On September 11, Nafoods Group JSC (code: NAF) will finalize the list of registered shareholders to pay a 10% stock dividend for 2022, equivalent to issuing 5 million new shares. The ex-dividend date is September 10, meaning investors buying the stock today will not receive the dividend.

However, this doesn’t seem to deter demand for NAF. The stock surged from the get-go, even hitting the ceiling price at one point. In less than two weeks, NAF’s market price has climbed nearly 17%. This upward momentum is supported by positive news about the company’s flagship products.

During his working visit to the US on August 27, 2024, Deputy Minister Hoang Trung and the delegation of the Ministry of Agriculture and Rural Development met with Deputy Minister Hafemeister and representatives of relevant agencies of the US Department of Agriculture. The two sides reached an important agreement on exporting Vietnamese cape gooseberries to the US market.

According to statistics, Vietnam is the third largest exporter of cape gooseberries in the world, after Peru and Brazil. Before receiving the “visa” to enter the US, Vietnamese cape gooseberries were already exported to demanding markets with stringent requirements for quality, quarantine, and food safety, such as South Korea, China, Australia, France, Germany, the Netherlands, and Switzerland.

In Vietnam, Nafoods is the most well-known name in exporting cape gooseberries in Asia, with a production volume accounting for 10% of the global market share. In addition to cape gooseberries, the company also leverages the advantages of tropical fruits such as dragon fruit, mango, pineapple, coconut, and papaya, offering a diverse range of products like dried fruits, concentrated fruit juices, and frozen fruits.

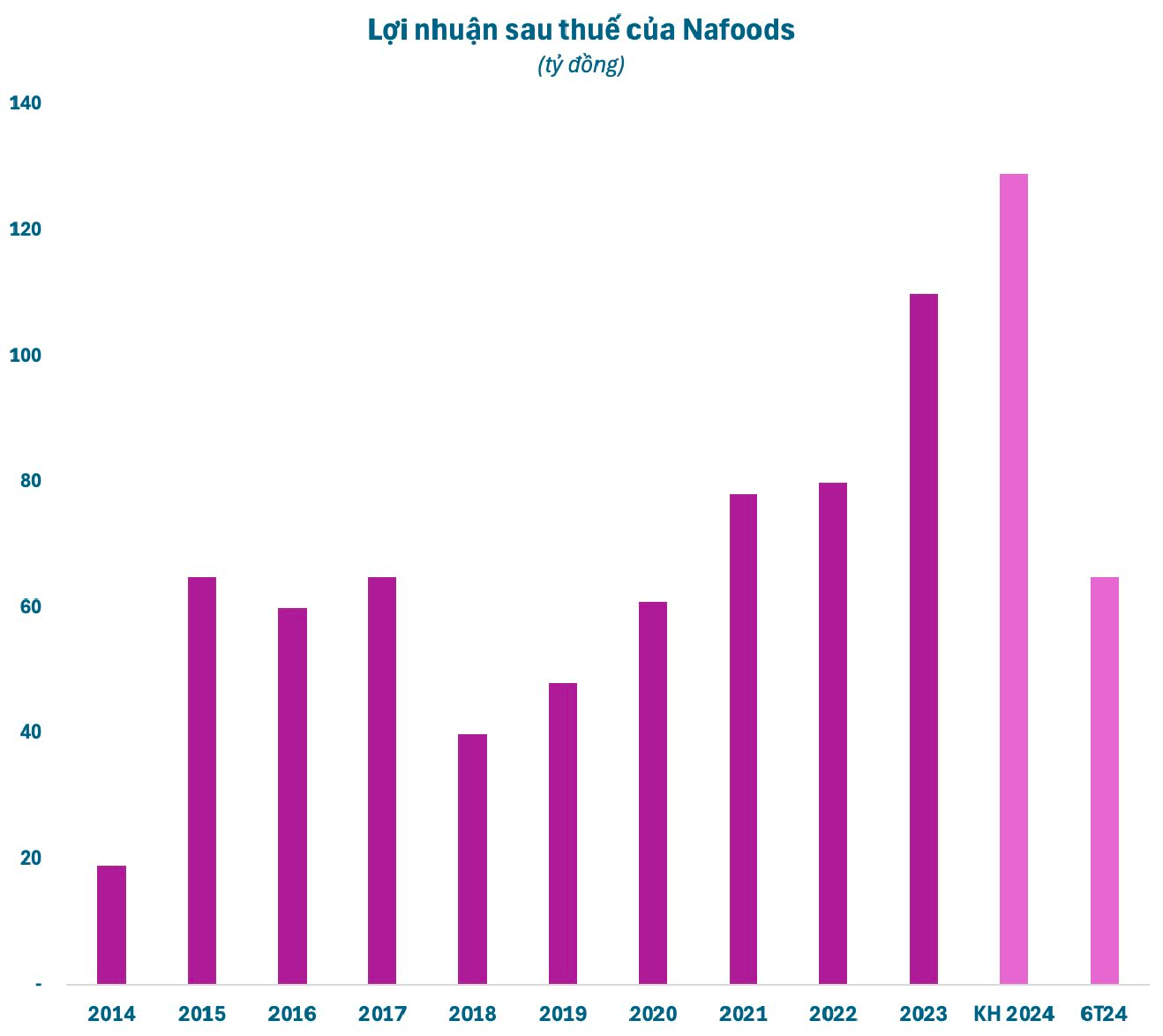

With its integrated value chain, from cultivar development to processing and exporting, Nafoods has consistently grown its business performance in recent years. In 2023, NAF recorded a slight 2% decrease in revenue to VND 1,733 billion, but its after-tax profit surged to a record VND 110 billion, a 37.5% increase compared to the previous year. The gross profit margin improved significantly from 21.3% to over 27%.

Looking ahead to 2024, Nafoods anticipates challenges and risks in its business operations. The company faces high and volatile input costs and intense competition in the context of uncertain global trade, which impacts its profit margins.

Nonetheless, Nafoods has set ambitious business plans for 2024, targeting a revenue of VND 2,200 billion and an after-tax profit of VND 129 billion, representing growth of 27% and 17%, respectively, compared to 2023. If these goals are achieved, the company will break its profit record once again.

In the first half of this year, Nafoods posted a revenue of VND 752 billion and an after-tax profit of nearly VND 65 billion, an 11% decrease and a 5.3% increase, respectively, compared to the same period in 2023. With these results, the company has achieved 34% of its revenue plan and 50% of its profit target for the year.