. The HNX-Index decreased by 0.61 points, trading around 234 points.

Stocks in the VN30 basket rose and fell alternately, with a balanced buying and selling force. Specifically, FPT, VNM, VPB, and MSN respectively contributed 1.08 points, 0.34 points, 0.24 points, and 0.19 points to the overall index. In contrast, MWG, CTG, TCB, and SSB faced selling pressure, taking away more than 1.1 points from the VN30-Index.

Source: VietstockFinance

|

Leading the recovery was the information technology sector, with the increase mainly coming from the industry giant FPT, which rose by 0.84%… while the remaining codes were either stagnant or slightly decreased, such as CMG, ITD, and PIA.

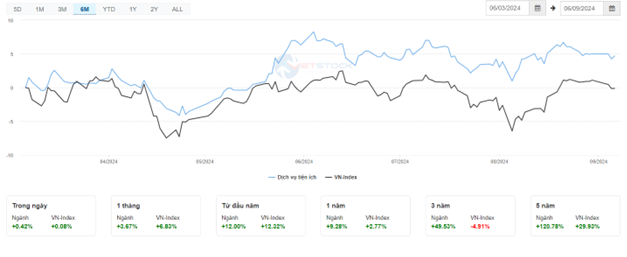

Following was the utilities sector, with a modest recovery of 0.38% due to the strong divergence within the industry. Notably, GAS increased by 1.08%, BGE increased by 0.96%, CNG increased by 0.7%, and QTP increased by 0.7%… On the contrary, REE, NT2, PPC, and SBA remained in the red, but the decrease was not significant. Additionally, it was quite positive that utilities maintained their Outperform status compared to the VN-Index in the last six months.

On the other hand, the telecommunications services sector had an unfavorable performance, continuing its decline for the third consecutive session, with a decrease of 1.7%. Specifically, the red color appeared mainly in the two industry giants, VGI, which decreased by 2%, and CTR, which decreased by 0.8%. Moreover, buying power remained present in some mid- and small-cap codes such as FOC (up 0.69%), SGT (up 1.73%), and YEG (up 0.22%), but it was not enough to change the sector’s situation.

Compared to the beginning of the session, the divergence continued without any signs of change, with more than 1,000 codes at the reference level and the sellers slightly dominating with 331 declining codes and 201 advancing codes.

9:30 am: Caution at the beginning of the session

At the beginning of the session on September 6, as of 9:30 am, the VN-Index fluctuated around the reference level and decreased by more than 1 point, closing at 1,266.58 points. Additionally, the HNX-Index also slightly decreased, reaching 234.44 points.

According to the latest report from ADP, the pace of job growth in the private sector has hit its lowest level in more than 3.5 years. Specifically, in August, private companies only hired 99,000 employees, significantly lower than the figure of 111,000 in July (which has been adjusted downward) and far from the Dow Jones forecast of 140,000. This is the weakest job growth since January 2021.

Another report from the US Department of Labor also provided rather pessimistic figures. Accordingly, the number of job opportunities in July hit the lowest level since the beginning of 2021. Meanwhile, Challenger, Gray & Christmas – a reputable employment consulting firm, recorded that August was the month with the highest number of layoffs since 2009 and also the year with the slowest recruitment pace in their history of tracking.

The red color temporarily dominated the VN30 basket, with 16 declining codes, 8 increasing codes, and 6 stagnant codes. Among them, CTG, HDB, and BCM were the most negatively affected stocks. On the contrary, GAS, BID, and BVH were the stocks with the strongest increases.

Tomorrow’s Stock Market Outlook: Will the Force of Bottom-Fishing Persist?

“The stock market witnessed a late surge of buying activity on September 4th, as bargain hunters stepped in to take advantage of the dip. This bottom-fishing pushed the market to trim its losses, instilling hope among investors that this trend could persist and potentially pave the way for a market rebound.”