| Financial Performance of FID in the First Half of 2015 – 2024: A Review |

According to FID, the decline in revenue by 66% year-on-year to VND 14 billion, resulting in a net loss of VND 2.5 billion, was due to ongoing business operations and delays in goods delivery.

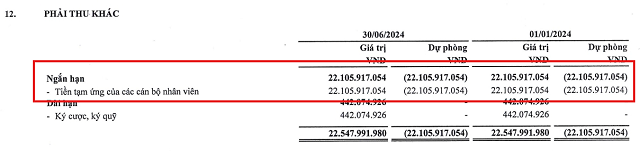

In addition to the disappointing financial results, FID also received a qualification from its auditor, UHY, regarding a VND 22 billion advance to an individual by its subsidiary, Vietnam Industrial Steel Joint Stock Company (FID holds 76.82% stake), which they were unable to fully audit due to insufficient evidence of its existence, value, and future economic benefits.

“As a result, we were unable to determine the necessary provision and the existence of this advance, as well as their impact on the consolidated financial statements,” UHY stated in their report.

FID explained that the subsidiary made the advance to an individual for company-related tasks, and as of June 30, 2024, the individual has not provided complete documentation, hence the lack of basis for processing the advance.

Source: FID

|

Furthermore, the auditor expressed an opinion on the lack of documentation for a loan from the Vietnam Bank for Investment and Development (BIDV) – Dong Do Branch, which has been overdue for over three years and is recorded on the subsidiary’s financial statements at VND 28 billion. Similarly, the subsidiary has a loan from the Vietnam Bank for Agriculture and Rural Development (Agribank) – Head Office Branch, with accumulated interest of approximately VND 16.8 billion as of the end of June 2024, for which interest recognition has also been suspended.

According to UHY, proper recognition of these amounts would reduce the retained earnings on the subsidiary’s balance sheet and subsequently affect FID‘s corresponding figures.

FID stated that the subsidiary has not yet reached an agreement with the banks on the method for calculating interest expenses, hence the qualification.

“Vietnam Airlines Reports Impressive Turnaround: H1 2024 Gross Profit Soars to 6.704 Trillion VND, a 2.2X Surge Year-over-Year”

Vietnam Airlines (Vietnam Airlines, code: HVN) has released its reviewed consolidated financial statements for the first six months of 2024, reporting impressive figures with a revenue of VND 52,562 billion, a nearly 20% increase compared to the same period last year. After deducting the cost of goods sold, the gross profit stood at VND 6,704 billion, more than double that of the previous year.

The Profitability Race: A Tale of Two Hospitals Unveiled

While TNH Hospital boasts growing profits, it struggles with capital to expand its branches. In contrast, Tim Tam Duc Heart Hospital, despite its seemingly modest profits, has consistently rewarded its shareholders with dividends.

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”

The Uncertain Future: A Series on Businesses Under Audit Scrutiny

Many newly-listed companies have released their reviewed semi-annual financial statements for 2024. However, auditors have raised concerns about their ability to continue operating as going concerns.