Ho Chi Minh City Stock Exchange (HoSE) has recently added CMX, the code of Camimex Group Joint Stock Company, to the list of securities ineligible for margin trading. This decision was made due to the company’s negative undistributed post-tax profit on the reviewed consolidated financial statements for the first half of 2024.

Camimex is one of the largest shrimp processors and exporters in Vietnam. Notably, the company is one of the few large-scale organic shrimp producers in the world and the only Vietnamese enterprise that currently meets the organic standards of Naturland, EU Organic, and BIO SUISSE across its entire supply chain, from breeding to dining.

However, the company’s business performance in the first half of the year was not very optimistic. Despite a doubling of revenue to VND 1,482 billion compared to the same period last year, a significant increase in expenses caused a 46% drop in post-tax profit to VND 26 billion, with a net profit of VND 19 billion. As a result, they have only achieved 25% of their annual profit target. As of June 30, 2024, the company had an undistributed post-tax loss of VND 111 billion.

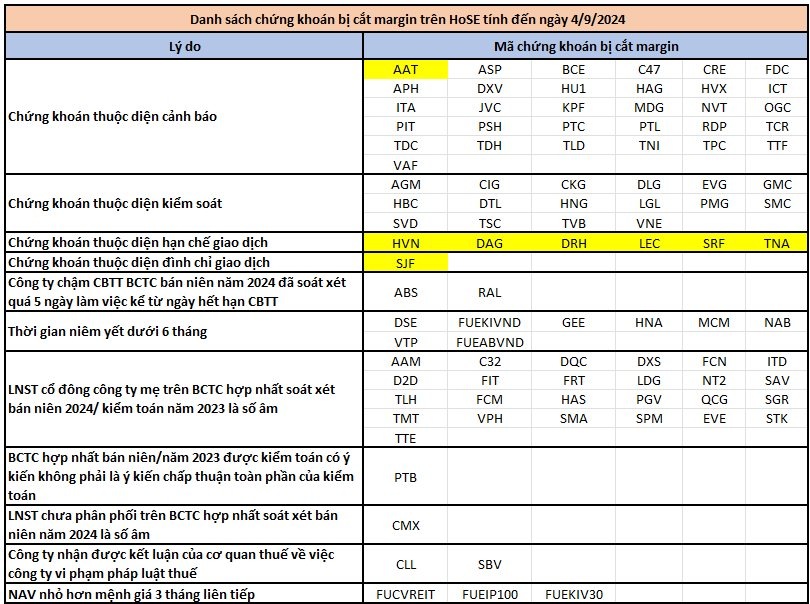

As of September 4, 2024, the number of securities delisted from margin trading on HoSE has increased to 96. The reasons for the delisting include securities under warning/control/restricted trading; negative post-tax profit/net profit, audited financial statements with opinions from the auditing organization; less than 6 months of listing… Popular stocks like FRT, HNG, QCG, HBC, HAG, HVN, LDG, TDH, and more remain on this list.