The recent issuance value was nearly VND 111 billion at par value, and TMS will utilize profits from audited consolidated financial statements for the year 2023. If the plan is executed as intended, TMS will increase its charter capital to over VND 1,693 billion.

Previously, on August 08, TMS paid cash dividends totaling over VND 79 billion to its shareholders, equivalent to a 5% ratio, sourced from post-tax profits up to December 31, 2023. This was also part of the 2023 dividend plan approved at the 2024 Annual General Meeting of Shareholders back in April 2024.

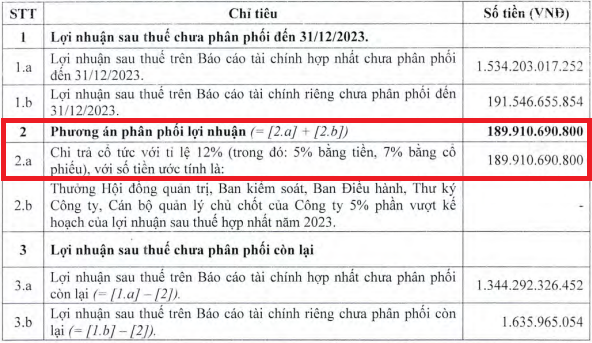

Specifically, the meeting approved the 2023 profit distribution plan, which included a 12% dividend payout ratio, with 5% in cash and 7% in stocks. At that time, the calculation of the dividend ratio was based on the post-tax profits on the separate financial statements up to December 31, 2023, as shared by the TMS leadership.

|

2023 Profit Distribution Plan of TMS

Source: 2024 Annual General Meeting Resolution of TMS

|

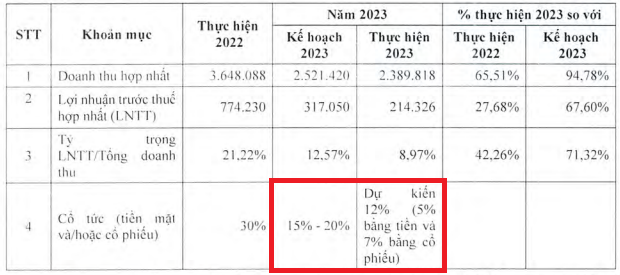

This plan sparked controversies at the meeting as it fell short of the 15-20% ratio approved at the previous year’s gathering. Facing questions from shareholders, CFO Le Van Hung explained that with VND 191 billion in post-tax profits on the separate financial statements, the maximum dividend payout ratio was 12%.

Chairman Bui Tuan Ngoc also stated that while they aspired to pay out 15-20%, the Company fell short of its 2023 business plan, missing the target by a significant margin that couldn’t even cover the additional 3% dividend. Moreover, they were constrained by regulations and couldn’t distribute dividends beyond their capabilities. In 2023, TMS underwent a stock issuance that led to dilution, and they lacked the financial resources to meet the initial dividend plan.

|

2023 Dividend Payout Ratio of TMS Falls Short of Initial Plan

Unit: Million VND

Source: 2024 Annual General Meeting Resolution of TMS

|

In reality, TMS endured a challenging 2023, with net revenue of nearly VND 2,390 billion and pre-tax profits of over VND 214 billion. These figures represent 95% and 68%, respectively, of their full-year 2023 targets and reflect a 34% and 72% decrease compared to their 2022 performance. After accounting for taxes and the interests of non-controlling shareholders, TMS posted a net profit of nearly VND 137 billion, a 79% decline.

The situation showed signs of improvement in the first half of 2024, as TMS recorded net revenue of nearly VND 1,512 billion and pre-tax profits of over VND 94 billion. These figures mark a 53% and 5% increase, respectively, compared to the first half of 2023. Ultimately, the Company’s net profit reached nearly VND 76 billion, a 4% increase.

With these results, TMS has crossed the halfway point toward achieving its 2024 net revenue target of over VND 2,895 billion. However, they still have a way to go to meet the pre-tax profit goal of nearly VND 419 billion.

| TMS’s Business Results in the First Half of 2024 Show Signs of Recovery |

TMS Shareholders’ Meeting: What’s the Basis for the Target of Doubling Pre-tax Profit?