Bank deposits are a popular investment choice among Vietnamese due to their safety, stability, and low risk. This method also helps protect and increase the value of capital over time.

As credit growth accelerates three times faster than capital mobilization, banks are raising deposit interest rates to enhance the competitiveness of savings accounts compared to other investment channels in the market.

However, when compared to other investment options, bank deposits are relatively less competitive in terms of interest rates. While investing in gold or real estate at the right time can bring profits of hundreds of millions to billions of VND in a short period, it takes a considerable amount of time to double your money in a bank account with an initial deposit of 1 billion VND.

In reality, deposit interest rates fluctuate, and these variations can impact the amount of interest earned. In a high-interest-rate environment, the time it takes to double your money accelerates, especially when compound interest is applied.

Assuming the current interest rate remains unchanged, how long would it take for a customer to double their initial deposit of 1 billion VND by reinvesting the interest earned annually?

The basic compound interest formula for banks is as follows:

A = P (1 + r) ^ n

Where:

– A is the future value of the investment.

– P is the initial principal amount.

– r is the annual interest rate.

– n is the number of times compound interest is applied.

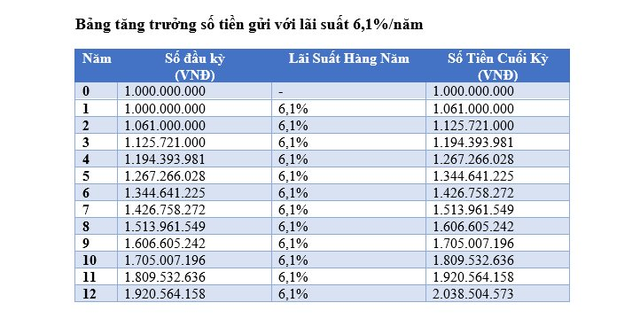

Currently, the highest deposit interest rates offered by banks such as HDBank, Saigonbank, OceanBank, and NCB are 6-6.1% per annum. Assuming this rate remains constant, it would take approximately 12 years to double the initial deposit of 1 billion VND through compound interest.

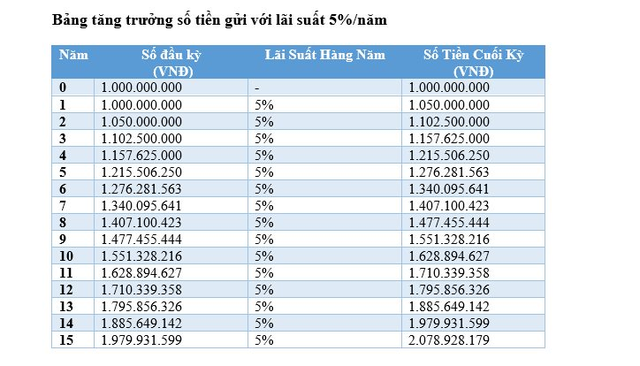

The Big 4 banks, including Agribank, BIDV, VietinBank, and Vietcombank, offer the lowest interest rates in the market, ranging from 4.6%-4.7% per annum, with a maximum of 5% for online savings accounts. Based on these rates, it would take approximately 15 years for customers to earn 1 billion VND in interest.

The Art of Compounding: Maximizing Your Savings with Rising Interest Rates

As we move into September, banks continue to favor the upward trend in savings interest rates, with increments ranging from 0.1% to 0.8%. According to analysts, the deposit rates offered by major commercial banks could witness a slight increase during the final quarter of the year.