Illustration photo.

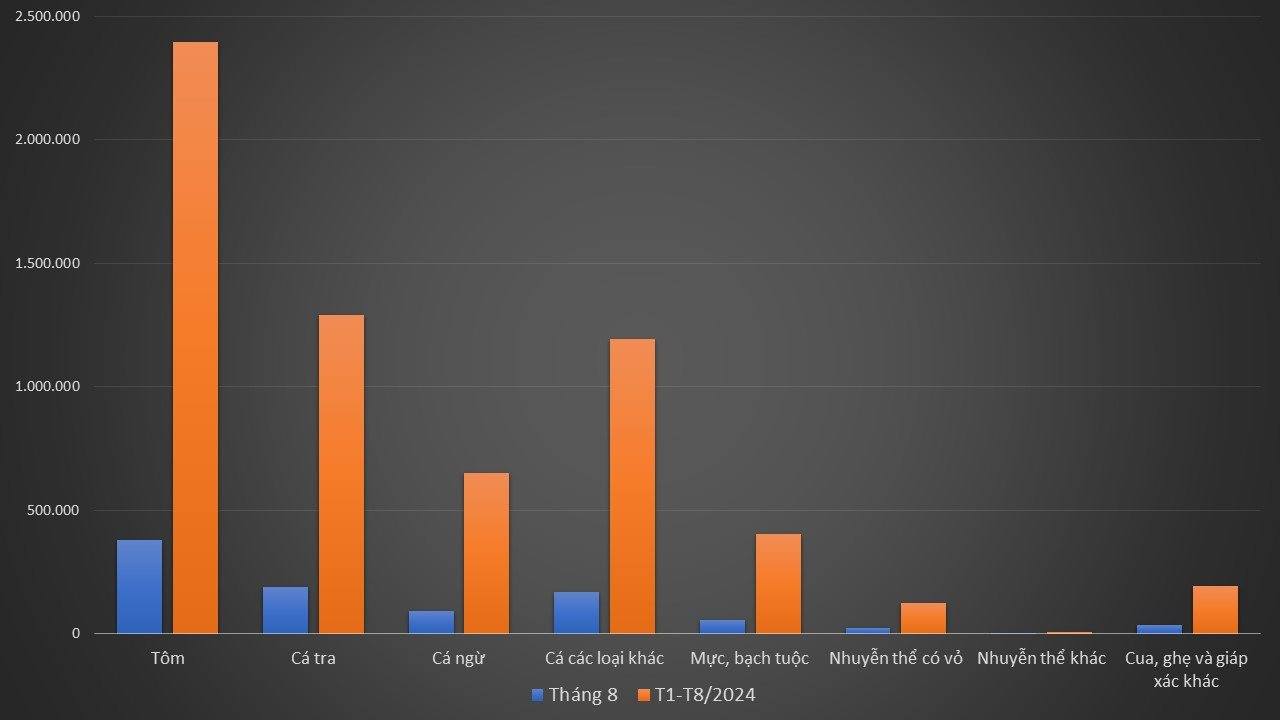

The Vietnam Association of Seafood Exporters and Producers (VASEP) reported that seafood exports in August 2024 rebounded with a 20% growth rate, reaching nearly $953 million. Cumulative exports of this commodity in the first eight months of the year reached nearly $6.3 billion, up nearly 9% over the same period last year.

Notably, exports of key products recorded double-digit growth rates of 2-3%. Specifically, shrimp exports increased by 30%, tra fish by 18%, tuna by 13%, and other marine fish by 12%.

Shrimp exports by the end of August reached nearly $2.4 billion, up 9% over the same period last year. In particular, white-legged shrimp accounted for about $1.75 billion (up 8%), while giant tiger prawn exports remained 7% lower than the previous year, at nearly $290 million. Meanwhile, lobster exports maintained their strong growth momentum in August, resulting in an 8-month export turnover 140% higher than the same period in 2023.

