The Ho Chi Minh City Stock Exchange (HOSE) announces a supplementary list of CMX securities that are ineligible for margin trading.

Accordingly, HOSE has just added the code CMX of Camimex Group Joint Stock Company to the list of ineligible margin trading securities. The reason is that the undistributed post-tax profit on the reviewed semi-annual consolidated financial statements for 2024 is negative.

Camimex Group, headquartered at 999 Ly Thuong Kiet, Ward 6, Ca Mau City, Ca Mau Province, Vietnam, was established in 1977 and operates in the field of seafood processing, preservation, and seafood products.

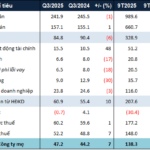

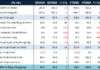

For the first six months of 2024, CMX’s net revenue reached VND 1,482 billion, doubling that of the same period last year (VND 744 billion). However, expenses increased significantly from VND 54.6 billion to over VND 71 billion, causing profit after tax to decrease by 46%, from VND 48 billion to VND 26 billion. The after-tax profit of the parent company reached over VND 19 billion.

As of June 30, 2024, the undistributed loss after tax was VND 111 billion, while the company recorded VND 115.8 billion at the beginning of the year.

Thus, as of September 4, 2024, the list of securities subject to margin cuts on HoSE has increased to 96 codes. The reasons for the margin cuts by HOSE include securities subject to warning/control/restricted trading; negative post-tax profit/net profit, audited financial statements with auditors’ opinions; listing time of less than six months, etc.

As of September 4, a series of “hot” stocks such as FRT, HNG, QCG, HBC, HAG, HVN, LDG, TDH, etc., continue to be on the list of margin cuts on HOSE.

The Penultimate Proposal: Unveiling the Ministry of Finance’s New Suggestions for Service Pricing in the Securities Sector

The Ministry of Finance is seeking feedback on the draft circular guiding service prices in the securities sector applied at the Vietnam Stock Exchange and its subsidiaries, and the Vietnam Securities Depository and Clearing Corporation.