4 Years, 4 CEOs: The Story of Gojek Vietnam

Gojek, the ride-hailing and food delivery app of GoTo, Indonesia’s largest digital ecosystem, has announced its departure from the Vietnamese market starting September 16th. According to the “tech unicorn,” this strategic decision aims to consolidate the company’s business operations.

Introduced to Vietnam in August 2018 as GoViet, the app initially offered ride-hailing and on-demand delivery services, later expanding into online food delivery. With aggressive promotional campaigns, including rides priced as low as 1,000 and 5,000 VND, GoViet quickly established itself as a formidable competitor to the giant Grab.

However, just six months later, in March 2019, both the CEO, Nguyen Vu Duc, and the COO, Nguyen Bao Linh, unexpectedly resigned. Le Diep Kieu Trang, former CEO of Facebook Vietnam, took over as the new leader of GoViet. Yet, after five months at the helm, this well-known businesswoman also stepped down.

In August 2020, the GoViet brand and its iconic red and white uniform were retired, making way for Gojek Vietnam. The new color scheme of green, black, and white mirrored that of its parent company. Phung Tuan Duc, the former Operations Director of GoViet, was appointed as the new CEO.

At that time, Gojek was lagging behind its rivals. According to ABI Research, GoViet held a 10.3% ride-hailing market share, trailing Be (15.6%) and Grab (72.8%). In the food delivery segment, GoFood also played catch-up to GrabFood and Now in terms of customer satisfaction and regular usage.

Gojek’s parent company, GoTo, faced significant challenges in its pursuit of profitability. In 2022, GoTo reported a net loss of 40.4 trillion Rupiah (approximately 2.7 billion USD), a 56% increase compared to 2021, far surpassing the company’s revenue.

In January 2023, after more than four years with Gojek Vietnam as COO and then CEO, Phung Tuan Duc left the company to pursue personal endeavors. Sumit Rathor then became the fourth CEO of Gojek Vietnam since its inception, approximately four and a half years after its entry into the market.

Phung Tuan Duc, Gojek Vietnam’s Longest-Serving CEO.

Falling Behind in Both Ride-Hailing and Food Delivery

In December 2023, another tech unicorn, Baemin, bid farewell to the Vietnamese market. Despite the potential of Vietnam’s food delivery market, as evidenced by the data, and the fact that online food ordering had become a way of life for urban residents, Baemin’s departure served as a reminder to remaining players of the challenges and competitiveness of this industry.

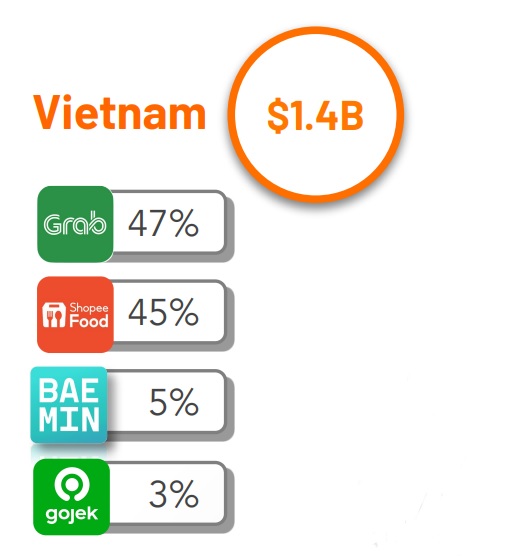

According to Momentum Works, in 2023, Baemin held only a 5% share of GMV (gross merchandise volume) in Vietnam’s food delivery market, a modest figure compared to GrabFood (47%) and ShopeeFood (45%). Even with Baemin’s presence significantly reduced before its exit, GoFood’s share remained at a meager 3%.

GMV Share of Food Delivery Platforms in Vietnam in 2023. Source: Momentum Works.

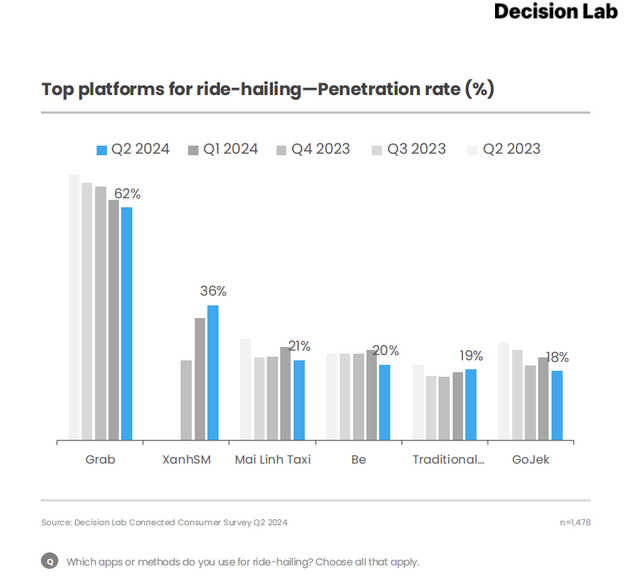

In the ride-hailing sector, Gojek’s penetration rate stood at 18% in Q2 2024, according to Decision Lab, a 4% decrease from the previous quarter. From Q2 2023 to Q4 2023, this figure consistently declined. In comparison, Gojek’s rate was only half that of Xanh SM, a newcomer to the market since April 2023, which has been steadily growing each quarter.

Penetration Rate of Ride-Hailing Apps in Vietnam across Quarters. Source: Decision Lab.

As early as April 2023, Nikkei Asian Review published an analysis highlighting GoTo’s struggles with increasing losses due to an ill-timed IPO and excessive diversification. The article cited Jianggan Li, CEO of Momentum Works, who suggested that GoTo should divest from non-core businesses and exit the Vietnamese market as competition was not feasible in the short to medium term.

A year and a half later, this prediction has come to pass.

Minh Anh

The Perfect Storm: As Super Typhoon No. 3 Looms, Thanh Hoa Endures Heavy Rains and Strong Winds, with Trees Uprooted and Strewn Across the Province.

From the evening of September 5th to the early hours of the 6th, heavy rains and strong winds battered the province of Thanh Hoa, causing extensive damage. Many trees were uprooted and toppled, a scene of chaos and destruction was witnessed across the region.

A Generous Bank Waives and Reduces a Plethora of Card Fees Starting This September

“Not only does this bank offer free card services, but it also loosens the conditions for annual fee waivers by reducing the minimum transaction turnover by over 50%. This is an incredibly attractive offer and a unique opportunity for customers to take advantage of. With such a significant reduction in the minimum transaction requirements, the bank is making its services more accessible and rewarding for all.”