The General Statistics Office has just released data indicating that the consumer price index (CPI) for August 2024 remained stable compared to the previous month. This stability can be attributed to the fluctuating prices of goods and consumer services in August, with increases in the prices of food and rental housing, and a decrease in domestic fuel prices following the global trend.

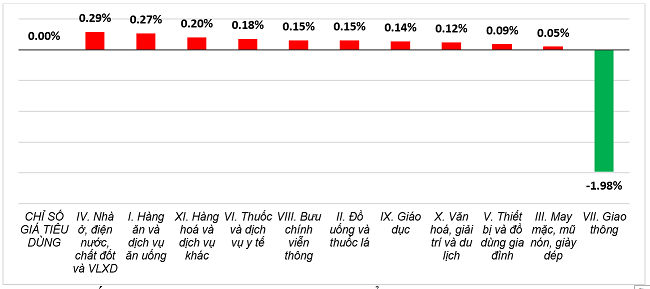

Compared to December 2023, CPI in August 2024 rose by 1.89%, and by 3.45% compared to the same period last year. Out of the 11 main groups of consumer goods and services, 10 groups experienced a slight increase in prices, while the transportation group saw a decrease compared to the previous month.

Among the 10 groups with price increases, the housing, electricity, water, fuel, and construction materials group witnessed the highest increase of 0.29%. This was mainly due to the rising demand for rental housing in some localities as the new school year approached, leading to a 0.45% increase in rental prices. Additionally, gas prices rose by 0.67% as of August 1, 2024, in line with global price adjustments.

Following this, the food and catering services group increased by 0.27%, contributing to a 0.09 percentage point rise in the overall CPI. Specifically, cereals rose by 0.19%, food by 0.28% (adding 0.06 percentage points to the overall CPI), and dining out by 0.26%.

The group of other goods and services saw a 0.2% increase, including a 1.91% rise in administrative and legal service fees, an 1.89% increase in jewelry prices, a 0.52% rise in environmental sanitation services, and a 0.28% increase in watch and jewelry repair services.

The health and medical services group witnessed a 0.18% increase, with inpatient treatment fees rising by 0.29% and outpatient treatment services by 0.11%. This can be attributed to the continued implementation of new healthcare service prices in some localities during August 2024, in accordance with Circular No. 22/2023/TT-BYT dated November 17, 2023, issued by the Ministry of Health, which unifies health insurance-covered treatment prices between hospitals of the same level nationwide and provides guidance on price application and payment for treatment expenses in certain cases.

Additionally, other groups such as postal and telecommunication services rose by 0.15%, beverages and tobacco by 0.15%, culture, entertainment, and tourism by 0.12%, and household appliances and utensils by 0.09% due to increased labor costs…

Notably, with the new school year approaching, the education group experienced a 0.14% increase. Writing instrument prices rose by 0.5%, paper products by 0.45%, and other stationery by 0.2%. Furthermore, education service fees increased by 0.13% as some public universities, private high schools, and kindergartens in certain provinces raised their tuition fees for the 2024-2025 academic year.

On average, for the first eight months of 2024, core inflation rose by 2.71% compared to the same period in 2023, lower than the average CPI increase of 4.04%. This was mainly due to the impact of rising prices of food, electricity, education, healthcare, and fuel, which are excluded from the core inflation calculation.

According to the report by the General Statistics Office, domestic gold prices moved in tandem with global gold prices. As of August 27, 2024, the global average gold price stood at 2,495.53 USD/ounce, a 3.63% increase compared to July 2024. Global gold prices rose as investors anticipated a potential interest rate cut by the US Federal Reserve in September, coupled with geopolitical conflicts and demand from central banks, which boosted gold purchases as a safe-haven asset.

In the domestic market, the gold price index for August 2024 increased by 1.93% compared to the previous month, 20.4% compared to December 2023, and 31.05% compared to the same period last year. On average, for the first eight months of 2024, the gold price index rose by 25.54%.

As of August 27, 2024, the US dollar index in the international market reached 102.38 points, a decrease of 1.97% compared to the previous month.

In Vietnam, the average free-market exchange rate was around 25,329 VND/USD. The US dollar price index for August 2024 decreased by 0.64% compared to the previous month, increased by 3.55% compared to December 2023, and rose by 5.86% compared to the same period last year. On average, for the first eight months of 2024, the US dollar price index increased by 5.85%.

The Central Bank Will Continue to Lower Lending Rates

The State Bank is implementing a range of solutions to boost credit growth, with a key focus on reducing lending rates.

The Power of the Vietnamese Dong: A Central Bank Perspective

From early 2024 onwards, in the face of international market pressures and domestic challenges, the State Bank of Vietnam has implemented a range of measures to support the Vietnamese Dong (VND).