In its latest announcement, Vinhomes Joint Stock Company (stock code VHM) has published the results of a shareholder vote regarding a transaction to repurchase up to 370 million VHM shares, equivalent to 8.5% of the circulating shares.

According to the vote count, a total of 58,083 votes were cast, representing 4.35 billion circulating shares (accounting for 100% of the voting shares). 301 ballots were returned, of which 300 were valid, representing 3.42 billion shares (78.52% of the voting shares).

The approval ratio was 99.91% of the total valid votes cast, corresponding to 78.44% of all voting shares in favor. The resolution to repurchase shares has been officially passed.

Vinhomes will proceed with the share repurchase as soon as the SSC approves their registration dossier. The repurchase will be executed through matching or agreement orders via securities companies, in compliance with legal regulations. Following the transaction, Vinhomes’ charter capital will decrease by VND 3,700 billion, from VND 43,543 billion to VND 39,843 billion.

According to Mirae Asset, Vinhomes’ share repurchase process is expected to commence in mid-September 2024. In a recent discussion with the Investor Relations (IR) team, Vinhomes affirmed that the repurchase plan will be funded by available cash and operating cash flow from the sale of certain projects. As such, Vinhomes stated that the share buyback would only have a limited impact on the company’s liquidity and debt ratios.

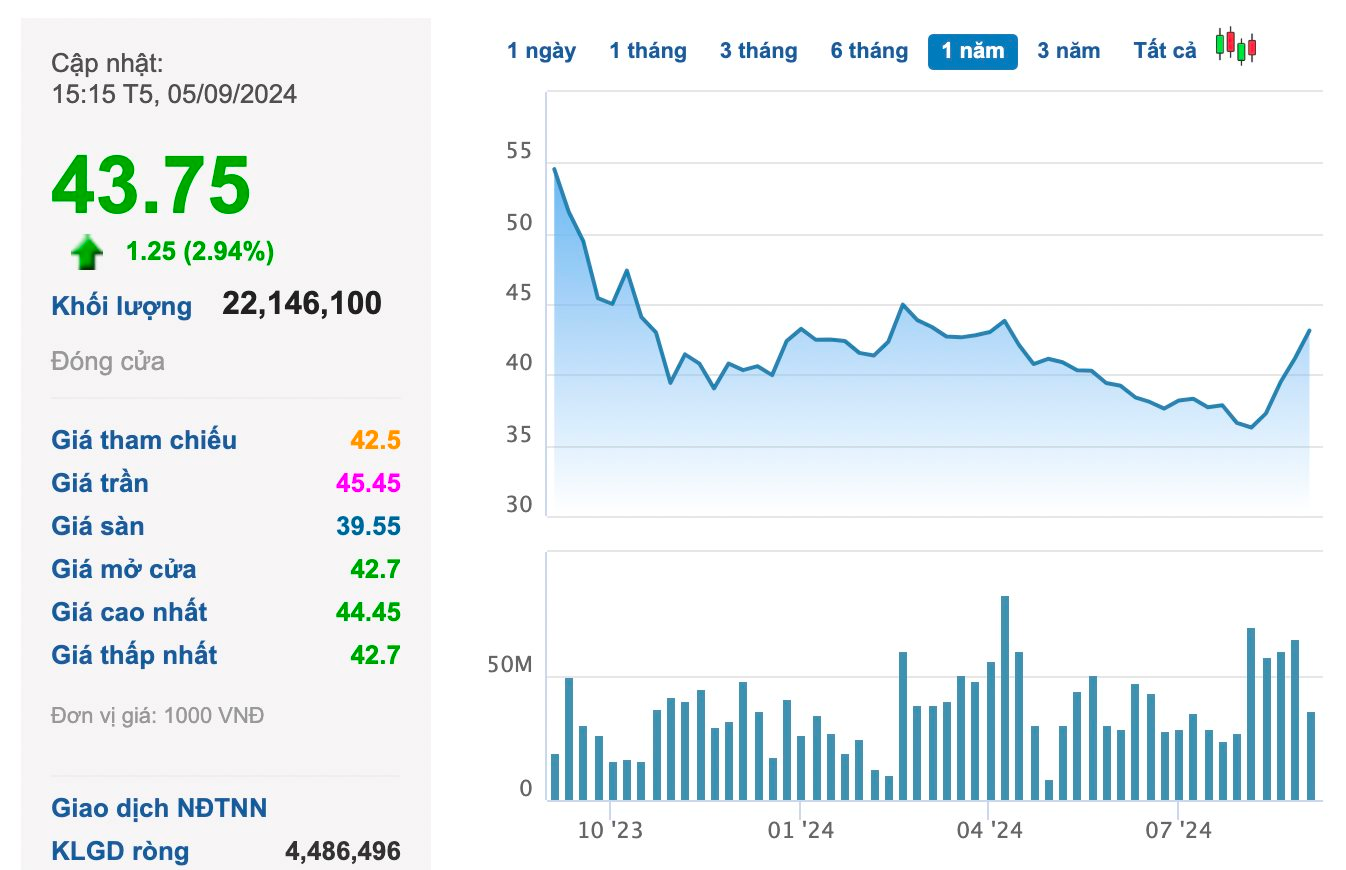

In the market, since the announcement of the share repurchase plan, VHM shares have reacted positively, surging over 20% to VND 43,750 per share, the highest in nearly five months. Market capitalization also surpassed VND 190,500 billion, an increase of more than VND 40,000 billion in the past month.

In parallel, Vinhomes shareholders also approved amendments and supplements to the company’s primary business lines, including the trading, installation, and design consulting of fire protection equipment and materials.

Regarding Q2 financial results, Vinhomes recorded revenue of over VND 28,200 billion and after-tax profit of VND 10,600 billion, a decrease of 13.5% and an increase of 10%, respectively, compared to the same period in 2023. For the first six months, Vinhomes posted net revenue of VND 36,429 billion and after-tax profit of VND 11,513 billion, mainly attributable to the recognition of bulk sales at Vinhomes Royal Island and ongoing deliveries at existing projects.

The Average Annual Income of Real Estate CEOs Reaches 4.9 Billion VND, Topping 14 Industry Sectors: KBC CEO Leads the Pack with a 17-Billion-VND Payday in 2023

A recent survey by FiinGroup of 200 public companies revealed that CEOs in the real estate industry earned an average of 4.9 billion VND per year, topping the list of 14 sectors. The highest-paid CEO in this industry was Ms. Nguyen Thi Thu Huong of KBC, who took home a impressive 17 billion VND in 2023.