FiinGroup and FiinRatings recently released a report titled “Income of CEOs and Board of Directors in Public Companies in Vietnam in 2023,” analyzing data from a survey of 200 public companies on the Vietnamese stock market.

CEO is the Highest-Paid Position

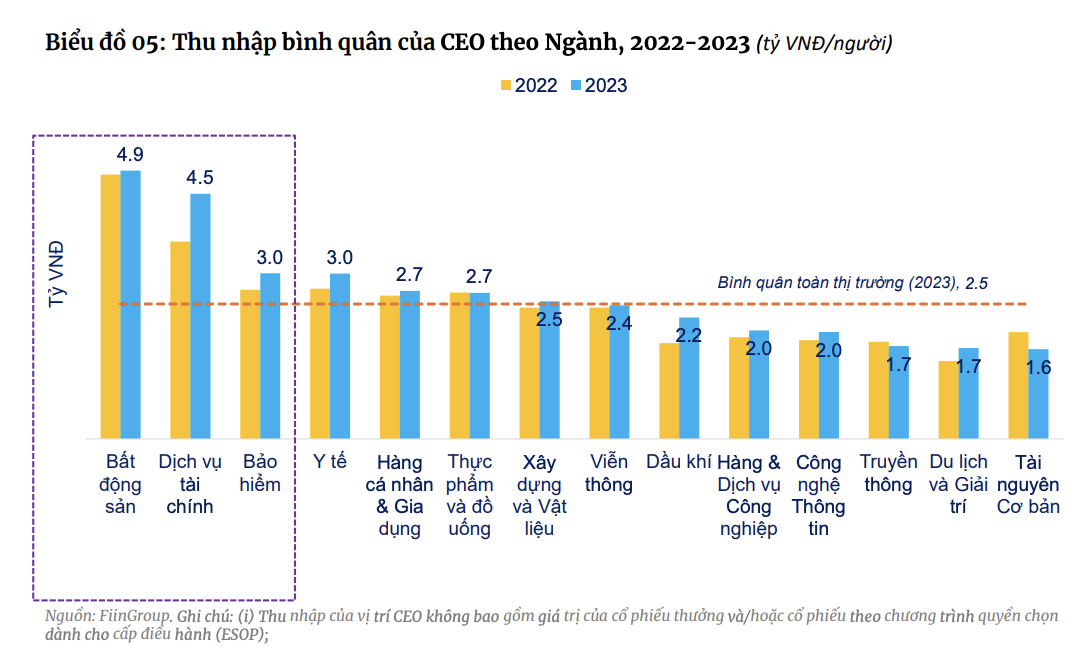

According to the survey, the average income (excluding ESOP) of CEOs in Vietnamese public companies is below VND 2.5 billion per year in 2023. This is the highest-paid position among the surveyed businesses.

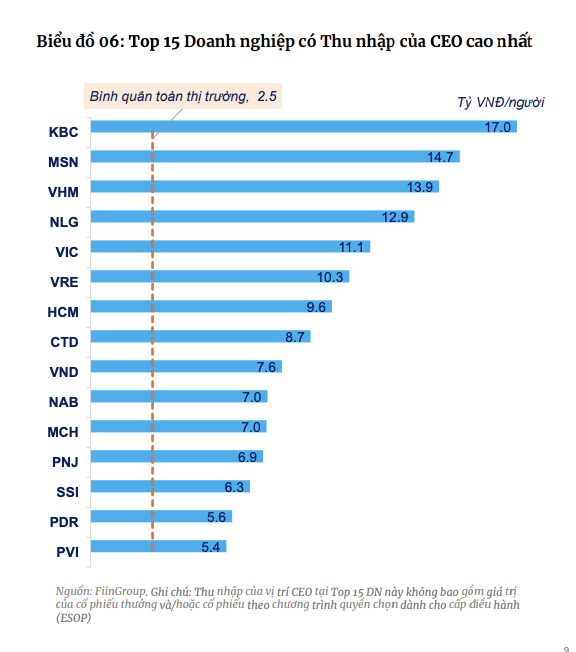

Real estate, financial services (mainly securities companies), and insurance are the industries with the highest average income for CEOs. Some companies in the top 15 highest-paying enterprises include KBC, MSB, VHM, NLG, VIC, VRE, HCM, CTD, VND, NAB, MCH, PNJ, SSI, PDR, and PVI.

