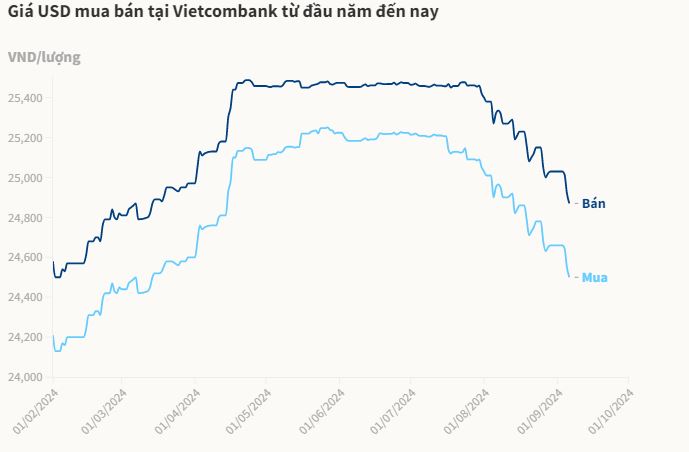

On September 6, the State Bank of Vietnam announced the central exchange rate at 24,202 VND per USD, a decrease of 20 VND from the previous day. With a 5% margin against the central rate, commercial banks are allowed to buy and sell USD within the range of 22,992 – 25,412 VND.

This morning, the US dollar price at commercial banks fell deeply for the second day, with a total adjustment of 150-220 VND per USD in two days.

Vietcombank adjusted its buying and selling prices down to 24,500 – 24,870 VND, 50 VND lower than yesterday.

At other banks in the market, the US dollar price fell even further. BIDV today reduced both buying and selling rates by 115 VND to 24,470 – 24,810 VND. Eximbank decreased its rates by 100 VND to 24,450 – 24,810 VND. At ACB, each USD is now at 24,400 – 24,800 VND, 100 VND lower than yesterday.

The USD price in Vietnam has been on a downward trend since the beginning of August. Compared to the historical peak set over a month ago, the USD bank rate has decreased by more than 2.3%.

Currently, the greenback’s value is back to the mid-March level and is only about 1.5% higher than at the start of the year.

In the unofficial market, foreign exchange points also deeply cut buying and selling prices this morning. In Ho Chi Minh City, the USD price was 100 VND lower than yesterday, at 25,100 – 25,190 VND.

The domestic dollar price cooled down thanks to the movement of the USD Index – a measure of the US dollar’s strength in the international market. This index started to decline from the end of June, and the downward trend became more pronounced from the beginning of August. Currently, the USD Index is around 100.97 points, 3.3% lower than at the beginning of August.

Quỳnh Trang

The Freefall of the USD: A Dramatic Plunge Sees Almost 100 Cents Lost

The US dollar took a tumble on the black market today, plunging by almost 100 units compared to yesterday’s rates. In contrast, the official exchange rate remained relatively stable, showing little change from the previous day’s figures.