CME Solar Investments JSC (CME) and Vista Global under Samsung C&T (a part of the Samsung Group) have reportedly signed a joint venture agreement to accelerate the development of rooftop solar energy in Vietnam.

The joint venture, named CME-Vista, aims to combine expertise, resources, and technology to promote the development of solar energy projects in Vietnam and expedite the adoption of clean energy solutions nationwide.

Samsung C&T Corporation, established in 1938, is a global conglomerate with four business groups: Engineering & Construction, Trading & Investment, Fashion, and Resorts. Globally, the company is a renowned name in the construction industry, with notable projects including the Burj Khalifa (Dubai), Petronas Twin Towers (Kuala Lumpur), and the Incheon Grand Bridge (Incheon). In the field of renewable energy, the company has also developed and constructed over 5,000 MWp globally.

Samsung, a South Korean multinational conglomerate, has been operating in Vietnam since March 2008. With an initial investment of $670 million, Samsung has expanded its presence in the country, and its total investment now stands at approximately $20 billion. The company has expressed its ambition to develop rooftop solar energy in Ho Chi Minh City, aiming for a net-zero emission industrial park.

Samsung’s expansion into renewable energy is understandable, given the market’s potential and government support. As a tropical country, Vietnam has significant opportunities for solar power, according to experts.

As of the end of 2023, the total solar power capacity in Vietnam was approximately 16,600 MW, with over 9,000 MW coming from rooftop solar installations, contributing about 20.5% to the country’s total electricity mix. The Power Development Plan 8 sets a target to increase the total solar power capacity by an additional 4,100 MW by 2030, with a long-term orientation to reach 168,594 – 189,294 MW by 2050, producing 252.1- 291.5 billion kWh. By 2050, solar power is expected to become the largest electricity source in Vietnam, contributing over 38.5% of the total power capacity.

Moreover, the Vietnamese government has shown its commitment to promoting rooftop solar energy with the issuance of Conclusion No. 387/TB-VPCP by the Office of the Government. This conclusion emphasizes the need to develop and issue a decree on mechanisms and policies to encourage the development of rooftop solar power for self-consumption.

As per the conclusion, the Ministry of Industry and Trade and the Vietnam Electricity (EVN) are tasked with studying and proposing an increase in the capacity of rooftop solar power. Currently, the northern region of Vietnam utilizes only about 2.5% of its capacity, while the transmission system can safely accommodate up to 25-30%. Therefore, there is a need to adjust the scale of capacity in the north, which could reach up to 7,000 MW, and recalculate the mobilization capacity for Ho Chi Minh City.

