After 28 years of establishment and development, VIB is now a top-performing bank with a strong focus on retail and profitability.

The program runs from now until 09/10/2024.

Win iPhone 15 Pro Max and GA tickets to Anh Trai “Say Hi” Concert 2024 for MyVIB users

From now until 09/10, all valid transactions on the MyVIB digital banking app will earn points that can be redeemed for exciting gifts. The top 10 customers with the highest accumulated points will receive 2 iPhone 15 Pro Max and 8 Apple AirPods Pro.

Additionally, 40 GA tickets to the highly anticipated Anh Trai “Say Hi” Concert 2024, along with 08 exclusive jackets and 280 hats, will be given to 328 customers with the highest weekly points from now until 16/09. This is VIB’s special way of ensuring MyVIB users get to enjoy this much-awaited event.

Furthermore, 2,800 customers who reach the 28-point milestone earliest each week will receive e-vouchers for PNJ, Canifa, and Hoayeuthuong.

VIB executes a consistent strategy with a customer-centric approach during its digitization and digital transformation journey.

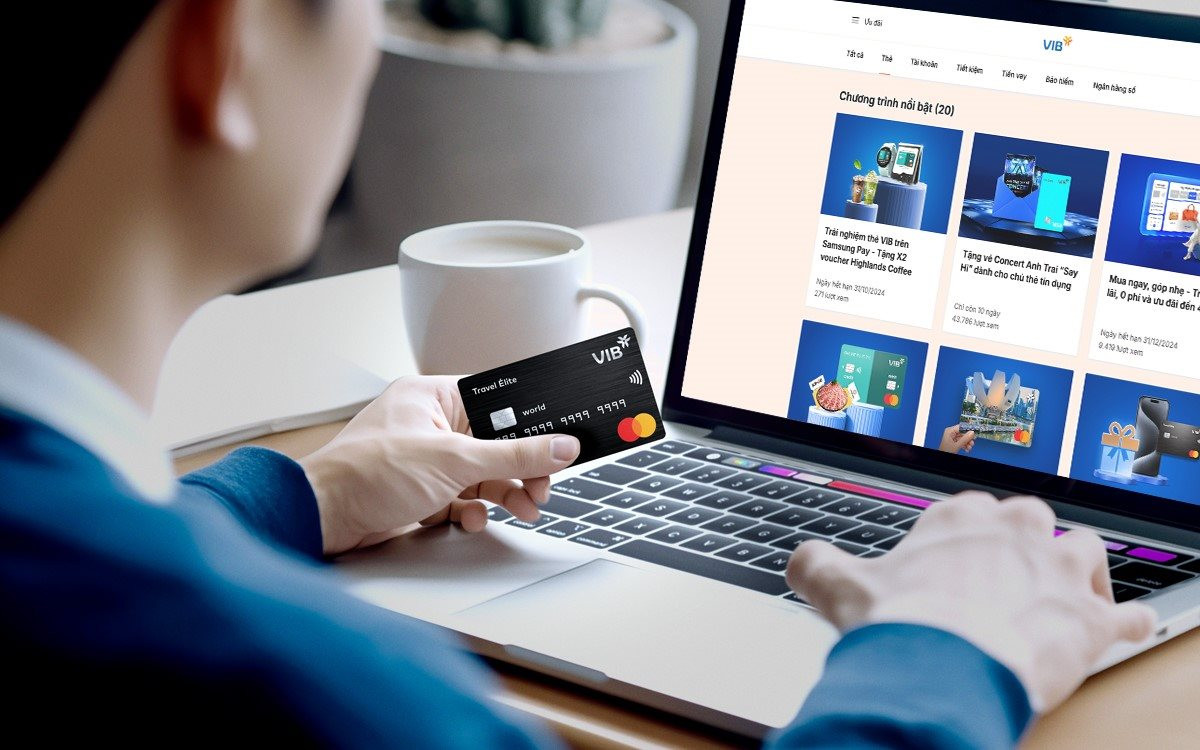

Cashback of VND 2.8 million for new credit cardholders

From now until 09/10/2024, the first 2,000 customers to sign up for a credit card and spend a minimum of VND 600,000 will receive a cashback of VND 280,000. Additionally, 200 customers who sign up for a credit card on 18/09 and spend a minimum of VND 6 million will receive a cashback of VND 2.8 million.