According to VASEP, aside from the challenges posed by anti-subsidy and anti-dumping duties, shrimp exports are on a positive trajectory, with stable growth rates in recent months. Moreover, a predicted decrease in global shrimp production in 2024 will likely drive up shrimp prices.

Seafood exports in August and the first eight months of 2024. (Data source: VASEP)

Regarding tra fish, exports of this product in the first eight months reached nearly $1.3 billion, a 9% increase over the same period last year. While exports to China remain stagnant, the recovery of the US market has served as a boost for tra fish export growth. Exports to the US increased by 23% compared to the previous year, while exports to China decreased by 3%.

Previously, the US Department of Agriculture (USDA) announced that they would purchase more seafood, including Pacific cod, also known as true cod, grouper fillets, and catfish products. The department also disclosed that they had paid $6.5 million for 1.5 million pounds of catfish.

Tuna exports by the end of August reached $652 million, a 21% increase over the same period in 2023. The general market trend still exhibits a demand for tuna products from Vietnam. However, exports of tuna are unlikely to maintain their strong growth rate in the coming months due to a shortage of raw materials.

Exports of squid and octopus were the most significantly impacted by the yellow card warning from the EU related to illegal, unreported, and unregulated (IUU) fishing. The issue of obtaining confirmation and certification of catch for these products presented considerable challenges, leaving businesses without sufficient properly documented export supplies. Consequently, as of the end of August, exports of squid and octopus remained 2% lower than the previous year, at $402 million.

Challenges Persist

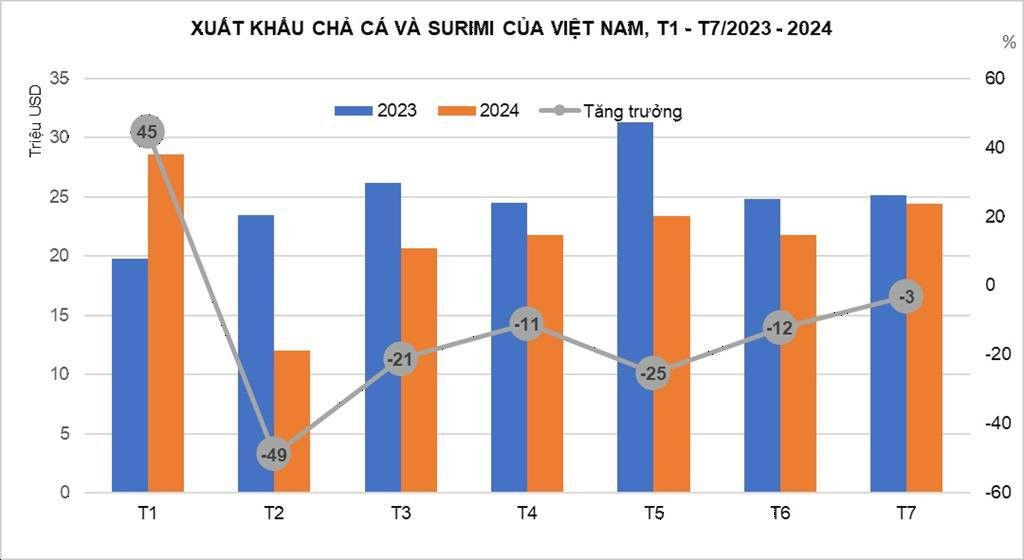

Alongside the positive figures, Vietnam’s seafood exports continue to face various challenges. For instance, exports of fish cakes and surimi from Vietnam in July 2024 continued to decline, reaching just over $24 million, a 3% decrease compared to the same period last year.

According to businesses, exports of fish cakes and surimi are still in a difficult phase due to the EU’s yellow card, which has delayed the process of obtaining confirmation and certification of caught fish for raw material production and export. Businesses face a shortage of domestic raw materials and encounter difficulties in importing raw materials due to regulations related to IUU fishing. All these factors are hindering the recovery of Vietnam’s fish cake and surimi industry.

