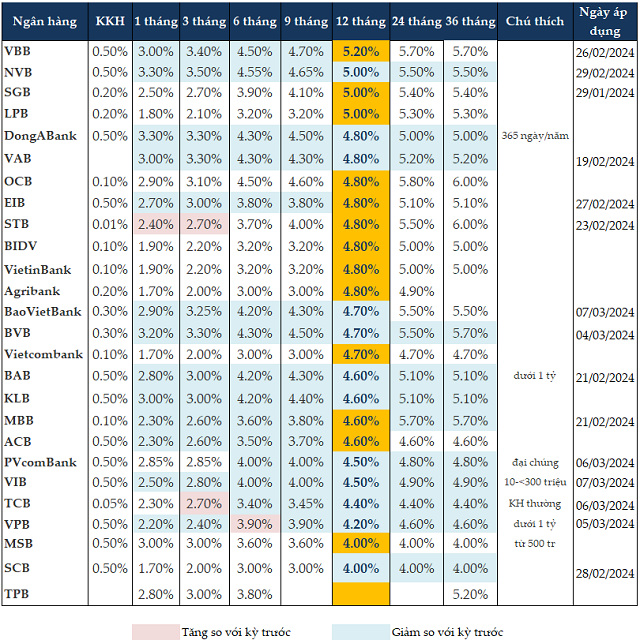

Sacombank, Techcombank, and VPBank are three banks increasing interest rates on certain terms under 6 months in the latest adjustment period.

Starting from February 23, 2024, Sacombank increases the interest rate of 1-month term deposits to 2.4% per year, and 3-month term deposits to 2.7% per year.

Techcombank only increases the interest rate of 3-month term deposits to 2.7% per year from March 6, 2024. Meanwhile, the bank reduces 0.1-0.2 percentage points for terms of 6 months and above. The interest rate for 6-month term deposits is reduced to 3.4% per year, and for terms of 12 months and above is reduced to 4.4% per year.

On the other hand, VPBank increases the interest rate of 6-month term deposits and reduces all other terms from March 5, 2024. For deposits below 1 billion VND, VPBank applies an interest rate of 3.9% per year for the 6-month term, reduces the interest rate for 1-month term deposits to 2.2% per year, for 3-month term deposits to 2.4% per year, and for 12-month term deposits to 4.2% per year.

Other banks continue the general trend of reducing interest rates for all term deposits such as NVB, DongABank, VietABank, BVB, BaoVietBank…

Starting from March 7, 2024, BaoVietBank reduces the interest rate of deposits with terms of 12 months and below by 0.5 percentage points. The interest rate for 1-month term deposits is reduced to 2.9% per year, for 3-month term deposits to 3.3% per year, and for 12-month term deposits to 4.7% per year.

In the adjustment period of March 4, 2024, BVB reduces the interest rate for all term deposits by 0.2-0.4 percentage points. The interest rate for 1-month term deposits is 3.2% per year, for 3-month term deposits is reduced to 3.3% per year, and for 12-month term deposits is reduced to 4.7% per year.

State-owned banks maintain the same interest rates for term deposits as the previous month. VietinBank and BIDV have the same interest rate schedule. For over-the-counter deposits, the interest rate for 1-2-month terms is 1.9% per year, for 3-5-month terms is reduced to 2.3% per year, for 6-9-month terms is 3.2% per year, for 12-18-month terms is 4.8% per year, and for terms of 24 months and above is 5% per year.

On the other hand, Agribank and Vietcombank have lower interest rate ranges. The interest rate for 1-2-month terms is 1.7% per year, for 3-5-month terms is 2% per year, for 6-9-month terms is 3% per year. The interest rate for 12-month term deposits at Agribank is 4.8% per year, while at Vietcombank it is 4.7% per year.

As of March 7, 2024, the interest rate for time deposits from 1-3 months is adjusted between 1.7-3.5% per year, for 6-9 months is in the range of 3.0-4.7% per year, and for 12 months is in the range of 4-5.2% per year.

For the 12-month term, VBB is the bank with the highest interest rate, reaching 5.2% per year. Next is NVB, LPB, and SGB with the interest rate of 5% per year.

For the 6-month term, NVB has the highest interest rate at 4.55% per year. Next is VBB and OCB with the interest rate of 4.5% per year.

Meanwhile, the 3-month term has the highest interest rate at NVB with 3.5% per year, and VBB follows with 3.4% per year.

|

Personal time deposit interest rates at banks as of March 7, 2024

|

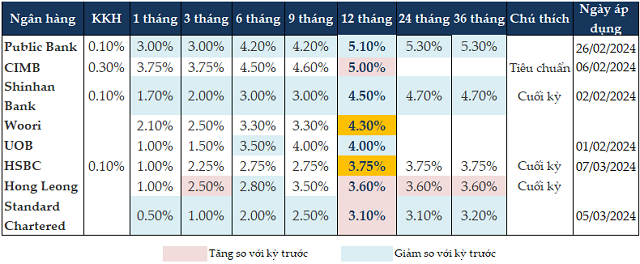

Foreign banks also have similar trends when some banks increase interest rates on certain terms. CIMB increases the interest rate for 12-month term deposits to 5% per year from February 6, while keeping the rates unchanged for other terms.

Hong Leong Bank only reduces the interest rate for 3-month term deposits to 2.8% per year and increases the interest rate for other terms. The interest rate for 12-month term deposits is raised to 3.6% per year.

However, as of March 7, 2024, Public Bank has the highest interest rate among foreign banks, reaching 5.1% per year for the 12-month term. For the 6-month term, CIMB maintains the highest interest rate at 4.5% per year.

|

Personal time deposit interest rates at foreign banks as of March 7, 2024

|

Although some banks have increased interest rates on certain terms, most experts still believe that interest rates will continue to decrease in the short term and remain at a low level as they are now, without creating a wave of increase in the short term.

Trần Trương Mạnh Hiếu – Head of Analysis Department at KIS Vietnam Securities Company believes that the banking system’s liquidity is abundant and ready to supply capital to the economy, so in the coming time, deposit interest rates may even decrease further and lending interest rates still have room to decrease.

PhD. Nguyễn Hữu Huân – Lecturer at Ho Chi Minh City University of Economics predicts that the savings deposit interest rate level will remain the same at least until the end of the second quarter of 2024, and may start to increase in the second half of the year if the economy recovers and credit improves.

PhD. Nguyễn Trí Hiếu – Banking and Finance Expert has a longer-term perspective. Although the current deposit interest rates continue to decrease, in the second half of 2024, when the economy operates more efficiently and the demand for loans may increase, banks may have to increase deposit interest rates to raise funds and lending interest rates may start to increase again.