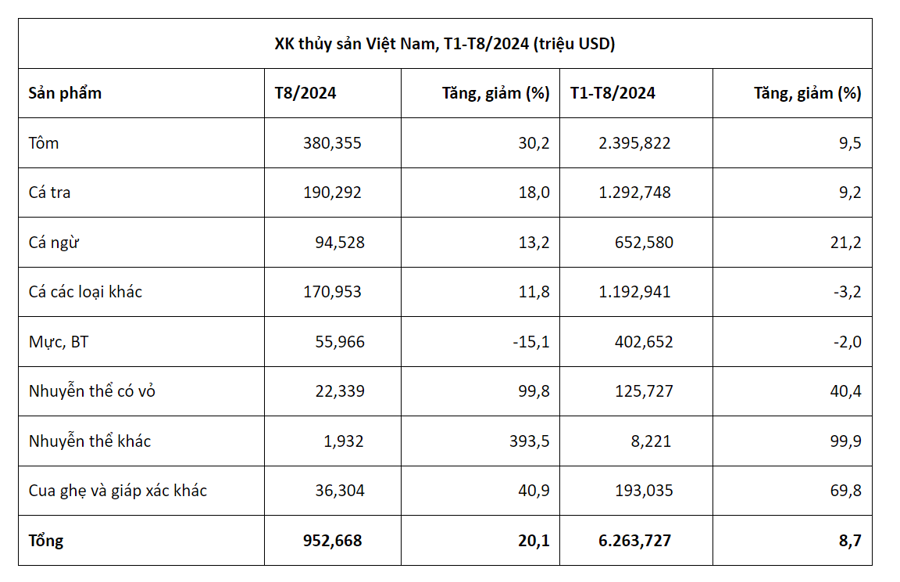

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood exports continued to recover, with a 20% growth in August 2024, reaching nearly $953 million. Cumulative exports in the first eight months of the year reached $6.3 billion, a 9% increase compared to the same period last year…

STRONG EXPORT GROWTH FOR TUNA AND SHRIMP

VASEP reported that shrimp exports as of the end of August 2024 reached nearly $2.4 billion, a 9% increase compared to the previous year. White shrimp exports accounted for approximately $1.75 billion, an 8% increase; while exports of black tiger shrimp remained 7% lower than the previous year, at nearly $290 million. Lobster exports, however, maintained their strong growth trajectory in August 2024, resulting in an impressive 140% increase in export turnover for the first eight months of 2024 compared to the same period in 2023.

Aside from the challenges posed by anti-dumping and anti-subsidy duties, shrimp exports are showing positive signs, with stable growth in recent months. Particularly after the Vietfish Seafood Exhibition in August, there have been encouraging signals for shrimp exports.

“Compared to August 2023, shrimp exports increased by 30%, tra fish by 18%, tuna by 13%, and other marine fish by 12% in August 2024.”

VASEP

Additionally, a predicted decrease in global shrimp production in 2024 is expected to drive up shrimp prices. Forecasts suggest that shrimp production in China, Ecuador, and India will all decline this year, resulting in a global reduction of approximately 260,000 tons (equivalent to a 5% decrease) to 4.89 million tons. Meanwhile, shrimp consumption is beginning to rise in Europe, and the US market has also shown a slight recovery, despite low import prices in China. These are positive signs for the shrimp market.

Tuna exports, as of the end of August 2024, reached $652 million, a 21% increase compared to the same period in 2023. The general market trend indicates a sustained demand for Vietnamese tuna products. However, in the coming months, tuna exports are unlikely to maintain the strong growth witnessed since the beginning of the year due to a shortage of raw materials. This is a result of the difficulties in procuring tuna that meet the minimum size requirement of 0.5 meters, as stipulated in Decree 37/2024. Consequently, there is insufficient domestic raw material for the production of canned tuna and other export products.

Source: VASEP.

Squid and octopus exports have been the most affected by the yellow card warning from the EU, with significant challenges in obtaining catch certification for these products, hindering businesses from securing sufficient export-ready raw materials. As a result, exports of squid and octopus remained 2% lower than the previous year, at $402 million, as of the end of August.