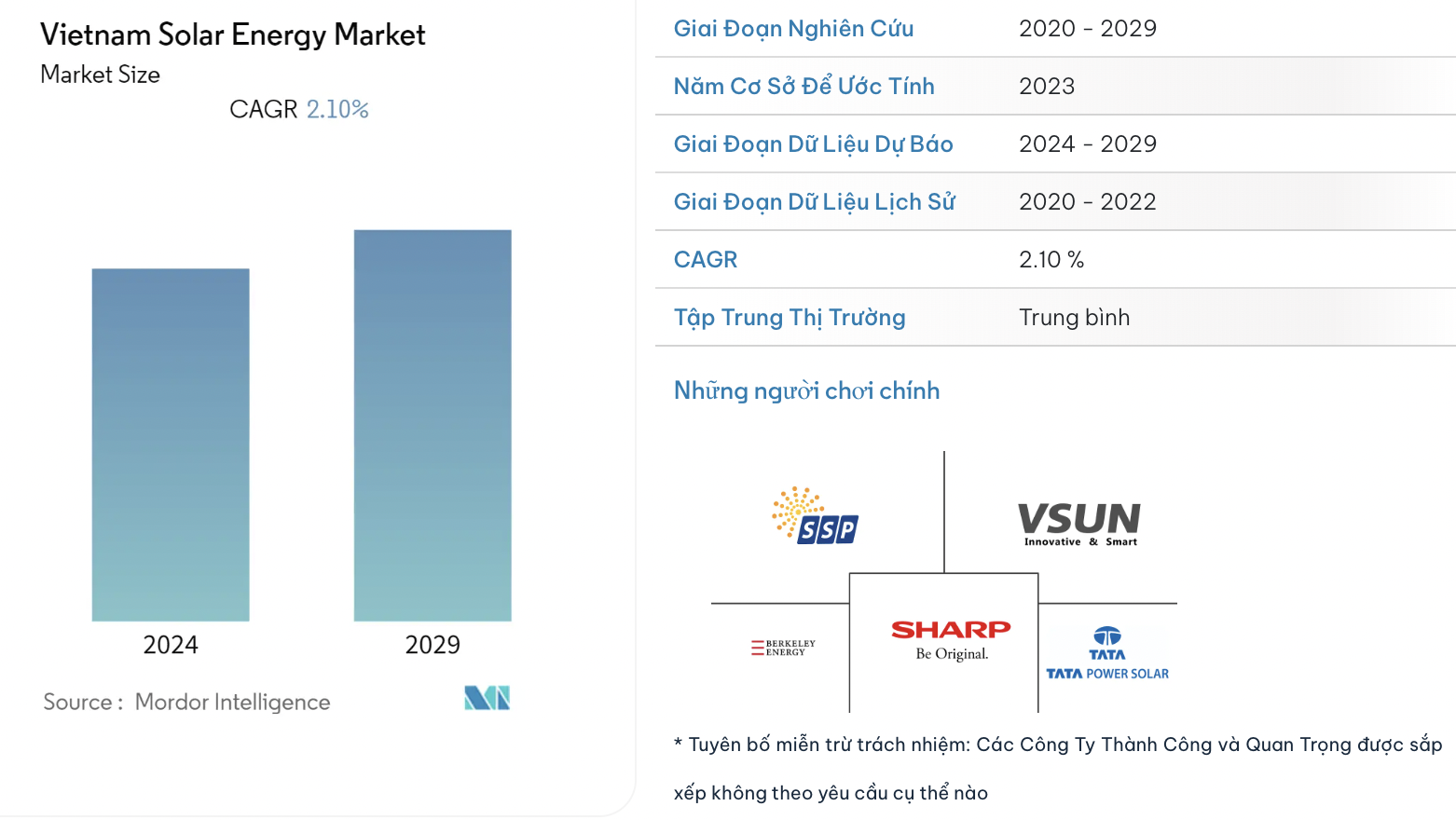

The Vietnamese solar market is highly competitive, with the presence of prominent domestic and foreign investors such as Trung Nam Group, TTVN Group, TTC Group, BIM Group, Vietracimex, SkyX Solar, and Trina Solar, among others.

According to a 2023 report by Mordor Intelligence, Vietnam’s solar energy market is estimated to reach 18.4 GigaWatt (GW) by the end of 2024 and is projected to reach 20.4 GigaWatt (GW) in the next five years, growing at a CAGR of over 2.1% during the forecast period. In the medium term, increased investment in renewable energy, rising electricity demand in major provinces, and the country’s shift from fossil fuel-based power generation are expected to drive the market.

However, the high initial investment costs of solar energy projects and the increasing adoption of alternative clean energy sources may hinder market growth during the forecast period. Nonetheless, Vietnam’s Power Development Plan 8 aims to increase the proportion of renewable energy to 10% over the next eight years, reducing reliance on imported coal-fired power and creating significant opportunities for the solar energy market.

The Billionaire’s Venture: A Revolutionary Business Model – Franchise Charging Stations with a Fixed Revenue Share of VND 750 per kWh of Electricity.

Global Charging Station Development JSC V-Green has announced the launch of a franchised charging station model in Vietnam, becoming the first company to implement this business model in the country.