“The Dangers of Black-Market Loans: A Warning for Students”

Students are easy targets for “black-market loans”

The Trap is Set

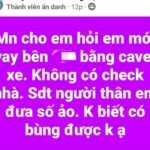

As the new academic year approaches, parents and students alike are busy searching for accommodation. This is also when we see a surge in consumer loan advertisements, luring vulnerable students with promises of simple loan processes and quick disbursements. All they need is a citizen ID and a student ID. Whether these loans are beneficial or not is unclear, but what is certain is that they are a trap laid by illegal lenders to ensnare unsuspecting students.

Take the case of Minh Tri, a student at one of Hanoi’s top universities, who shared his unfortunate experience with black-market loans. He sent a copy of his ID and family residence book to the lender and received a loan of 10 million VND within just two hours. However, he only received 8 million VND and was required to pay back 200,000 VND per day for 50 days. This marked the beginning of a series of unfortunate events that turned his life upside down. He received constant threatening and abusive phone calls from the lender, at all hours, because of a few days’ delay in repayment. This caused him immense anxiety and fear. Eventually, he confided in his family, who helped him resolve the situation.

Similarly, a female student in Ho Chi Minh City lost her tuition money and resorted to borrowing from a black-market loan app. When she couldn’t repay the loan, the app employees harassed her, forcing her to borrow from dozens of other apps to repay the initial loan. Her debt eventually ballooned to 300 million VND.

According to an expert, black-market lenders prey on students’ lack of financial knowledge and exploit their financial pressures. Many students are away from home for the first time and have to make their own decisions about their studies and daily lives. With limited funds from their families and the high cost of living in cities, it’s easy for them to fall into debt if they don’t manage their finances well. Black-market loans, with interest rates often exceeding 100% per annum, not only pose a financial threat but also severely harm the mental health of these young people.

Take Preemptive Action

Law enforcement agencies have repeatedly warned students and the general public about the dangers of black-market loans and the illegal activities of loan sharks. It is crucial to understand their tactics and the devastating consequences they can have on individuals and families. Be vigilant and do not fall prey to these lenders or assist them in any way. Report any suspicious activities to the local police, especially if you notice groups of young people renting temporary housing, as they may be involved in illegal lending activities. If you come across promotional flyers for loans in public areas, tear them down or scratch out the phone numbers to prevent others from falling into the trap.

To protect students from the risks of black-market loans, Dr. Duong Thi Thanh Mai, former Director of the Legal Research Institute of the Ministry of Justice, emphasizes the importance of students acquiring life skills to avoid such traps. In case they do fall victim, it is crucial to seek help immediately and not hide it, as the situation will only get more complicated over time. If necessary, report the matter to the police. Schools and authorities should also step up their efforts to educate students about the dangers of black-market loans and provide them and their families with information on how to access legitimate consumer credit from authorized organizations.

From a banking perspective, Mr. Le Hong Phuc, Deputy General Director of the Vietnam Bank for Agriculture and Rural Development (Agribank), asserts that accessing consumer credit has become much easier with the widespread network of bank branches across the country. Agribank, in particular, has introduced mobile banking services that bring banking services, including lending and debt collection, to remote areas on a weekly basis.

Additionally, major banks such as Vietcombank, BIDV, SHB, and VPBank have developed dedicated consumer credit products and services, offering electronic and online lending options with simplified procedures to make it more convenient for borrowers.

To ensure that consumer credit is accessible to vulnerable groups like students, the poor, and those in remote areas, Mr. Doan Thai Son, Deputy Governor of the State Bank of Vietnam, stated that the banking industry will continue to review and improve the legal framework for consumer lending activities. They will also enhance the management, inspection, and supervision of consumer lending by financial institutions to ensure compliance with legal regulations and protect the rights and interests of borrowers. Financial institutions should improve their methods of providing information and reaching out to potential borrowers to ensure they understand the products and services accurately. Close coordination with the Ministry of Public Security is also crucial to connect and utilize the National Database on Population to enhance the security and effectiveness of consumer credit activities.

The Dark Side of Lending: How ‘Predatory’ Loan Sharks Are Luring Victims

According to Professor Dr. Tran Ngoc Tho, a member of the National Financial and Monetary Policy Advisory Council, there is a proliferation of organizations on the internet offering credit services. These organizations lure unsuspecting individuals with extremely attractive conditions, and those lacking financial literacy may find themselves at risk of falling into the trap of “black-market loans”.