Source: VASEP

Additionally, the increased volume of Alaskan pollock surimi in the global market, which is already in a weakened state, presents a challenge for surimi businesses. It is possible that within the next few years, Alaskan pollock surimi will capture the market share of tropical fish surimi unless there is a revival in consumer demand.

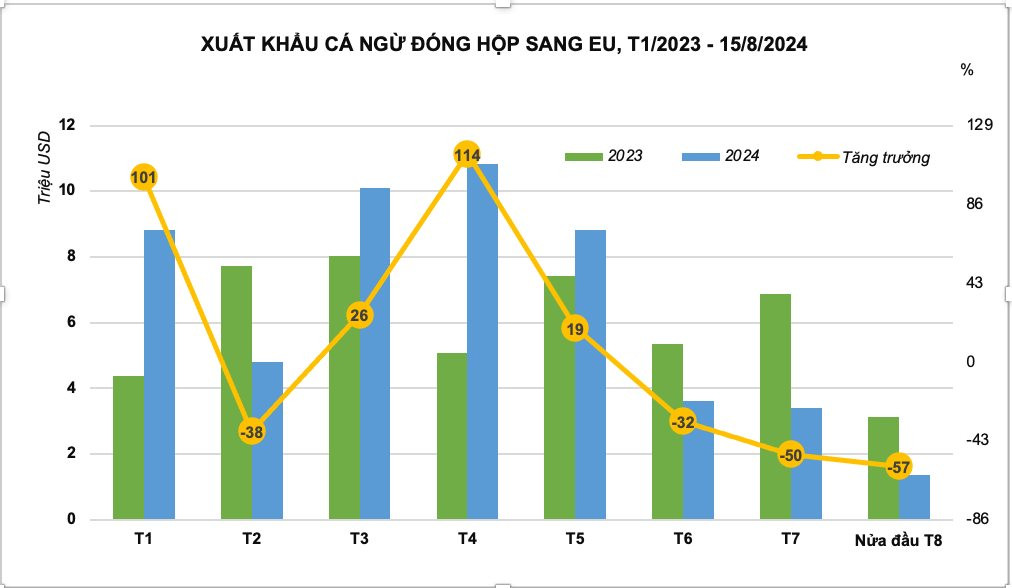

Similarly, canned tuna – the product group that maintained the best growth momentum in the first five months – has been continuously declining and plummeting since June.

According to businesses, in addition to the preferential tariff quotas gradually running out, companies are facing difficulties in sourcing yellowfin tuna with a pure origin (the primary raw material for the canned tuna processing and export industry).

Source: VASEP

Moreover, Decree 37/2024/ND-CP, which took effect on May 19, 2024, stipulates a minimum allowable catch size of 0.5 meters for yellowfin tuna. This regulation has made it challenging for canned tuna processing and exporting companies to procure the necessary raw materials.

As a result, some tuna businesses have halted their domestic yellowfin tuna purchases from fishermen due to non-compliance with the size requirements. Most fishing ports have also stopped issuing confirmation documents (S/C forms) for yellowfin tuna cargoes due to the fish not meeting the size standards set by Decree 37.

Consequently, the reserves of pure raw materials have been depleted, forcing businesses to switch to imported sources. With this alternative supply, canned tuna exports from Vietnam to the EU will be subject to higher taxes and will struggle to compete with products from countries like Ecuador and the Philippines. The industry faces the risk of losing its market share.

VASEP assessed that, overall, seafood exports to various markets have shown positive signs in terms of demand and a gradual recovery in prices.

However, significant challenges, such as the EU’s yellow card, anti-subsidy duties, and anti-dumping duties, continue to constrain growth prospects in the coming months. Therefore, seafood exports for the whole of 2024 are expected to fluctuate around $9.4-9.5 billion, representing a nearly 6% increase compared to 2023.