Among them, the CEO of KBC receives the highest remuneration in the market, earning over VND 17 billion per year, nearly seven times the market average. Other top-paying companies for foreign CEOs include Masan (MSN) and Nam Long Real Estate (NLG).

The FiinGroup report also reveals that the income of CEOs in state-owned enterprises is less than 50% of that in private enterprises, even though their operating efficiency, as indicated by the return on equity (ROE), is quite similar.

Banking Chairpersons’ Incomes Stand Out

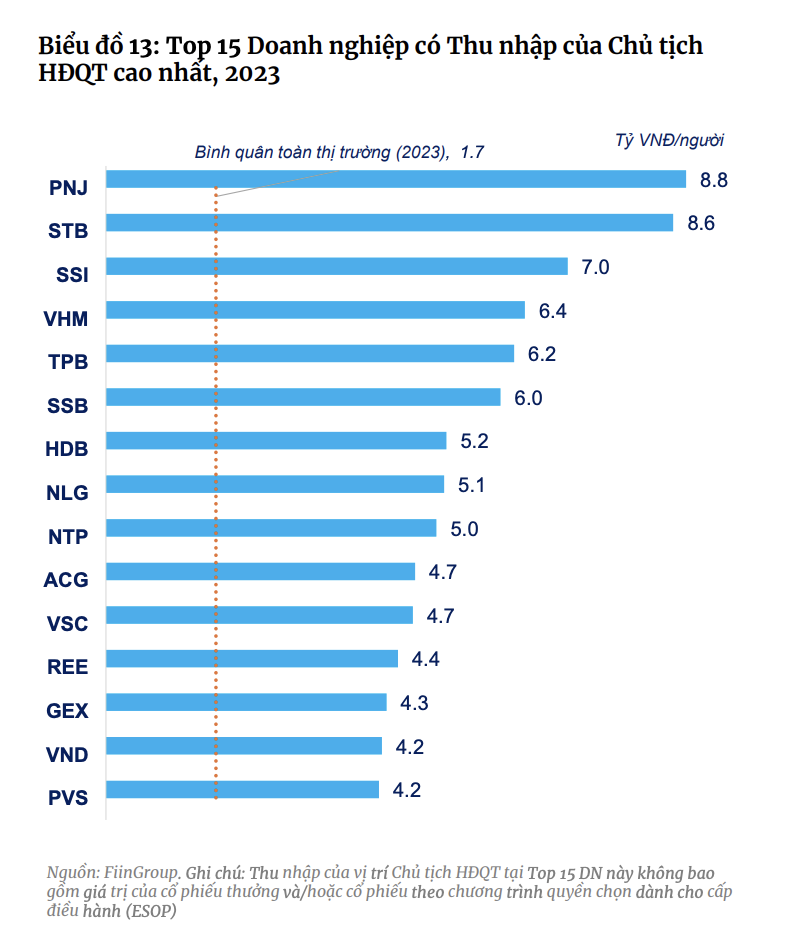

For the position of Chairperson of the Board of Directors, the average income for 2023 is VND 1.7 billion per person. Banking and financial services, mainly securities companies, have the highest average income for chairpersons due to the involvement of these leaders in the management of these institutions. The correlation between income and operating efficiency becomes more apparent when considering market capitalization.

The 15 companies with the highest salaries for chairpersons include PNJ, STB, SSI, VHM, TPB, SSB, HDB, NLG, NTP, ACG, VSC, REE, GEX, VND, and PVS.

The Chairperson of PNJ has the highest income at VND 8.8 billion per year, more than five times the market average. Following closely, the Chairperson of STB, Mr. Duong Cong Minh, earns VND 8.6 billion, leading among chairpersons of banks in Vietnam.

Moreover, there is a significant income disparity between industries for independent board members, with the highest incomes in the personal goods and banking sectors. However, the average income still remains symbolic in many enterprises. Considering market capitalization, the average income of independent board members improved significantly in the small-cap group in 2023 and slightly decreased in the mid-cap group.