|

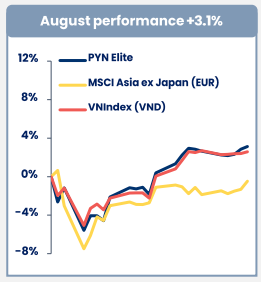

PYN Elite’s Performance vs. VN-Index

Source: PYN Elite Fund

|

According to PYN Elite, the investment fund’s performance reached 3.1% in August, outperforming the VN-Index’s 2.6% return. This positive result was driven by the outstanding performance of banking sector stocks and DBC, which increased by 10.9%. In contrast, ACV was the most disappointing stock in the fund’s portfolio, with a negative investment performance of -5.1%.

|

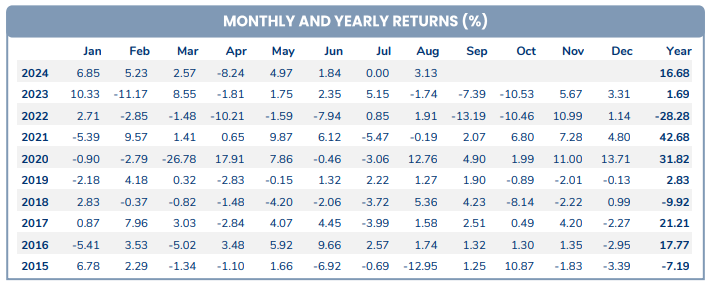

PYN Elite’s Investment Performance from 2015 to 2024

Source: PYN Elite Fund

|

With this month’s gains, PYN Elite’s investment performance in the Vietnamese market has improved to 16.68% year-to-date, up from 13.14% at the end of July.

Turning to macroeconomic news, on September 2nd, the Prime Minister set a target of approximately 7% GDP growth for 2024.

Additionally, the draft amendment related to allowing foreign institutional investors to purchase securities without pre-funding (Non Pre-funding Solution – NPS) is nearing approval. Securities companies are fine-tuning their operations and surveying priority funding limits for customers. The implementation of NPS will pave the way for Vietnam’s upgrade to the FTSE Emerging Market status, expected in September 2025.

“With the US labor market cooling and the Fed signaling interest rate cuts, the USD weakened by 4.1% in August. This eased pressure on most Asian currencies, leading to an average recovery of 3.5% against the USD for Asian currencies.

The Vietnamese Dong appreciated modestly by 1.5% against the USD due to the Vietnamese Dong’s previous strength (VND had depreciated less than 4.8% against the USD – the lowest compared to the average of 7.2% that other Asian currencies had depreciated against the USD) and the potential for the State Bank of Vietnam (SBV) to improve foreign reserves. We expect the Vietnamese Dong to strengthen further as the Fed begins cutting interest rates,” PYN Elite stated.

Double Delight as Exchange Rates Cool Off

The Vietnamese currency market has witnessed a positive trend recently, with the VND/USD exchange rate cooling off. The USD has dropped below the 25,000 VND mark. On August 29, 2024, the State Bank of Vietnam (SBV) set the daily reference exchange rate at 24,221 VND per USD, an increase of 9 VND from the previous session, but a decrease of 29 VND from the previous week. The SBV’s trading arm maintained the buying rate for USD at 23,400 VND while increasing the selling rate to 25,382 VND per USD.

The Tumbling Tower of USD on the Free Market

The US dollar (USD) witnessed a significant drop on the black market today, with each dollar falling by up to 100 VND in selling prices. Meanwhile, after two consecutive sessions of decline, USD rates at various banks climbed upwards.

The Dollar’s Downfall: A Business Relief

The US dollar is witnessing a significant drop across both the bank and free markets. Experts predict that this downward trend will persist through the end of the year, bringing much-needed financial relief to businesses. This favorable exchange rate development will ease financial pressures on businesses and boost their competitiveness in seeking new orders.