New credit cardholders during the “Vui sinh nhật, quà bất tận” program will also enjoy a promotional interest rate of 9.9%/year for the first 90 days from the card issuance date.

These benefits are applicable alongside the existing annual fee waiver promotion for new customers who meet the spending conditions, valid for cards issued from now until 09/10/2024.

Known for its leadership in the card trend, VIB is among the top banks with the highest card spending.

Bonus interest rate of 0.28%/year for savings deposits

Customers who make VND term deposits with tenors ranging from 01 to 36 months at VIB’s branches or through its online channels from now until 09/10/2024 will enjoy a bonus interest rate of 0.28%/year.

This promotion is applicable in conjunction with the existing policy of offering additional interest rates to new customers in the first month, as well as to customers using Diamond/Sapphire/iBusiness/Reserved/sBusiness packages at VIB. The total interest rate will not exceed the interest rate ceiling set by the State Bank of Vietnam.

VIB’s superior product and service quality has been recognized by reputable international organizations.

Established on 18/09/1996, VIB currently has nearly 12,000 employees serving over 5.5 million customers across 189 branches, transaction offices, and business centers in 29 key provinces and cities nationwide.

Over its 28-year journey, VIB has achieved remarkable growth and is now a leading retail bank with top industry growth rates. Its core products, including home and auto loans, credit cards, payment accounts, and the MyVIB digital banking app, consistently demonstrate strong performance.

VIB has consistently invested in a strategic and systematic manner to stay at the forefront of the digital transformation wave. MyVIB, in particular, exemplifies the successful integration of advanced technology into digital banking in Vietnam, featuring:

– Cloud-native: VIB is a pioneer in adopting cloud-native technology, enabling the development and operation of applications on a cloud-based platform. This enhances scalability, flexibility, and security.

– Augmented Reality (AR): MyVIB offers an AR experience, allowing users to access banking information and services in a more engaging manner. AR superimposes virtual objects onto the real-world environment, making financial transactions more enjoyable and accessible.

– High-level security and privacy: MyVIB continuously enhances security with advanced technologies such as biometric authentication (fingerprint and facial recognition), two-factor authentication (2FA), and NFC technology. This ensures a safe and convenient registration and transaction process.

The award for Vietnam’s Most User-Friendly Mobile Banking Application in 2024 showcases VIB’s innovation and commitment to providing an optimized and user-friendly digital banking experience. With the vision of “Becoming the most innovative and customer-centric bank in Vietnam,” VIB has developed MyVIB not just as a financial management tool but also as a fusion of cutting-edge technology and user experience, enabling secure and seamless financial transactions for its users.

Additionally, VIB has made significant contributions to the development of cashless payments, especially in the field of credit cards, earning recognition through international awards. The latest accolades include the “First Bank in Vietnam to Apply Augmented Reality (AR) Technology to Credit Cards” from Visa and the “Breakthrough in Credit Card Digitization” from Mastercard. In 2023, VIB was recognized by Mastercard as the bank with the “Highest Spending on Debit Cards,” “Highest Spending on Credit Cards,” and “Highest Spending on Cards Abroad.”

For more details on the “Vui sinh nhật, quà bất tận” program, please visit: https://www.vib.com.vn/

The Modern Phone Price Paradox: Why Buy the iPhone 15 When a $250 Chinese Phone Performs Better?

Why spend a fortune on the latest iPhone 15 when you can get a feature-packed Chinese alternative for a fraction of the price? The new iPhone may boast a sleek design and impressive specs, but is it really worth the hefty price tag? With a range of affordable Chinese smartphones on the market offering comparable features and performance, it’s time to question the value of Apple’s latest offering.