Overall, seafood exports to various markets have shown positive signs in terms of demand and price recovery. However, significant challenges remain, including the yellow card warning, anti-dumping duties, and anti-subsidy taxes, which are expected to constrain growth in the coming months. Considering these factors, VASEP predicts that seafood export turnover for the whole of 2024 will fluctuate between $9.4-9.5 billion, a nearly 6% increase compared to 2023.

STRONG EXPORT GROWTH FOR TRA FISH IN THE US MARKET

According to VASEP, tra fish exports in the first eight months of 2024 reached nearly $1.3 billion, a 9% increase compared to the same period last year. While exports to China remain stagnant, the recovery of the US market has served as a “lever” for the growth of tra fish exports.

Delving further into the US market, VASEP notes that the country continues to demand white-fleshed fish species through procurement programs of the US Department of Agriculture (USDA). On August 29, 2024, the USDA announced its intention to purchase additional seafood, specifically Pacific cod, also known as true cod, grouper fillets, and catfish products.

The USDA also disclosed that it had paid $6.5 million for 1.5 million pounds of catfish. The purchase was distributed to five processors in the US Gulf region: Alabama Catfish, based in Uniontown, Alabama; America’s Catch, based in Itta Bena, Mississippi; Isola, Mississippi Consolidated Catfish Producers; Heartland Catfish, also based in Itta Bena, Mississippi; and Magnolia Processing in Tunica, Mississippi.

“Tra fish exports from Vietnam to the US in the first eight months of 2024 increased by 23% compared to the same period last year, while exports to China continued to decline by 3%.”

VASEP

In 2023, global tra fish production reached 3.1 million tons, a nearly 9% increase compared to 2022. Vietnam is the world’s largest producer and exporter of tra fish, accounting for 52% of global production and 90% of global tra fish trade.

In 2023, approximately 563,000 tons of frozen tra fish were traded internationally, a 25% decrease compared to 2022. Frozen tra fish fillets accounted for 84% of total imports, despite a 29% decline from 2022. Frozen whole tra fish accounted for 15% of trade, a 3% increase from the previous year.

The volume of frozen whole tra fish imports in 2023 increased by 9% in China, 10% in Colombia, 82% in Uzbekistan, 54% in Qatar, and 5% in South Korea compared to 2022. Imports of frozen tra fish fillets also increased in Brazil by 15%, the Philippines by 10%, Singapore by 10%, the UK by 10%, and Germany by 45%. China remains the largest market for both frozen whole fish and fillets, accounting for 29% of global frozen tra fish imports, followed by the US at 15% and Brazil at 6%.

In 2023, the US imported nearly 92,000 tons of frozen tra fish, with Vietnam supplying 91% and the remaining 9% coming from Thailand and China. Europe imported nearly 66,000 tons of frozen tra fish, including 91% frozen fillets and 9% frozen whole fish. Of this, about 85% of the imported tra fish originated from Vietnam.

In Asia, China is the leading consumer of tra fish, accounting for 56% of import volume; Thailand contributes 11%, the Philippines 10%, and Singapore 6%.

In 2023, Latin America imported nearly 90,000 tons of frozen tra fish, with Brazil, Mexico, and Colombia accounting for 58%. Brazil, Honduras, and Argentina were the only countries in the region to experience positive growth that year.

Vietnam is the world’s largest producer and exporter of tra fish, with its products favored in many international markets for their delicious taste and competitive prices. However, tra fish exports also face several external challenges, including political conflicts, trade tensions, the Russia-Ukraine conflict, US anti-dumping duties, climate change, pandemics, rising transportation costs, and barriers in the application of science, technology, and digitalization.

The global economic recession has led consumers to be more frugal in their spending. Tra fish, with its affordable price point, is well-positioned in this environment. Vietnamese farmers and processors are optimistic about an increase in demand in the second half of 2024. VASEP predicts that tra fish exports in the latter half of the year will exceed $1 billion, bringing the estimated total for 2024 to $2 billion, a nearly 9% increase compared to 2023.