In a recent announcement by CSM, the dividend payout ratio for the upcoming dividend has been set at 3%, equivalent to VND 300 per share. With over 103.6 million shares in circulation, CSM is estimated to pay out more than VND 31 billion, with a projected payment date of September 27.

This dividend payout is in line with the plan approved at the 2024 Annual General Meeting of Shareholders and remains consistent with the ratios implemented in recent years.

Within CSM’s ownership structure, the Vietnam Chemical Group (Vinachem) stands as the largest shareholder and parent company, directly holding 51% of the shares. This equates to potential revenue of nearly VND 16 billion for Vinachem.

|

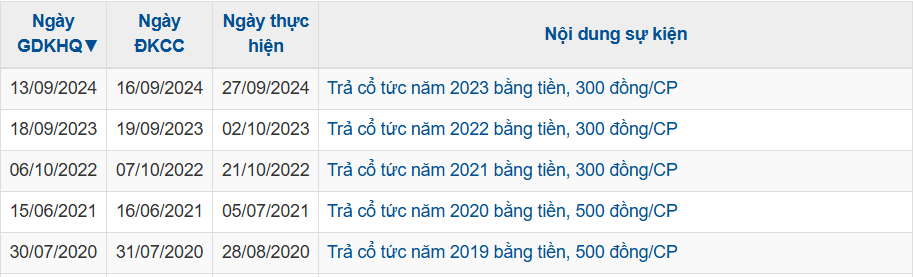

CSM’s Dividend Payout History in Recent Years

Source: VietstockFinance

|

For the first half of 2024, CSM recorded a revenue of VND 2.4 trillion, a 7% decrease compared to the same period last year. However, a nearly 14% reduction in cost of goods sold contributed to a gross profit of VND 347 billion, marking a 70% increase. This is the highest gross profit the tire manufacturing company has achieved since 2015, with a gross profit margin of 14.3%, almost double the 7.8% from the previous year.

The company’s revenue continues to be predominantly driven by export and domestic products, accounting for 95% of total revenue. Export products generated over VND 1 trillion, a 15% increase, while domestic products yielded more than VND 1.3 trillion, a 7% rise. On the other hand, revenue from ancillary materials sales dropped significantly by 72%, reaching only VND 148 billion.

According to CSM, the decrease in revenue is attributed to declines in both ancillary materials sales and revenue from the sale of semi-finished rubber products to Camso. However, the deeper retreat in cost of goods sold can be partly explained by the company’s successful cost-cutting measures in production.

Compared to the same period in 2023, CSM benefited from favorable exchange rate differences, resulting in a doubling of financial activity revenue to VND 43 billion. Additionally, a 33% decrease in bank interest expenses provided further financial respite.

CSM also witnessed a notable 241% surge in other income, recording VND 12.3 billion. Aside from VND 3.7 billion in scrap sales revenue, the company also accounted for an additional VND 8.3 billion adjustment as per the State Audit Office’s audit report for the 2022 financial statements.

However, both selling expenses and general and administrative expenses witnessed sharp increases of 94% and 198%, respectively, climbing to VND 139 billion and VND 155 billion. Notably, management personnel expenses exceeded VND 98 billion, a more than threefold increase.

The tire manufacturer attributed the rise in selling expenses to the implementation of sales policies aimed at boosting product distribution and providing appropriate policies for distributors. Additionally, higher export shipping rates also contributed to this increase. Regarding the surge in general and administrative expenses, CSM explained that the company had implemented policies for its employees.

Consequently, CSM’s net profit doubled to VND 41 billion, the highest since 2017, but still short of the peak net profit of VND 169 billion achieved in the first half of 2014. For the full year 2024, the company targets a revenue of over VND 5 trillion and a pre-tax profit of VND 80 billion. As of the halfway point, CSM has achieved 51% and 63% of these targets, respectively.

| CSM’s Half-Yearly Net Profit is the Highest Since 2017 |