On September 16, NET Detergent Joint Stock Company (stock code: NET) will finalize the list of shareholders to implement a 50% cash dividend payment for the year 2023. This means that for every 1 share owned, shareholders will receive VND 5,000. The expected payment date is September 27, 2022.

With nearly 22.4 million shares in circulation, the company plans to spend approximately VND 112 billion on dividend payments.

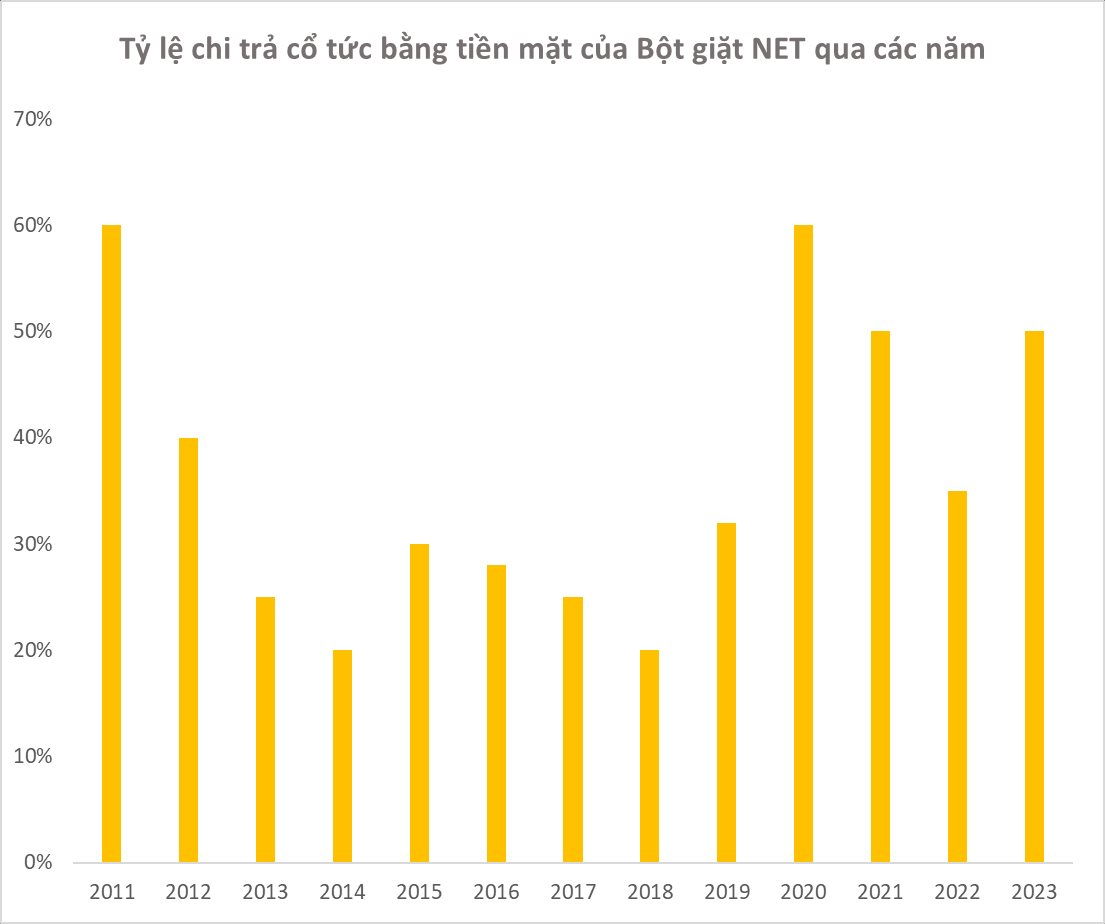

NET has maintained a tradition of high cash dividend payouts over the years, with the highest rate being 60% (VND 6,000 per share) in 2011 and 2020. In addition, the company also rewarded shareholders with a 100% stock dividend in 2014 and a 40% stock dividend in 2016.

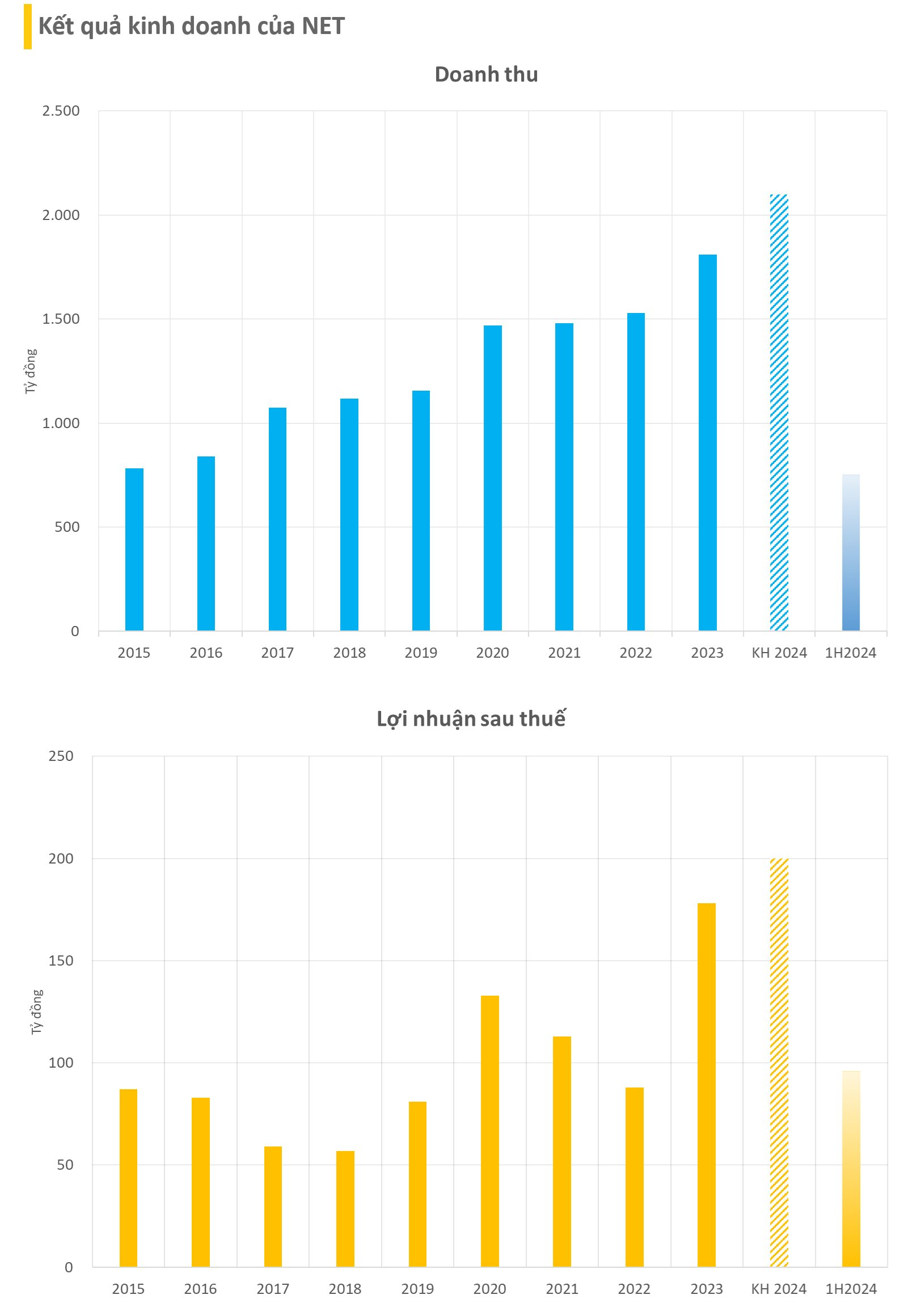

The high dividend payout comes on the back of strong financial performance. In 2023, NET reported a 102% surge in net profit to VND 178 billion, the highest in the company’s history, surpassing even the most optimistic profit target set by NET.

For the first half of 2024, NET recorded a 13% year-on-year decrease in revenue to over VND 753 billion. However, net profit still increased by 27% to more than VND 96 billion due to reduced operating expenses.

Established in 1968, NET is one of the leading domestic companies in Vietnam specializing in household care products. NETCO operates two factories, one in Hanoi and the other in Bien Hoa, with a designed capacity of 180,000 tons of detergent powder and 90,000 tons of liquid detergent. NET is a strategic partner of Unilever, supplying high-quality cleaning products such as OMO and Surf laundry detergents, Sunlight dishwashing liquid, and VIM floor cleaner. The company has consistently increased its product supply to Unilever over the years.

A turning point in NET’s business came in early 2020 when Masan HPC Company Limited, a wholly-owned subsidiary of Masan Group, acquired a 52% stake in NET at an average price of VND 48,000 per share. Based on NET’s current market price of VND 92,000 per share, Masan Group’s subsidiary has nearly doubled its investment in just over four years, excluding dividends.